Searching for Best never ends. You find it difficult to settle for good or average. You want best food, best clothes, best car, best home…and so on. While searching for investment products also you look out for the best instruments. This is why you invested in Mutual funds which are promoted as best mutual funds to invest in 2013. But What is best? As per me Best is what is most suitable to your personal requirement /goals and risk profile. As I am not aware of your goals or risk profile, so keeping that separate, I present you a list of best Mutual funds to invest in 2014 as per my parameters.

Parameters to select the Best Mutual funds to invest in 2014

In my post published in Money control.com I have discussed about various parameters while selecting best mutual funds to invest in. Let me summarize those here:

1. Performance ranking – Quartile ranking

As per these rankings Mutual funds are divided in 4 quartiles based on the returns they have generated. Quartile 1 carries top 25% of funds and Quartile 4 carries 25% of funds given least return.

2. Ratio analysis – Alpha , Standard deviation

Alpha denotes the extra return that the fund manager has generated as compared to benchmark. Standard deviation denotes how risky or volatile the fund is.

3. Fund manager tenure and experience

Fund manager tenure tells us that since how long the fund is being managed by same fund manager. Recent change in the fund manager should make the investor wary about the future of the fund.(Also Read:MF case study)

4. Expense ratio and Scheme Asset size.

High expenses means less returns, but expense ratio is the factor of scheme asset size. SEBI has put restrictions on the Expense ratio which depends on the funds asset size. Higher the asset size lower will be the expenses. Though we can look out for a minimum expected scheme asset size but if the fund is consistently performing and fund manager is experienced and generating Alpha, so many time expense ratio does not matter. But higher the Asset size is always better.

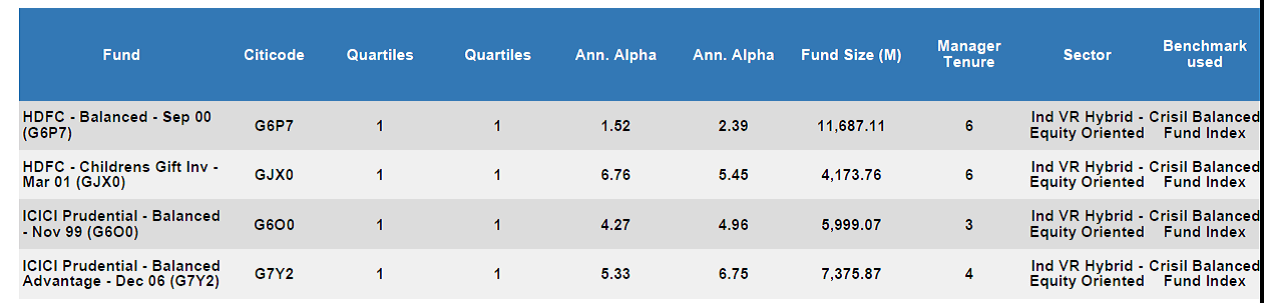

So based on above mentioned parameters, to find out best mutual funds to invest in 2014,we have filtered out the funds which should fall into Quartile 1 ranking for 1 and 3 year performance, Should have generated Positive Alpha in last 1 and 3 year and fund manager tenure should be at least of 1 year.

Before going ahead, I would like to reiterate that consider the below list of funds as something you should look at after understanding your risk profile, and decided on a suitable asset allocation. Zeroing onto specific funds in your particular case might require understanding of funds Risk parameters too. Also keep in mind the standard disclaimer that fund houses give :

“Mutual funds investments are subject to market risks, read all scheme related documents carefully before investing”

