For those who are aware of online term plans, HDFC Click 2 protect is not a new name for them. It is one of the popular names in online term plan market, which almost every seeker of online term plans must have went through before finalizing his selection. With a great claim settlement ratio, competitive premium rates, dependable brand image this product has always been difficult to ignore. HDFC Click 2 protect Plus is a new version of the same plan with some add on optional features.

This particular term insurance plan can also be bought offline and thus is available to all those also who are not internet savvy. Among the additional features it has come up with 2 options which include regular monthly payments to the nominee, along with lump sum payment of Sum assured. One another feature allows the insured to increase or reduce the sum assured at specified life events. Overall it sounds a nice product, let’s find out more.

HDFC Click 2 protect plus term insurance plan– in Brief

HDFC Click 2 protect plus is a pure term insurance plan, specifically called as “a traditional non-participating term insurance plan”. It is an extended version of the other popular online term plan of HDFC with name HDFC Click 2 protect, which might get discontinued soon. The “Plus” factor in this product brings along 3 optional features, which are as below

1. Extra Life option: You can top up your existing life insurance coverage with accident insurance cover by paying some extra premium.

2. Income option: In this option at the time of claim, 10% of Sum assured will be paid as lumpsum and Balance will be paid in monthly installments scattered over 15 years time frame.

Say for e.g for a Sum assured of Rs 1 cr, in case of demise of the policy holder family will get Rs 10 lakh in lumpsum and remaining Rs 90 lakh will be divided into monthly installment of Rs 50000/- and be paid monthly for next 15 years.

3. Income Plus option: Here 100% of Sum assured will be paid on death in lumpsum and monthly income equal to 0.5% of Sum assured will be paid for next 10 years. The monthly income can be level or increasing @10% p.a. as chosen by policy holder.

Taking the same case as in point 2 above, in this case family will get Rs 1 crore as lumpsum plus a monthly installment of Rs 50000 fixed amount for next 10 years or Rs 50000 per month with increment of 10% p.a.

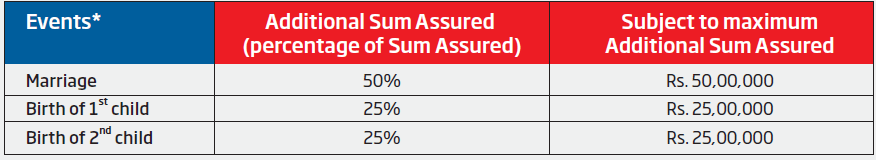

Besides the above in HDFC click 2 protect plus term insurance plan, there’s one Life stage protection feature available in the base plan i.e. Plan with no option (as mentioned above ) opted for. With this feature insured can increase or reduce the sum assured on the occurrence of a specified life event like Marriage or Birth of child. The Premium will be reworked based on new sum assured. It will work like as below:

After 45 years of age if you feel that you have accumulated enough corpus to provide the necessary financial security to the family and you don’t require this much of insurance cover then you can get your sum assured reset to the original sum assured which was at inception of the policy.

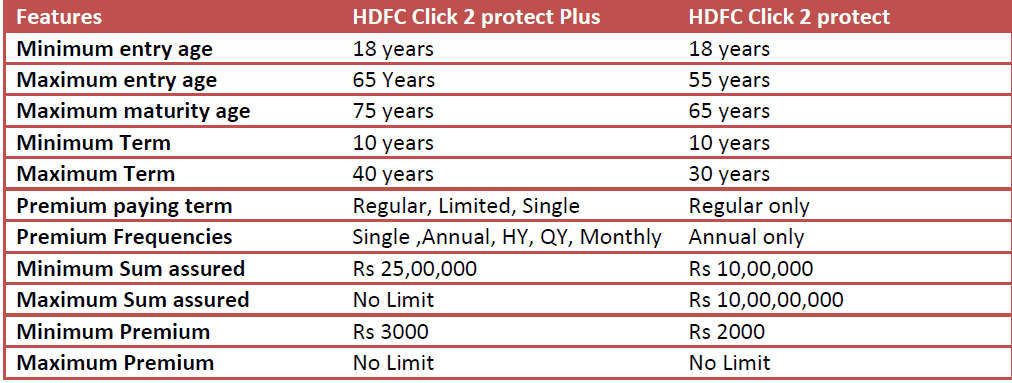

HDFC Click 2 Protect Plus – Key features

Below are the key features of this new online term insurance plan, in comparison to its earlier version

