Index funds in India have slowly gaining Traction, and there are a few important reasons to it.

In the last 1 year, looking at the active funds’ performance vis a vis their benchmarks or broad indices, the debate of active vs passive has once again ignited. Most of the actively managed funds have failed to beat the Index performance, so it is natural to put blame on the style of Investing.

Since the Active style of Investing demands higher cost due to the fund manager involvement, when investors do not see any Alpha generation (Or Extra Returns) as compared to the benchmark, they start questioning the costs.

It is natural to expect that if we are paying something, we should get something extra than what is commonly available through Index investing. It is not only the fund managers that Investors have started raising such questions to, it includes others too.

Why pay Distributor when we can go Direct ?, (Read: Invest direct, the financial Planning way)

Why pay for advice when we can Do it self and do our own Research? ,

Why pay fund manager when passive investing gives high returns?

But before completely shunning Active funds to go Passive, one should do the cost-benefit analysis and then decide after considering all pros and cons.

My Today’s post is about Index funds in India. What they are, what are the options available and does it make sense to get into such schemes, if it does when should you get into one.

What are Index funds?

Index funds are those Mutual funds which try to replicate its performance of a particular index say the Sensex or Nifty and the likes. Unlike Other Mutual funds, where fund manager performance is judged on the returns he delivers over and above the returns of the index that is its benchmark, in Index funds the endeavor is to have the same returns which Index is generating.

To achieve this goal of generating returns equal to the benchmark, the fund manager need not go into the analyzing the business numbers, profitability, sales, future growth or other qualitative factors of the companies, but just needs to keep the stocks in the same proportion as that of the Index.

Thus, due to lesser ‘Active’ involvement of the fund manager, the costs in these funds are lesser than the Actively manage funds.