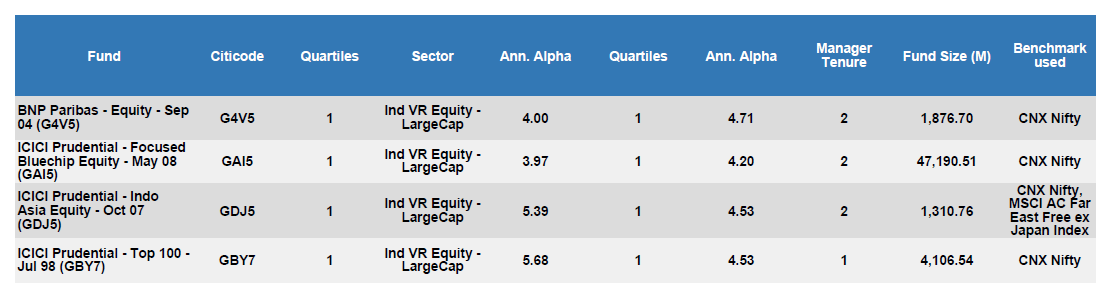

Best Mutual funds to invest in 2014 – Large Caps

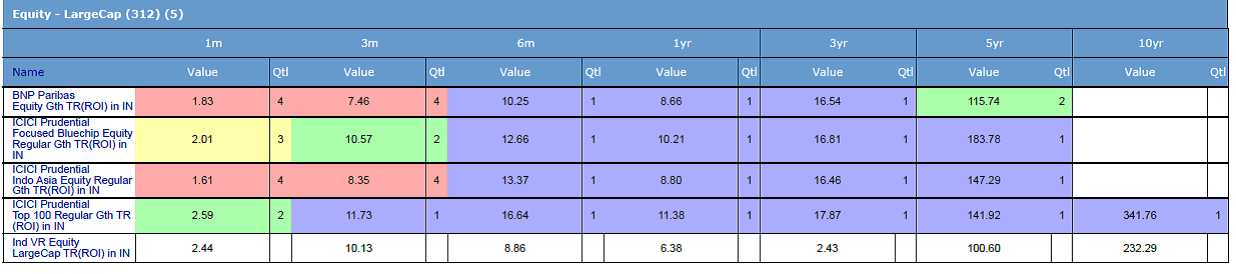

Best Mutual funds to invest in 2014 – Large Caps (Performance)

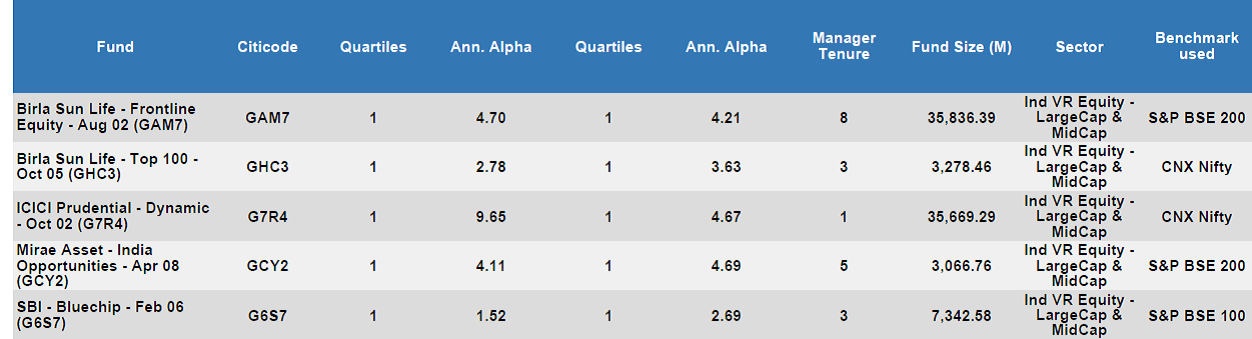

Best Mutual funds to invest in 2014 – Large and Midcap

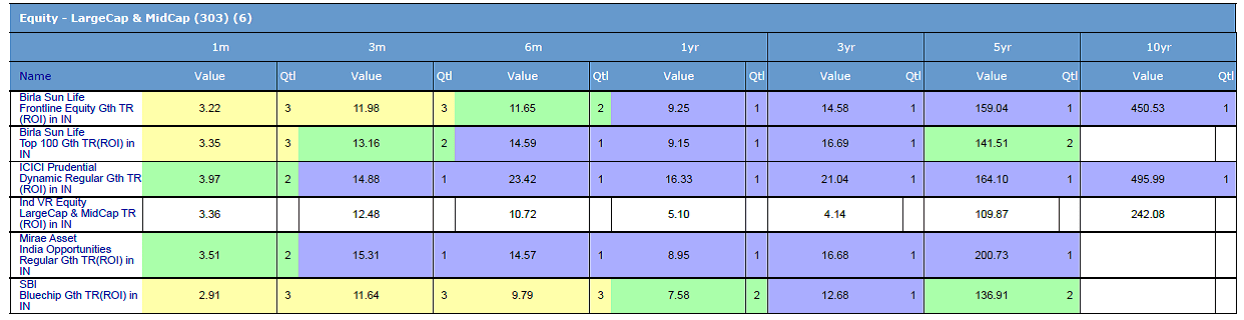

Best Mutual funds to invest in 2014 – Large and Midcap (Performance)