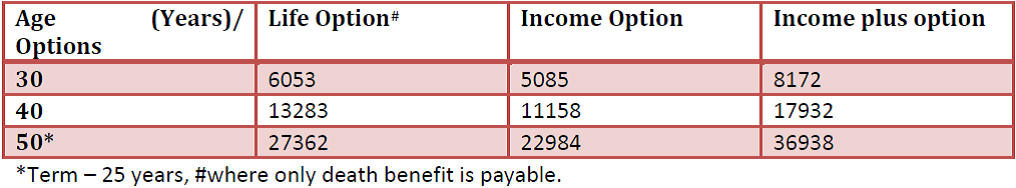

HDFC Click 2 Protect Plus – Premium quotes

The premium quotes below are of a regular policy for a healthy non-smoker male for a Sum assured of Rs 50 lakh. The Term of the policy is 30 years. All quotes are for offline purchase, which are around 5% costlier than the online term plan purchase quotes

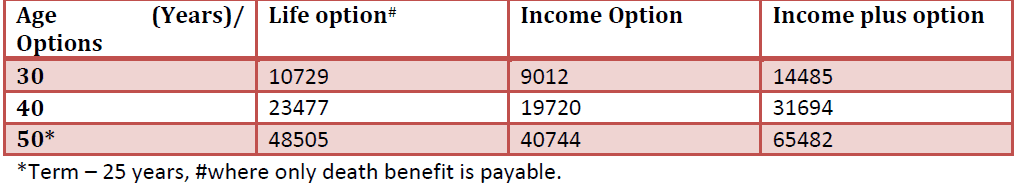

The premium quotes below are of a regular policy for a healthy non-smoker male for a Sum assured of Rs 1 crore. The Term of the policy is 30 years. All quotes are for offline purchase, which are around 5% costlier than the online term plan purchase quotes

HDFC Click 2 Protect plus – Should you buy?

When it’s a question of buying a term insurance plan, I can answer with closed eyes. Yes. Everyone should be having adequate life insurance cover and term insurance plans are the cheapest way to buy that cover. Online term insurance plans are more economical then offline products. So in my opinion, HDFC Click 2 protect plus through Life Option is must to be considered product.

(Read : 7 financial planning tips for beginners)

I like things to be simple and clear, and that’s why a bit reluctant on opting for any add on feature. In case of income option, insurance company will keep 90% of the Sum assured with themselves and distribute balance in monthly installments without any interest. So financially speaking it doesn’t make sense. Even if the nominees park the claim received in a bank FD they can generate better income and monthly returns.

(Read : Learnings from a financial planning case study of suddenly single women)

In Income Plus option, the difference in premium can be used to buy another term plan to enhance the cover and if used wisely (if claimed) again can generate better returns and monthly income.

Conclusion

Keep your finances Simple. HDFC Click to protect plus can be considered for pure online term insurance plan or offline purchase without any add on topping 🙂 (Read: Comparison Term insurance plan with Income benefits)

What do you think about this new version of HDFC click 2 protect? Do you find the add on features attractive?

Sir, Max Life Insurance is also offering similar plan with income options, only thing is their term of policy is less and monthly income is 0.3% instead of 0.5% of the sum assured. I just wanted to know which would be a better company to go ahead with when it comes down to claim settlement ratio.

Rishabh, both HDFC an Max life are good companies. As far as claim settlement ratio is concerned there’s hardly any difference between these 2. You may chk out this link http://www.mintwise.com/wp-content/uploads/2014/01/Claims-Ratio-2012-2013.jpg?4a6cdf

But i think that claim ratio though important is not the only factor which you should look into while buying the policy. You should visit company’s local office, talk to call center people, experience the customer service delivery…all this shows the service philosophy of the company

Disclose everything asked in the policy form and which is known to you. No company with good service quality will deny a genuine claim.

Rishabh, I agree with Manikaran Sir. Please look at other factors also as in this link below.

http://www.mintwise.com/compare-online-term-insurance-plans-india-2014/

Another thing people are falling to is the very long policy term offered by various companies. Many people feel that term insurance cover should be for as long as possible. But if you read this link below you will realize that it is not advisable to go beyond retirement age or at max 65. Do go through it and let us know your views.

http://www.mintwise.com/term-insurance-policy-age-60/