HDFC Life has launched a new pension plan with the name “HDFC Life pension Super Plus” which adheres to the new guidelines of IRDA on pension Plans. Besides this HDFC pension plan has one online variant too – HDFC Click 2 retire

Last year in November 2011 IRDA announced new guidelines on pension plans and w.e.f Jan’12 all life insurance companies were asked to withdraw their existing pension products if they are not complying with the new guidelines.

Some of the Highlights of those guidelines are mentioned below:

Assured benefit: At the time of taking the policy, every company has to disclose to the customer a non-zero rate of return on the premiums paid or an absolute amount which he will receive at the vesting age.

Death Benefit: In the event of death, the company has to pay back all the premiums paid by the customer along with the guaranteed rate of return as disclosed to the nominee.

Pension benefits: At the time of vesting, the pension has to be compulsorily provided by the same insurer who’s offered the pension plan. This is done to reduce the burden on LIC which is currently catering 90% of all pensions and thus risky for a company and its customer.

Surrender/Vesting: At the time of Surrender or vesting the policyholder should be given the option to commute 1/3rd value and for the balance, he should be offered with a compulsory annuity. Alternatively, policyholders can go with annuity for 100% fund value. This annuity should be at the Pension annuity rate as per the latest approval of the authority.

Features of HDFC Pension plan-Super pension plus

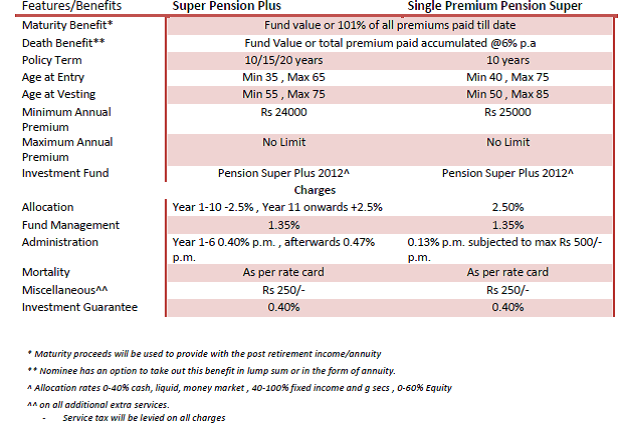

Actually, HDFC Pension plan has 2 variants – one is with the regular premium option and the other is with a single premium option. The single premium product has been launched with the name “HDFC Life single premium pension super”. Feature-wise these products are almost similar. The below table will take you to the features of both variants among hdfc pension plan.

Other Features of HDFC Pension plan-Super Plus pension

Policy Discontinuation/Surrender

If you discontinue paying the premium or request for surrender before completion of 5 years:

Fund value less discontinuation charges will be parked in a discontinued policy fund and will earn a minimum specified guaranteed return as specified by IRDA. The current guaranteed rate is the rate of saving bank accounts of the State bank of India. 0.50% will be charged on this discontinued Policy fund.

No discontinuance charges will be levied on Policy surrendered after completion of 5 policy years and also on a single premium policy.

The Discontinuation Charges have been standardized by IRDA for all ULIP policies.

Policy Proceeds:

You have the option to take the maturity or surrender benefit in the following manner

- Take up to 1/3rd of the benefit as lump sum tax free amount and Rest has to be converted into pension/annuity through the immediate annuity plan of HDFC.

- You may also utilise the whole amount in purchasing annuity from HDFC life.Read more: Retirement planning case study

Should you invest in HDFC pension plan- Super pension plus?

The new IRDA guidelines on the pension plans have surely made these as cost-effective products as compared to their previous versions.

The compulsory buying of annuity has on one hand taken back the flexibility of withdrawal but on the other is asking for only serious investors who are actually investing for a pension. Now no seller can pitch you a pension plan as an Investment product of which you can withdraw after the stipulated period. But before investing, you should be able to differentiate between

Now no seller can pitch you a pension plan as an Investment product of which you can withdraw after the stipulated period. But before investing, you should be able to differentiate between

But before investing, you should be able to differentiate between the Retirement Plan and the Pension Plan. You cannot decide on entering in such products when you are not financially planned.

