We all know that Life is full of Uncertainties. To cover up our Financial Responsibilities we take Life Insurance and that too with proper calculation and good Sum Assured, to save our savings from medical expenditure we take health Insurance.

But there is one more type which is most Ignored but most important one which is Accident and Disability Insurance. This is the cheapest Insurance policy but it gets ignored just because it does not carry any tax benefit, the reason because of which most of the Insurance policies got purchased.

Where we calculate Human Life value to check how much family will need after the insured’s demise to cover up the financial responsibilities and obligations, then do you think that responsibilities will reduce if a person don’t die but gets disabled.

This could be the event when a person gets dependent on his own dependents.

Please Understand-“Where Medical problem can increase your expenditure, disability has dual effect as in along with increasing expenditure it will reduce your Income also. To cover up all the uncertainties relating to Accident, accident Insurance plays a Major Role.

What is Accident?

In Insurance terminology, Accident is defined as A sudden, Unforeseen and unexpected event caused by external, violent and visible means (but does not include and illness or disease) which results in Physical body Injury (but does not Include mental, nervous or emotional disorders, Depression or anxiety).

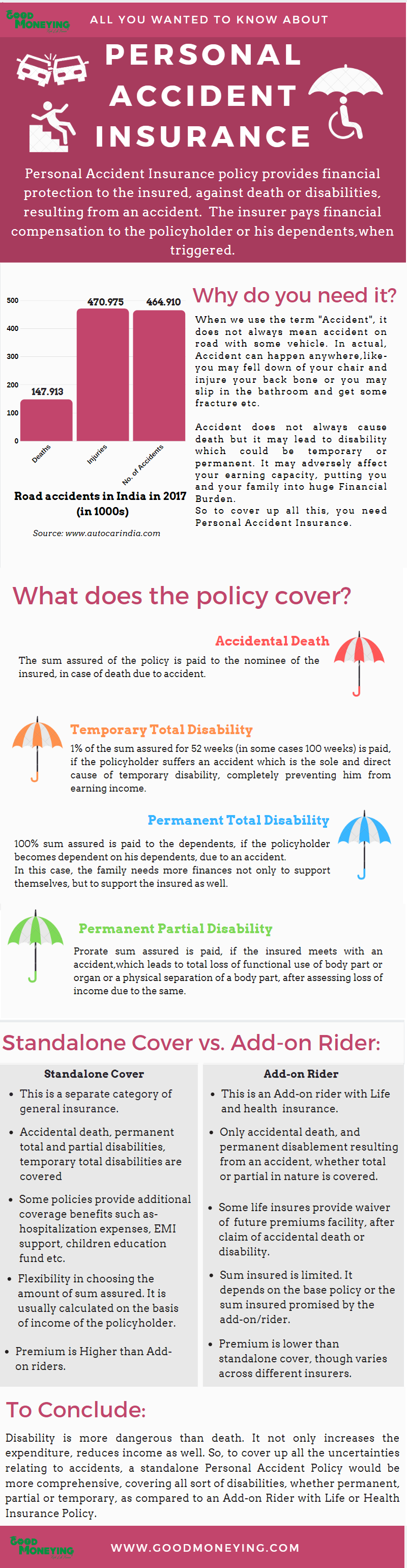

When we use the term Accident it does not always mean accident on road with some vehicle but in actual Accident can happen anywhere like if you fell down of your chair and injured your back bone or you slip in the bathroom and got some fracture etc.

Why Personal Accident Insurance?

Accident does not always cause death but sometimes it leads to disability which could be temporary or permanent. The disability leads to reduction in your earning capacity. Sometimes disability is so severe that you might have to leave your job or at least be on leave for some months. This may put you in a financial Crunch; there could be a huge Financial Burden on your family. So to cover up all this you need Accident Insurance.

What Personal Accident Policy Covers?

It generally covers the 4 aspects:

- Accidental Death: Although Death can also be covered through Life Insurance Policy, but if you have accident policy than you can claim from this also if the demise is due to any accident.

- Permanent Total Disability: This is more severe case than death since in these kinds of cases person becomes permanent dependent on his dependents. And now family needs more finances not only to support themselves but to support you also. In This case if disability is due to accident then Insurance Company will pay the 100% Sum assured to dependents.