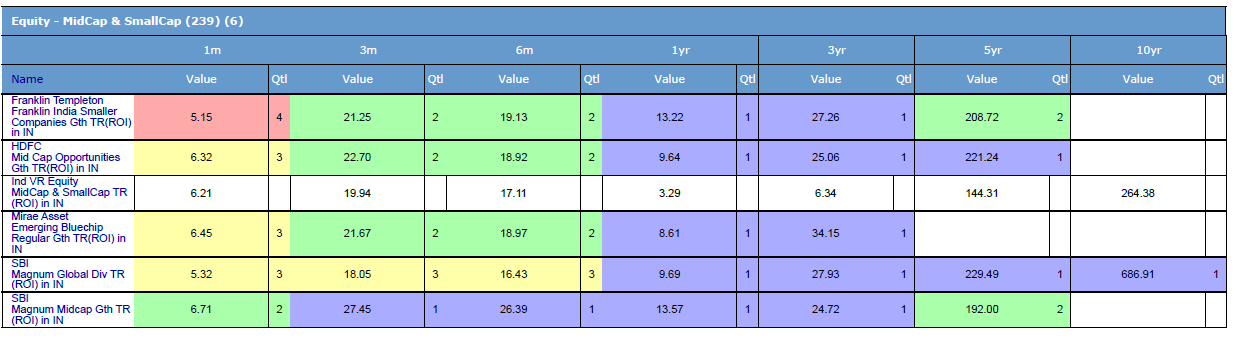

Best Mutual funds to invest in 2014 – Mid and Small Cap

Best Mutual funds to invest in 2014 – Mid and Small Cap (Performance)

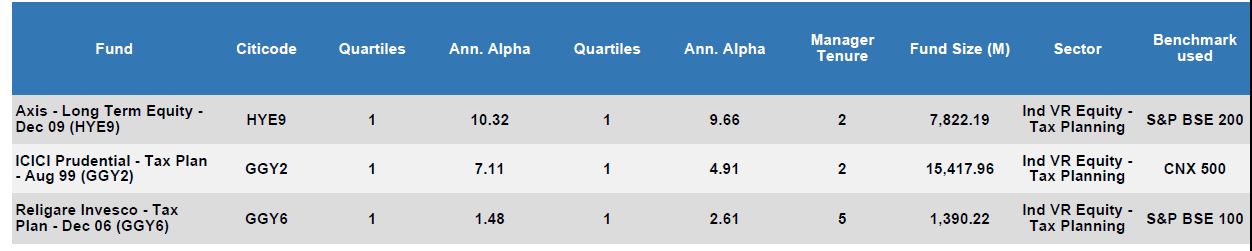

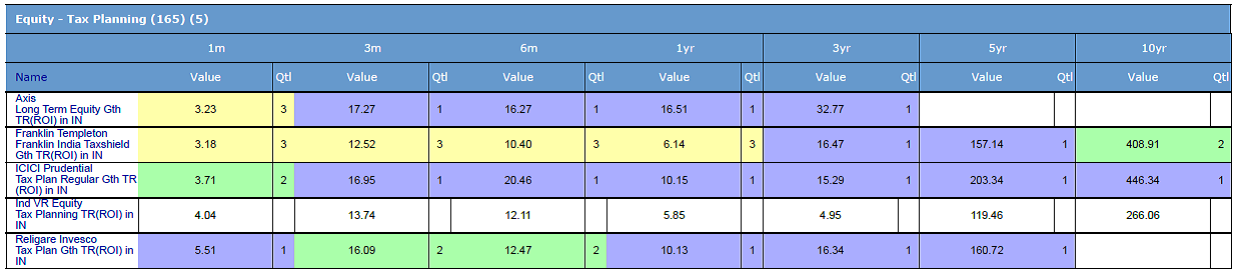

Best Mutual funds to invest in 2014 – ELSS

Best Mutual funds to invest in 2014 – ELSS (Performance)

I have included Franklin India Tax shield in the performance comparison, since few months back when i did the same filtering on Tax saving funds, Franklin India tax shield came out as clear winner (Tax saving mutual funds for 2013). Just wanted to figure out what went wrong now.