A proper financial plan can’t be designed just by keeping one goal in mind. So time is to brace up , understand your financials, decide on your goals, have a holistic view of your requirements and then work onto a financial/pension plan by keeping in mind other Cost effective (NPS) and tax-efficient investment options (Mutual funds/PPF) available in the market.

After that figure out whether you should buy HDFC life Super Plus pension plan or not. The decision is completely financial.

Thanks Manikaran for the review. I was just about to call HDFC executive to understand this product..but your review has done the job. So what is your view should an investor do?

You r most welcome rahul.

As i wrote in the article…buying or not buying a plan completely depends on how planned you are. If you have arranged for your basic requirement and are in process of doing retirement planning then you may consider such products. But still in my view NPS is a better option as compared to this..due to its low cost structure and multiple fund management options.

Dear Sir

Please check the Fund performance of both the instruments.

Regards

Is there any other company also which has pension products as per the new guidelines?

may be lic has some plan…but i guess it is not in ULIP. In private sector HDFC is the only one which’s come up with new plan as per new guidelibes

What are the major difference between Jivan Nidhi, HDFC Pension Plan and NPS? Which, according to you has upper hand?

HDFC plan is a ULIP , LIC new jeevan nidhi is an endowment, and NPS is much flexible than both these…if i have to select among these 3 only than i would go with NPS. NPS is much cost effective and gives option to switch between 6 fund managers. Also the TIER 2 accounts solves the problem of liquidity too.

Hi Manikaran, Thanks a lot for your update. I have bought this policy in Dec-2012 and paid 5 Premiums (2012 to 2016) and each premium of 1 Lakh, so total paid 5 Lakhs and the Maturity date is Dec-2027. Can I continue or Leave now and go for NPS? Please advise. Thank you.

I don’t think you would be having an option to surrender the plan and take back the complete money in lumpsum. You compulsorily have to buy annuity. So in that case Leaving is not an option but you can go with NPS, depending on the cash flow surplus you have

Hi Manikaran,

I have bought the HDFC Life Pension Super Plan in Dec-12 and paid 5 Premiums till today (each premium of 1 Lakh for Annum). Can I continue or discontinue this policy and go for NPS? Please advise. Thank you.

Regards.

Hi Manikandan, i have invested 6 L for 3 years in pension super plus but the returns is less than 4%, I would like to discontinue my policy .

My policy payment term is 5 years and I will be eligible for 1/3rd Fund Value(FV)at the end of 5th year.so if I discontinue now,will I get FV minus discontinuance charges?

Hey Arun. This is Manikaran.

If you discontinue your policy premiums, your fund value will move to discontinuation fund after deducting of the charges and will stay invested there till the time you ask for surrender. ONce you surrender you will get 1/3rd proceeds as tax free lumpsum money and for the rest amount you have to buy annuity from HDFC.

Contact HDFC people for more details

I have HDFC life pension super plus plan .I paid premiums for 8 years till now, but it’s performance is not that promising. Annuity rates are also going down. Should I surrender my policy ?

Not only pension products but the rate of returns are going down in each and every investment product. Thanks to the economic scenario.

That is the reason we financial planners always advise people to have a suitable Retirement Plan in place rather than depending on a single pension plan.

Now coming to your question of whether to surrender this product or not. Well, there could not be a one-line answer to this. You should look at the purpose of buying the product, was it solely on the basis of returns or something else.

Consult your financial planner or Investment/Insurance advisor and see that the product still serves that purpose and fits in your financial plan or not and decide accordingly.

i have paid 35 lack in last 7 years .

how is the future of the plan

if i start my pension now how much i will get & is it a good time to start or continue paying the premium

plz advise

rgds

I have invested 10 Lakhs over last 10 years and still the value is just 10.5 Lakhs today. If I get out of the policy as you mentioned I can only get 1/3rd and remaining 2/3rd has to be invested in Annuity. This has turned out very bad investment for me and I don’t want to put good money on this. What is the best way to get the maximum money out of this policy? Is there any way to get full fund value back?