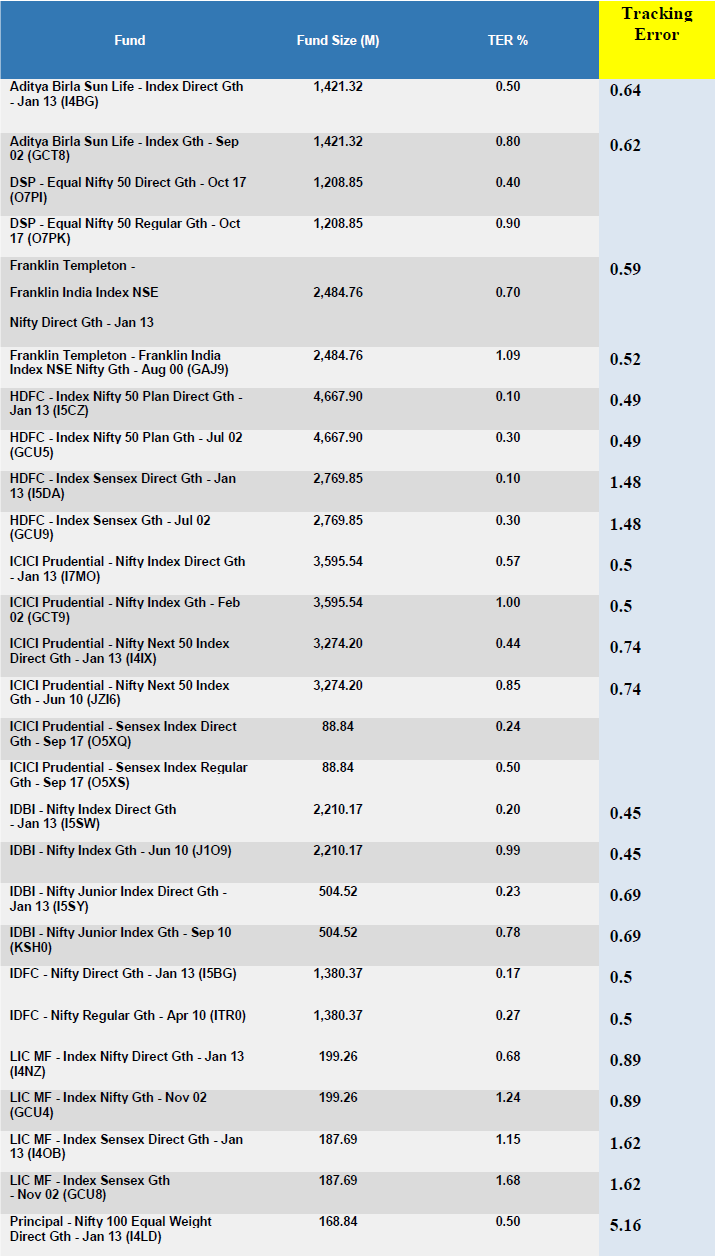

List of Index Funds in India with the TER and Tracking error

Please note that the AUM is In Millions and Not crores. Source: FE 18.12.2018

You can very well see from the above list that Index funds at this stage are available in Large-cap segment only Like Sensex, Nifty 50, Nifty Next 50, Nifty 100, so if at all someone wants to explore the Index funds to invest in, then the exposure can be taken only in the Large cap segment.

Does Index Funds in India be able to replicate Index Completely?

No. The reason is that the fund will make the changes in the portfolio only after it is updated in the Index and this may not happen instantly. This is called as Tracking error and tells how much the fund manager has failed in Tracking the Index.

Besides the Tracking Error, the expense ratio of the fund plays a role in the fund performance. Higher the expenses, Higher the Tracking error, lower the similarity of Returns between Index and Index funds.

(Also Read: How to Review Mutual funds Investment Portfolio?)

How do Active Mutual funds work differently than Index funds?

Active funds do not go by Index composition. They take it as a benchmark but are not bound to be in the same proportion of stocks and in the same ratio as in the Index.

The fund manager will do their own research and make estimates about the future growth of the stock and thus keep or sell out of the fund’s portfolio.

However, since they have to beat the index to show their worth to the investors, they take the well-researched call, which may or may not prove be correct.

And this is where the Risk and Return factors of the fund manager come into the scene.

Beating the Index does not always mean just going beyond capturing the upside of the market, but also protection on the downside.

In the Hindsight, you may say that the fund has not generated returns equal to benchmark index in last few years, but if it has protected you from volatility in line with your expectation based on your risk tolerance then that is also a part of the success of active management.

But yes, at the end what matters to the Investor is the return and new investors do not see the volatility in the past but just point to point returns and make a judgment based on this. This is a wrong way of making fund selection.

(Read: Are balanced advantage funds better than balanced funds?)

How have the Actively Managed funds performed in the Past?

