On January 15th 2015 much awaited rate cut was announced. To start with, it is 0.25% of repo rate, but market participants as per media news are expecting this to go up to 125 basis points in FY 2015-16. Somewhere I also read some real estate developer expecting this year rate cut to be around 300 basis points so to boost up the demand in the realty sector.

All said and done, there’s no end to expectations but RBI will work the way they should be and what it feels is good for the economy. But this is also true that more rate cuts will happen in future. Where these cuts impact positively on the lending rates by reducing the loan interest rates, this will also impact negatively on the deposit rates. In fact only few months back, few banks had reduced there deposit rates due to subdued loan demand.

Low rates will impact government borrowing rates too and which in turn leads to reduction of small saving rates likes Public provident fund. National savings certificate, Senior citizen saving scheme etc., since all the deposit rates are now market linked and depends on the government securities rates.

So what should an investor do? It always pays to be proactive and take necessary action based on expected market scenario. I have figured out some investment options/strategies which are expected to generate good returns in this falling interest rate scenario.

Investment options in falling interest rates scenario

1. Corporate deposits:

In falling interest rates regime it is always wise to make longer tenure investments to manage reinvestment risk. But somehow longer tenure investments i.e. 5 years plus are not available at attractive rates. The deposit rates on less than 5 years tenure investments are at high rates as compared to 5 years plus ones. This I am mentioning of bank deposits.

But if you look at the alternate to it in the form of corporate deposits, there you will find better returns in the same tenure. Theoretically the corporate deposits are meant to be of high risk but with the rating made compulsory for corporates to come up with deposits, selection has become easy for investors.

Say for e.g. where Punjab national bank offers interest rate of 8.75% for 1y-5y fixed deposits, and 8.50% for 5y-10y deposits, there PNB Housing finance which is rated “FAAA” by CRISIL is offering rates as 9.25% for 12m-48m and 9.15% for 48m-120m tenure. FAAA rating by CRISIL indicates the highest safety regarding timely payment of interest and principal.

Same goes with HDFC Ltd, Dewan Housing Finance Limited and other deposits which are offering a spread of 50-100 basis points in interest rates.

But investor should also understand the other side of these investments too.

Corporate deposits are among the unsecured deposits of company and will be paid at the last step in case of a company gets wind up. So while going with this investment options (corporate deposit) one should relate the interest rates and credit rating and decide as per the understanding and risk tolerance.

2. Debt mutual funds (Duration funds):

When market interest rates falls, the return on small saving instruments also gets impacted. But opposite is true in case of duration funds. It takes benefit from falling rates and rises with every fall due to negative correlation between bond prices and interest rates.

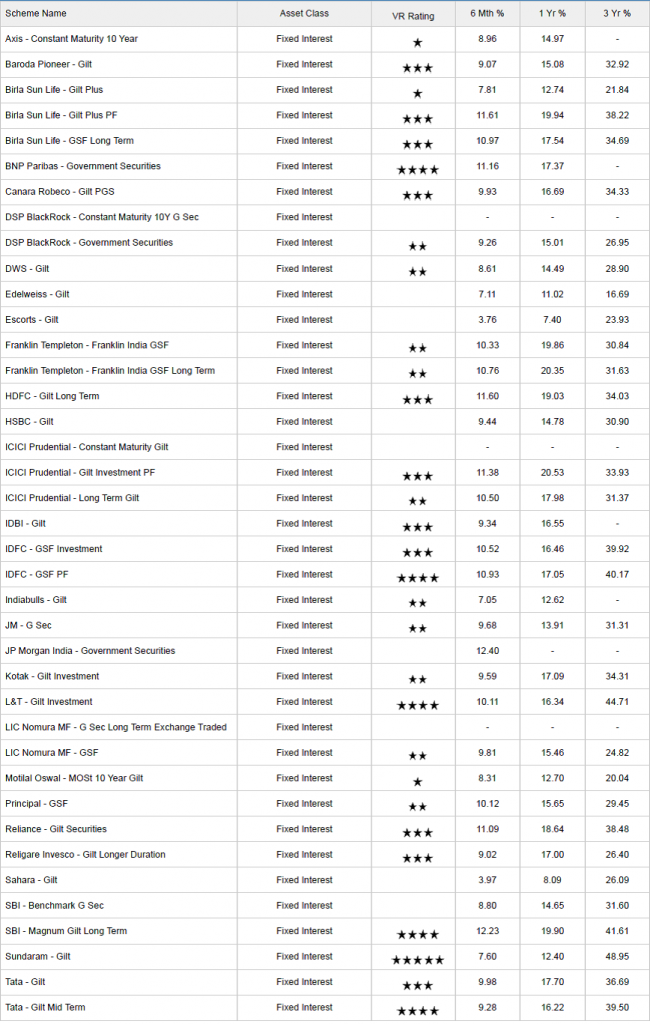

As I wrote above that it always pays to be proactive, those who have taken positions in duration funds in last 1-2 years have gained a lot out of it. Check out the Long term Gilt fund and income fund returns list below, leaving 2-3 funds you will find most of the others giving double digit returns.

Long term Gilt fund as on 27 Jan 2015 ( Click here for full report)

Income funds as on 27 jan’2015. ( Click here for full report)

There’s also a flip side to this investment options. Sometimes you expect that rate cut is imminent and with that in mind takes position in duration funds, but to your shock you find that rather than cutting rates, RBI raise it, as was happened in July 2013 when to control the currency fall RBI raised the MSF (Marginal standing facility) rates. That day NAV of long duration funds fell almost 3%.

Another point to watch here is the quality of portfolio that your fund is having. Sometimes to generate high returns fund manager carries a portfolio of low rated and high yield bond securities. When everything goes fine then you won’t be impacted with this kind of portfolio, it is only when something negative happens and one of the companies in the portfolio defaults. This will impact the complete returns in negative way.

3. Equity:

Keeping all other things constant, falling interest rates are positive for equity market. Low interest rates will lead to availability of cheap loans to the business houses and manufacturing companies, which in turn increases the economic activities. Production increases, job opportunities increases, Consumption and spending power increases, demand increases…and all these things will result into good stock market performance.

But on the other side, do remember that stock market doesn’t move only due to interest rates movements; there are many other domestic and global factors that impact the stock performance.

Conclusion:

Falling interest rates are posing an opportunity for tactical investors. But one should be ready for the flip sides of these and prepare you for the negative impact on the portfolio by following asset allocation and goal based approach. Above mentioned investment options will work in your favor, but it’s better to align them with your overall objectives and financial plan. ( Read: how to determine asset allocation mix for your portfolio)

Do you have any other investment options in mind for this scenario? Do share your opinion on the investment options suggested above.

Dear Sir,

I am afraid not jump to conclusion.

I wan to add my 2 cent.

gilt fund are risky compare to dynamic bond fund.

if you see return for the past 5 year gilt fund are not giving more return compare to dynamic bond fund. In Dynamic bond asset allocation is also good

I.g. Bond 54% equity 10% rest in cash liquid.

Gilt fund they invest 70% to 80 %

In bond. So re investment risk is more in long term period.

IN DYNAMIC BOND FUND FM actively manage fund rather than gilt fund.

You can compare last five year return with Uti dynamic bond fund.

IF you are investing less than 3 year tax treatment would be sane,as per fdr(in debt fund case)

Sadashiv, if its a dynamic bond fund then it should not be into equity. Which specific fund you are pointing to?

I am a prospective investor and was looking for profitable options to invest. I wanted your views about Peer to peer lending and is it a viable option to invest?