- Permanent Partial Disability: If accident leads to total Loss of Functional use of body part or organ or a Physical separation of a body part then Insurance Company will access the loss on your income due to this loss and pay some part of Sum assured. Generally Insurance companies have mentioned the payment chart on the policy wordings.

- Temporary Total Disablement: If an Insured suffers an accident which is the sole and direct cause of temporary disability which completely prevents him from performing each and every duty pertaining to his employment or occupation then company will pay 1% of SA per week for maximum of 52 weeks or for the actual period in weeks you remain absent from work (whichever is less). There are some companies which pay 1% of SA for 100 weeks also. This benefit you can call as Income Insurance benefit as you will not lose on your monthly income if insured properly.

Personal Accident Insurance vs. Accident Rider in Life Insurance:

Accident Rider in Life Insurance policy is generally linked to the coverage you have opted for in Life Insurance so you might not be able to do justice with Accident coverage.

Moreover at the time of claim if you take claim once from Life Insurance company then the rider in the policy will be treated as matured which means in future you cannot take benefit of the same. So it’s always better to take Separate Personal Accident Policy and before purchasing do the calculation as you do while purchasing Life Insurance as this time this is the coverage which will support you also in case of any uncertain event.

Also Check- Standalone Personal accident cover or accident rider- what to choose?

Manikaran Singal is the founder and Chief financial planner at Good Moneying Financial Solutions. He is a CERTIFIED FINANCIAL PLANNER CM and SEBI registered Investment adviser (Regd no. INA 100001620). He’s having 20+ years of experience in financial services space.

Manikaran Singal is the founder and Chief financial planner at Good Moneying Financial Solutions. He is a CERTIFIED FINANCIAL PLANNER CM and SEBI registered Investment adviser (Regd no. INA 100001620). He’s having 20+ years of experience in financial services space.

[…] Personal accident (PA) policy: This is the most ignored amongst the lot as it does not have any tax benefit. On the other side it is the cheapest, so sometimes you find its benefit attached with your credit card, bank accounts etc. But like other policies this policy has its own impact on your financial well-being and insurance portfolio. This policy covers you in the case of accidental death, permanent total disability, permanent partial disability and temporary total disability. You can purchase this policy separately or can take it as a rider with any life insurance policy. But it is advisable to take it separately as you can manage it better. Also, the stand alone policies are generally more comprehensive than riders. (Read: don’t ignore personal accident policy) […]

[…] Personal accident cover is no doubt a must have cover, as it covers the disability. But its sum assured advisable should be equal to what you have selected for Life insurance. Also it should cover every aspect of disability like Permanent total, permanent partial and temporary total. (Read: don’t ignore personal accident insurance) […]

Thanks for the useful article. Request you to write a separate detailed article on Accident Insurance vs. Accident Rider in Life Insurance, if possible.

Thanks for liking my article Divya. I will sure write on your advised article soon.

Excellent information. I am about to buy an accidental policy for me and this article gave me deep insite. Thanks.

Thanks Rakesh. I am glad that i was of some help. 🙂

Thanks for the informative article.

I do have one minor suggestion. I read article on my phone and having share buttons on left side makes it extremely difficult to read and at times very distractive. Will really appreciate if we can do somethign about it.

Point noted Kinjal and thanks for your appreciation. I am working on redesigning of complete website. Very soon you will find a new look and feel of it. and I’ll make sure you won’t find any such distractions then. My apologies for now.

Hi Manikaran,

Thanks for stressing out on the importance of Personal Accident Insurance. Can you also publish some fact and figures with comparison of what you feel are good plans in this space.

Regards

My idea is to keep things simple. Don’t look at any additional feature which any company offers, stick to basics. I think the most important feature in any accident policy is Temporary total disability. Permanent disability though can’t be ruled out but the way medical technology has been advanced, this would be very rare, as most of the disabilities can be operated and managed by artificial limbs. Unless the accident has not impacted brain, most of other disabilities can be managed.

I prefer to go with that policy which can give maximum temporary total disablement benefit, and i found Apollo Munich’s policy to be the most suitable one.