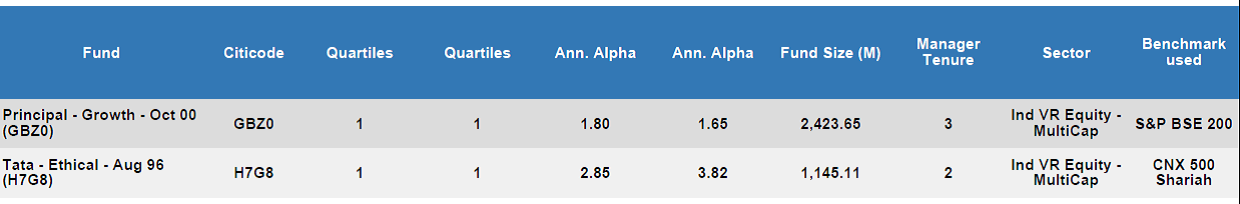

Best Mutual funds to invest in 2014 – Multi Cap

As there’s nothing much to show on Multi cap funds, so i have not made any performance comparison of these funds

Best Mutual funds to invest in 2014 – Equity Oriented hybrid

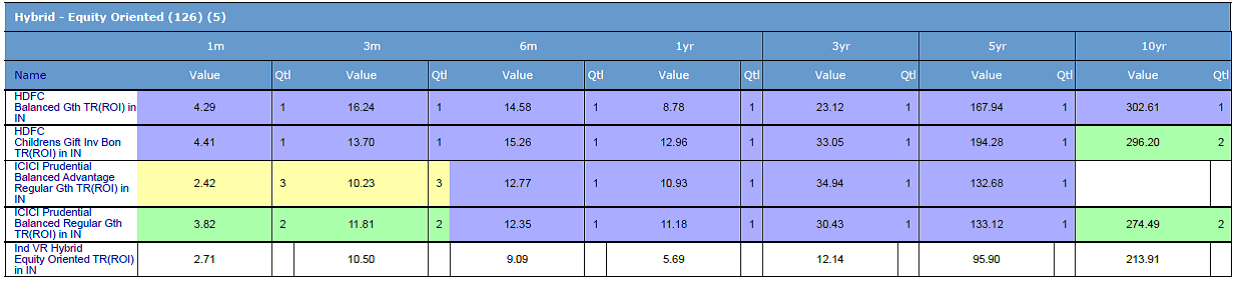

Best Mutual funds to invest in 2014 – Equity oriented Hybrid (performance)

Data Source: the complete data above has been generated from FE analytics as on 31/12/2013

Every new year brings another opportunity to review the things and take corrective actions as and when required. So this post on “Best Mutual funds to invest in 2014” will help you in making an opinion on your Mutual funds portfolio.

I have covered only equity and equity oriented hybrid funds in the article. As selecting parameters of debt mutual funds are bit different so that will be covered in a separate article.

Do share, how did you like the article above.

Very helpful post.

Could you explain the color codes used ex: green signifies what,what does blue mean etc?

Hi

Thanks for liking my post.

Color codes depict the quartile performance ranking of particular fund in particular month. Blue – quartile 1 (top 25%) , Green quartile 2, yello quartile 3 and Red quartile 4(lowest 25%).

Hope it helps

Hello Sir

I am investing in HDFC Equity, IDFC premiur equity plan A(G), UTI opportunities and ICICI prufoccussed bluchip equity from last 15 months;2500/m in each. kindly share your views and advice.

Thanks in advance

Pushp 15 months is too short a time to make changes in a equity portfolio. Among your funds 1 is mid cap oriented and 1 is large cap fund the other 2 are diversified (large and Mid cap). Except HDFC equity , all the funds are doing good in their respective category. and HDFC equity is showing signs of improvement too. so i would advise you to stay invested and continue with your SIPs and review the things again after 6 months. by that time election fever will also settle down.

Also always look at your portfolio in toto and follow asset allocation approach. This will help you in rebalancing the portfolio year on year and also lead to timely profit booking or purchasing more in low markets.

Good post, the parameters set by you are good. A little incomplete.

One needs to also look at other factors both macro and micro to then finally choose a fund. Am sure you must be doing it already, may have not posted on the blog.

The FII inflows, currency and balance of payments will also have a huge impact on the performance of the market and hence the funds.

But really like your assessment criteria.

Regards,

Bhanu saxena

Bhanu, thanks for liking the post.

