The investment world is noisy—market updates, expert opinions, social media debates, and endless comparisons between different strategies. For many investors, this constant influx of information does more harm than good. Instead of focusing on a well-defined investment path, they get caught in an endless cycle of doubt and impulsive decision-making. They chase after the latest trends, abandon strategies mid-way, and waste time on superficial research, all in the name of making the best financial moves. In reality, they end up confused, frustrated, and often poorer than when they started.(Read: What is the Right Time to Start Financial Planning? )

Today I am going to mention and discuss about 3 trends that are most distracting for Investors and never let investors work on their financial well-being in a structured approach. This noise benefits others who are creating it but investors are on the losing side.

DIY Investing: A Trend Without Direction

Do-it-yourself (DIY) investing has become a fashion statement, often with no real sense or direction. This trend took off with the introduction of Direct Mutual Funds—low-cost products initially meant for informed investors. However, thanks to social media influencers, and so much data available online, even those with no financial background started believing they could be investment experts.

Finfluencers, in their 1-2 hour videos or quick reels, offer investment advice without any accountability. Investors, driven by the promise of fast returns, blindly follow these recommendations. Fintech platforms capitalized on this behavior by launching apps that highlight “best-performing schemes” in real-time and allow investments at zero cost. In an attempt to save a few rupees, investors willingly share personal data and grant unrestricted access to these apps.

The cycle typically starts with Mutual Funds—because they have “No Advisory/Distribution cost option: available, Then, DIY investors move on to stocks, followed by derivatives like F&O. When losses pile up, some even take loans against securities or prematurely exit investments at a loss. In this whole game no points for guessing who loses and who wins. While not all DIY investors follow this path, most lack direction. They hesitate to seek professional advice because cost is their primary concern.

With an overflow of information from news portals, social media, and TV shows, DIY investors spend excessive time searching for the “right” piece of advice. Meanwhile, experienced investors understand the value of time. They work with professionals, follow goal-based investing, and engage in meaningful discussions with advisors who provide unbiased financial insights. (Read: SIPs: Why Most Investors Fail to Continue? Common Mistakes to Avoid..)

MFD vs RIA: The Advice Dilemma

Ever since SEBI introduced Investment Advisor Regulations, investors have faced another layer of confusion: whom to approach for advice? Mutual Fund Distributors (MFDs), formerly known as Independent Financial Advisors (IFAs), or SEBI-registered Investment Advisors (RIAs)?

Although SEBI issued clear guidelines on who can use the title “advisor,” the distinction isn’t always evident in practice. Financial planning is another gray area. SEBI considers it part of investment advisory, yet many unregistered market participant offers it through digital tools, or do it for FREE to gain new clients. Many professionals hold certifications like CFP, CWM, or NISM, but not all are registered as RIAs. So, should investors pay a fee to RIAs or work with well-certified MFDs who earn commissions? (Read: How do Financial advisors Charge fees in India?)

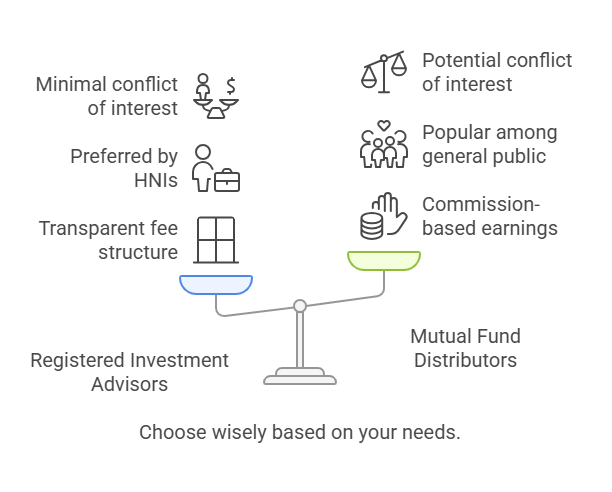

The primary distinction between working with a Registered Investment Advisor (RIA) versus a well-certified and experienced Mutual Fund Distributor (MFD) often boils down to the fee structure. (Read:5 ways to review mutual funds investment Portfolio )

RIAs typically charge fees for their advisory services, which is considered to be a transparent mechanism while MFDs earn commissions, on the products they sell, which may lead to conflict of interest. Beyond this, the practical differences in the advice provided may be minimal. But here the fee payment is not liked by many, and thus RIA services are generally preferred by HNIs or Mass affluents, and also Commissions have gained such a bad name that even good MFDs are suffering due to this.

To make matters worse, fintech platforms provide free goal-based planning calculators, further fueling investor skepticism. Many wonder why they should pay for professional advice when “DIY tools” are readily available. This adds to the investor’s dilemma, leading them to self-medicate with free tools instead of seeking qualified guidance.

Direct vs Regular: The Cost Trap

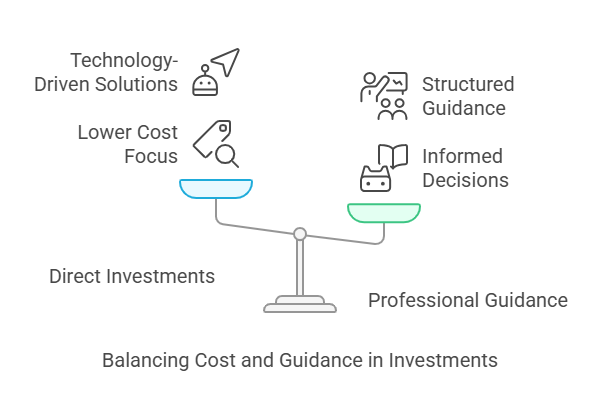

Another major distraction is the Direct vs. Regular debate. Indian investors often go to great lengths to find the cheapest deals, even if it means wasting hours comparing prices. Naturally, when they see that Direct plans have a lower cost than Regular ones, they gravitate toward them.

However, without professional guidance, they end up making poor financial choices. While low-cost Direct investments and technology-driven solutions have helped deepen market participation, they’ve also led to a surge in misinformed decisions. Many investors start SIPs based on short-term market trends, only to stop them abruptly when the going gets tough.

Recognizing the knowledge gap, the regulator introduced an exam to educate investors on investments. But with financial markets becoming increasingly complex, a basic certification isn’t enough. Many investors remain vulnerable to poor decision-making due to a lack of structured guidance. (Read: Financial Planning vs. Wealth Management )

The Reality Check: Who’s Responsible?

At the end of the day, no single party is to blame. Investors prioritize cost savings, regulators offer multiple advisory models, and the industry continues to create new investment channels. Everyone is doing their job. But who ensures investors make the right choices?

The way things are changing we need to adapt accordingly and adopt the technology to the best use. But only tech will not be able to provide you with the right advice based on your requirements.

Ultimately, it all comes down to Caveat Emptor—let the buyer beware. In a world full of distractions, only those who cut through the noise, seek the right guidance, and stay disciplined will truly create wealth.