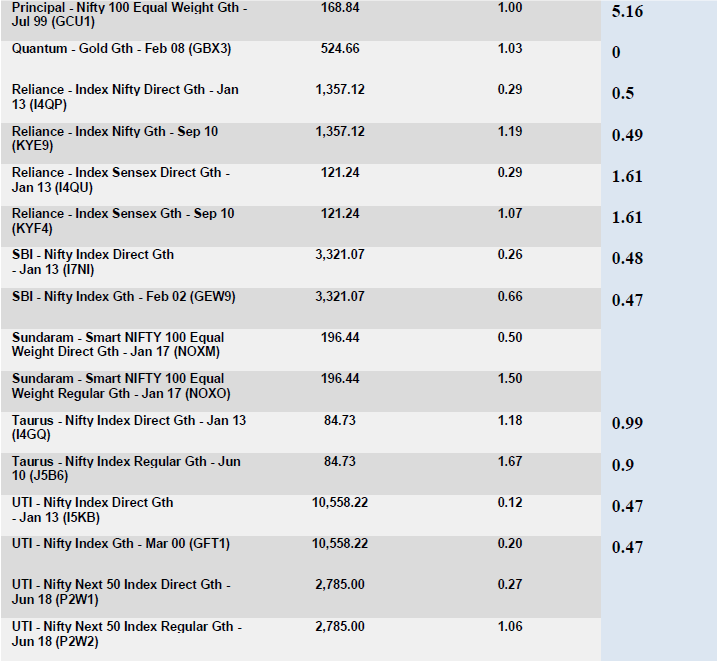

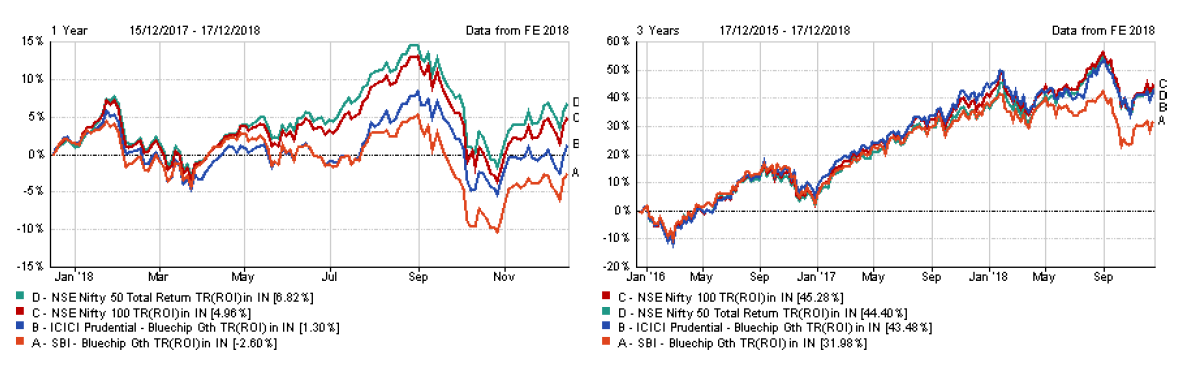

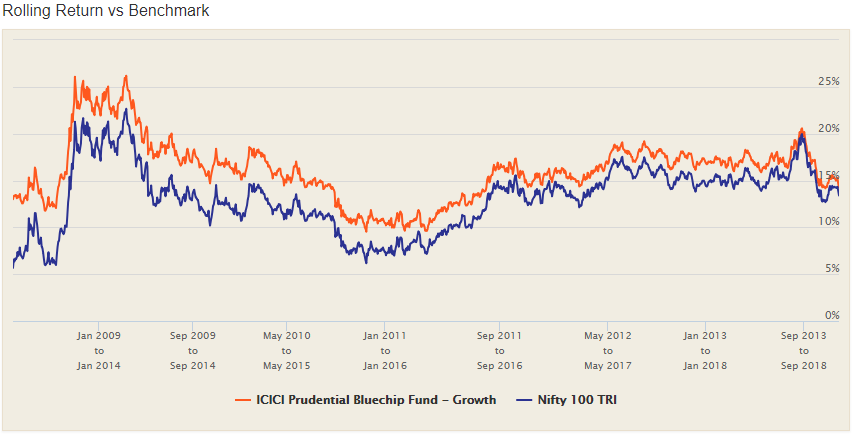

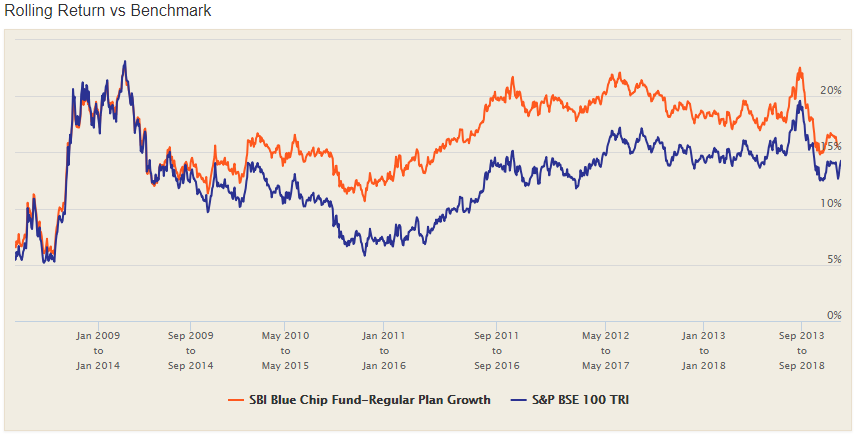

For this purpose, I have taken 2 popular large-cap funds i.e. ICICI Prudential Bluechip fund and SBI Bluechip, having a benchmark as Nifty 100 TR & BSE 100 TR Respectively. And taken them in Regular option as Direct does not have 10 years track record.