Franklly i think that rather than FII flow i should be bothered about Investor’s personal cash flow and goals targeted , Personal networth should be considered before looking at country’s balance sheet. The macro factors that you are mentioning is no doubt important but is funds manager job, and if he’s tracking and formulating his investment strategies well then it will definitely reflect in the alpha he generates and quartile ranking of funds. macro and Micro factors of economy keeps on changing and one cannot change the funds so frequently.

What do you think?

Investor goals and financial flows would have already been taken into account by a good financial planner. I meant that as a FP one needs to also have a very good idea in both the macro and the micro picture of the markets other than the fund manager view. If we only depend on fund manager to be able to determine the various factors then this could be dangerous for the investor. The macro factors of the country need to be taken into consideration by the FP before investing in the asset class, otherwise we will have a 2008 situation with clients money. If a FP is aware of situations then the loss can be mitigated. Eg like some good FPs in 2008 at the height of the market crash were everybody had negative returns had given very high positive returns by investing in gilt funds.

It is important to have a own view on all factors enabling one to choose the investment better and yes the using the details shared by you earlier to really make a good strong portfolio in an investment plan.

Regards,

Bhanu Saxena

Hi all, First of all I would like to introduce myself. I’m Jaya Kumaran from Malaysian Indian. I heard mutual fund india are doing better ….I want diversify my investment to india via mutual funds….

Well, will be appreciate if you can e-mail me the details or direct it to the respective person.

Regards

Jaya

Hi

Nice article. Want your advice on the following. I am 38 and investing in equity diversified MF via sip growth option since from 2005 in few top funds for long term to meet my financial goals. Do my funds generate sufficient wealth in the long run say 10-20 yrs. L&T Equity fund, DSPBR Top 100, FT India Blue chip fund, IDFC premier equity- plan A, Quantum LTE. Please comment

Yeah sure satish. Your choice of funds is good and it is properly diversified in equity segment. Moreover since you are continuing from 2005 so you must have already generate good corpus with good returns.

Do remember the basic mantra, your portfolio should be adequately allocated between debt, equity and gold. Do invest in products like PPF and Debt Mutual funds too, so in volatile phases you should not be bothered about the overall value of total investments , though you have already seen and even stay intact with your investments. Good Luck

Hi

I currently have HDFC Top 200 Growth and ICICI Prudential Blue Chip as well as L&T Equity Mutual Fund Growth .

I will finish the three year term in HDFC and L&T this year. Should i continue with them or invest in some other mutual fund

Thanks!

Ronette, If i look at the last years track record of HDFC Top 200 and L&T equity then yes both have been laggards. But over a long term time frame and also the improvement in last few months tells that you should continue with the funds.

Moreover besides performance many other factors that i have discussed in the article above are getting favorable for these funds. So better to renew the SIP and review after 6 months.

My husband has been investing Rs.3000/month in HDFC Top 200 since June 2010, Rs.3000/month in DSPBR Top 100 since May 2011 and Rs.2000/month in UTI Opportunities since July 2012.

He wants to start another MF of Rs.3000. Looking at the above SIPs, could you suggest one which we can align for our long term goals. Looking for a time frame of 15-20 years.

You may add pure mid cap funds like Franklin smaller cap fund or HDFC Mid cap opportunities in your portfolio.

But as Mid cap segment is a bit volatile one, so make sure that you stick to your long term horizon and never get lose your focus on goals.

Dear Mr. Manikaran,

My husband is 44 now. He wishes to start his retirement plan through MF investments for coming 15-16 years. He is ready to take risks but wishes to generate a good corpus amount that will enable him to receive Rs 40,000 per month at the age of 60 on wards. Please let us know the amount required to invest monthly basis for this target, the distribution plan (over equity, debt..), and also suggest the mutual funds. We wish to start as soon as possible. He saves Rs. 1 lakh per year in PPF.

Kindly provide your valuable suggestions. Waiting for your reply.

Thanks and Regards,

Debarati Sen

My husband is 44 now. He wishes to start his retirement planning through MF investments for 15-16 years. He is ready to take risk but wishes to generate corpus that will enable him to earn Rs. 40,000 per month at the age 0f 40 on wards. Please let us know amount required to invested to achieve the target, fund distribution pattern (% in equity, debt..) , and also suggest the name of the mutual funds. He saves Rs. 1 lakh per year in his PPF account.

We wish to start the investment as early as possible. Please provide your valuable suggestion.

Thanks and regards,

Debarati

First of all , accept my apologies for replying so late on your query.

I understand that your husband wants to invest in Mutual funds for his retirement planning goal which is 16 years away from now. See as this is a sensitive goal, so this space is not enough to answer your query in detail as this requires a thorough understanding of your husband’s risk profile which helps in defining the asset allocation he should be in. Mathematically Rs 40k of today after adjusting inflation of 7% will become Rs 1.18 lakh after 16 years. Assuming Life expectancy of 85 years and assuming same rate of inflation and post retirement rate of return of 9% ( with proper asset allocation), he needs a corpus of 2.78 crores.

Now to accumulate this much of corpus and assuming your savings will generate 12% p.a of return, you need to save around Rs 48500/- p.m to achieve your target.

I would advise you to consult a SEBI registered Investment adviser, to guide you further on this. He’ll take into account your existing investments and savings and will advise your on suitable asset allocation along with products suitable to your goal and risk profile.

I’m 43 now and wish to invest for 15/16 years to generate corpus for my retire life.

My present SIP investment (since last 6 months) is as follows :

1. DSP BR Top 100 – Growth (Rs. 2500),

2. Franklin India Bluechip Fund – Growth (Rs. 2500),

3. HDFC Top 200 Fund – Growth (Rs. 2500)

4. ICICI Prudential Focused Bluechip Equity – Regular Growth (Rs. 2500)

5. SBI Emerging Business Fund – Direct Plan – Growth (Rs. 3000)

I also intend to invest in another 5 MFs. Please rank the below mentioned MFs to invest Rs. 2500 each:

1. L&T Equity Fund – Growth

2. IDFC Premier Equity Regular

3. Quantum Long Term Equity

4. UTI Opportunities Fund

5. Axis Focused 25

6. ICICI Dream Fund (Rs. 2500)

Also, please suggest any specific Gold Fund or any other fund SPECIFICALLY which will suit my portfolio.

Regards,

Amit

Hi Amit

Your portfolio is tilted towards more of a large cap, though all the funds selected are fine but its better to increase some mid cap flavor to it when your horizon is of 15-16 years. Add IDFC Premier equity and Mirae asset emerging bluechip fund.

There’s no point increasing the number of funds to be more than 6-7. I would say to discontinue one of pure large cap like DSPBR Top 100 or Franklin Blue chip and divide your total investments into the remaining funds.

I hope that when your are planning for your retirements years, you have already made necessary allocation in debt through PPF , EPF and other debt products. have a proper allocated portfolio and do timely rebalancing to achieve your goals.

For gold allocation you may go with Goldman sachs Bees

Hello Sir,

I want to invest in mutual fund for 3 year , 5000 per month SIP .. Tell me which on will be the best

Hello Sir,

I want to invest in mutual fund for 3 year , 5000 per month SIP .. Tell me which on will be the best

.Currently investing 1000 pe month in dsp black rock small & midcap regular growth and 1000 per month in kotak select focus Growth ,ince June 2014 . tell me for how many year Can i continue to onvest in these 2 fund….

For 3 years, i don’t advise to invest in equity. If you want to go in for 3 years only…go with a balanced fund like HDFC balanced.

Its always better to have a goal and defined asset allocation, which puts you into a process to invest, sell and reinvest.

singal sir, how r u i have a ? regarding investing in ppf & elss both r tax saving products. one has equity exposure and other has a fix rate of interest and backed by govt. which one u suggest for wealth accumalation from tax point of view. please send me some distinguist help. thank u

Rupesh, I am fine ,thanks.

Whether to Invest in PPF or ELSS from wealth accumulation point of view totally depends on your risk tolerance and your target amount.

You know how both products work, you know the risk associated and return generation capacity of both, so selection should not be much difficult for you. Where PPF generates a fixed return, ELSS returns depends on stock market movement. PPF generates non volatile returns, ELSS has potential to generate much higher returns than PPF.

See i am an equity person. I strongly believe that if you can stay invested in ELSS for the time you have lock in in PPF you will surely generate huge returns. But if you are allergic to volatility then go for PPF.

Alternatively mix both.

Hi,

your articles and advices are really helpful for investor like me.

I want to start SIP with long term goal (16 – 20 years). I have shortlisted some funds as below;

1. ICICI Prudential Focused Bluechip Equity – Rs. 7000/-

2. Mirae Asset India Opportunities Fund OR UTI Equity Fund OR Quantum Long Term Equity Fund– Rs. 5000/-

3. HDFC Mid-Cap Opportunities OR ICICI Prudential Value Discovery Fund – Rs. 4000/-

4. HDFC Balanced Fund – Rs. 3000/-

Kindly review and suggest

also pls refer No. 2 & 3 and suggest which one I should select

apart from this kindly suggest me one more fund for Rs. 5000/-

regards

Bhartendu, your fund selection is looking fine to me.