Why these funds? I don’t know…maybe these are the ones I prefer to give to my clients based on my selection criteria. You may click on the images to have an enlarged view.

The Graphs clearly says that in 1-3 years, funds have not done that well or have given similar or lesser returns than the Index, but over 5-10 years’ time i.e when markets have gone through different cycles, the active management has been able to generate better returns.

Not only Point to point Returns, but even the 5-year daily rolling returns show the same picture, and I think 5 year is a decent time to look at the performance of an equity scheme.

Why should one look out for Index funds in India?

Now the question comes if Active fund managers have done well then why you read everywhere about going into Index funds?

I think there are 3 reasons for it:

- It is a new thing to discuss. Though Index funds are old but the discussion is new or has regained importance. Everyone likes to know “What’s new?”. So, you are getting what you are looking

- In today’s era when the focus is more on cost, the lower costs product will surely gain attention. Value or benefit becomes secondary criteria when costs are less.

- One major expectation of success of index funds in India overActive funds is the SEBI Recategorization of Mutual funds, strictly defining the Investment space and benchmarking to TRI indices.

Post Recategorization of Mutual funds as implemented in the Second quarter of FY 2018, funds have been provided with a strict and limited definition of large-cap stocks (Top 100), Midcap stocks (Next 150) and Small Cap stocks (next 250). (Read: 5 important changes announced in Mutual funds space in 2018)

And thus, now fund houses can’t have their own definition of the categories and have to strictly select stocks among these defined areas only.

Also, now the funds’ structures have been clearly defined and restricted. This means a Large cap fund, has to be allocated at least 80% of its money into Top 100 stocks only.

Unlike earlier when it is up to the fund house to say that they are a large cap but they could take exposure to Midcaps also to some extent. (Though the scope of 20% is still there?)

The recent performance of the fund shows badly vis a vis the Index, which was also due to the impact of Recategorization, as many funds had to reshuffle their portfolios due to new rules. Recent performance figures always leave a strong impression in one’s mind and sometimes it becomes the basis of that belief that this is how future is going to be.

Should one go with Index funds in India or not?

This is the most important question. It is important to understand how Index funds work. Active and Passive investing style both have their own advantages and disadvantages. Where fund manager takes an informed decision while selecting stocks, it is always difficult to beat the one-sided index, especially the rising one, which sometimes is due to the performance of only a few stocks.

And with the restrictions that SEBI has put in, the fund performance vis a vis Index may get hit over a period of time. But still, it may not be wise to completely shun the Active funds, and also not ignore the Index funds too.

Index funds can be added in large-cap allocation just to diversify the Fund Manager Risk of wrong selection of stocks and not beating the benchmark.

But going 100% Passive also may not make sense to me at least for now.

How about you? what do you think of Investing in Index funds in India? Do you agree with my views? Please share in the comments section below. It will be interesting to know

Actually this whole issue of Active Fund v/s Passive or Index based funds came up in the last few years or rather last one year because of lackluster market and fund performance due to variety of reasons. One must understand that when you expect Alpha return on the upside, then you must be ready to face ‘Alpha’ return on the downside also – albeit not in the same ratio.

In the US where, almost 80% of the market cap is invested in/through MFs only, which means that MFs ‘control’ the investment market in a way and therefore in those markets, ‘Alpha’ return is very much unlikely or very rare. And therefore people go through MF.

In India, the role of MF in the entire market cap is roughly around 11-12%, and therefore, people expect Alpha return from their MF Schemes.

However, one can invest a part of his investment in good performing Index Fund which would give a steady and safe return over a long period.

The market capitalisation of nifty 50 and nifty next 50 are different. If you invest in both these passive funds, should they be in the same proportion.

Depends on what kind of portfolio you want to have. If you want to have exposure to complete top 100 Large stocks then yes. But be aware of the volatility and returns potential in both these segments. Next 50 is quite volatile.