When your horizon of 16-20 years then don’t add balanced fund into it. Rs 3000/- of balanced fund and also Rs 5000/- which you want to invest more, can be clubbed and Invested in any other fund from point 2 and both from point 3.

So in total you will be having 1 pure large cap, 2 large cap oriented and 2 mid and small cap funds. Good portfolio 🙂

Hi Sir, I am regular investor for last 2.5 years on the following funds:

1) HDFC Top 200 – INR 5000

2) HDFC Balanced Fund – INR 4000

3) ICICI Focused Blue Chip – INR 5000

4) Franklin Focused Blue Chip – INR 4000

5) IDFC Premier Equity – INR 4000

As I thought Midcap exposure is low started SIP on following funds from this month (Sep’14)

1) UTI MID Cap fund – INR 4000

2) ICICI Prudential Value Discovery Fund – INR 4000

Question 1: Pls advice on the quality of funds. Can stay invested for next 10 yrs in all theses funds.

Question 2: As of today am investing INR 30,000 per month. Whats the max corpus I can expect in next 10 years.

Question 3: Saw good growth on the funds with avg 15% return as of today (2.5 yrs list) with the current market acceleration too. So redeemed 25% (without capital gains tax ) of total value as of today to prepay my homeloan & reduce debt. Pls advice if its is a right move.

Ans 1 – Funds are fine. Can’t comment on portfolio.

Ans 2 – No Idea. it depends on assumption you take.

Ans 3 – Better to consult your financial planner for this answer. You must have don this txn after understanding the pros and cons of the same and also knowing its affect on your other long and short term goals.

Hi Sir,

Currently I am Investing in Below Fund Regularly Per Month Basis .My Scenario is for 3 Yesr

-Franklin India Smaller Cos Fund(G) 1,000

-ICICI Pru Exports & Other Services Fund-Reg(G) 1,000

-HDFC Balanced Fund(G) 2,100

-SBI Pharma Fund-Reg(G) 1,000

-Kotak Select Focus Growth – 1000

Please Do i Need to change My Portfolio..

Please Suggest sir waiting your response..

My age is 29 and being a banker myself have delayed in planning for my retirement .so I intend to save 30000 per month for next 25 years.

please advise if my fund selection is good.

1.icici pru tax plan -elss 4000 per month

2.relianc tax saver 4000 per month

3.axis long term equity elss 4000 per month

4.franklin Templeton tax shield 4000 per month

5.icici pru focused bluechip 2500 per month

6.hdfc balanced 2500 per month

7.mirae emerging bluechip 2500 per month.

8.birla sunlife top 100 2500 per month

9.idfc premier equity 4000 per month

Note -I plan 1.5 lakhs per annum for elss tax planning .so only have 4 funds .

request your comments

Thabresh, you don’t need 4 ELSS funds for your tax saving, i think 1 or 2 will do. Also i think that you must be having some insurance plans with you, and your bank must be deducting EPF from your salary, so you my not need 100% tax saving investments in ELSS.

Regarding other funds ,the selection is fine, but replace HDFC balanced with HDFC equity as balanced funds from asset allocation point of view creats confusion. Also i believe that besides this equity allocation you must be saving in some debt instruments like PPF or Bank deposits too, which is required to keep the volatility of the portfolio in acceptable line.

Thanks for your speedy reply.Also one more clarity on Elss.

Is Elss performance on same lines of Diversified equity or during bear market will these investment take a hard hit.

Im curious on this as I invested in HDFC tax saver in 2012 and its almost doubled in 3 years.So are the performance of good diversified equity funds.But i have not done any investment when market went down drastically like 2008.

These are like normal diversified equity funds only.

Hi Mani, between Canara Robeco Emerging Equities, Reliance Small Cap and UTI Midcap, which is better for investing? Help me choose. Do we go on the basis of AUM, in case all are well managed (ie., higher the AUM, better)? I propose atleast Rs.10000 pm in anyone of these. Please give your views.

If performance wise both are looking more or less same, then go with the one with low expenses ratio ( which yes is a factor of high AUM). Also look at the fund managers tenure. Older the better.