The standard deduction is a fixed amount that is allowed as a deduction from your Gross Income to arrive at Net Taxable Income. The purpose of this is to adjust those expenses out of income that otherwise is not claimable under any section or rule.

The standard deduction in Income Tax is applicable to 2 heads of Income. One is Salary that is Reintroduced in 2018 and the other is Income from House property. Though I have written a detailed post on how to calculate income from house property giving a special mention to standard deduction there, this post is specifically about Standard deduction on salary income, and a brief on Rental income.

What is Standard deduction in Income tax and Who can claim?

Standard deduction on Salary is a fixed benefit amount that is deducted from the gross salary, to calculate the Taxable Income. This is irrespective of the expenses done or Investments made by an Individual. It was abolished in 2005, but reintroduced in Budget 2018 by the then Finance Minister Mr. Arun Jaitley.

Standard deduction replaced the benefit of Medical Allowance of Rs 15000 and Transport allowance of Rs 19200.

The beauty of Standard deduction is its simplicity as a fixed deduction, unlike the medical allowance where salaried people have to submit the Medical Bills to claim the benefit.

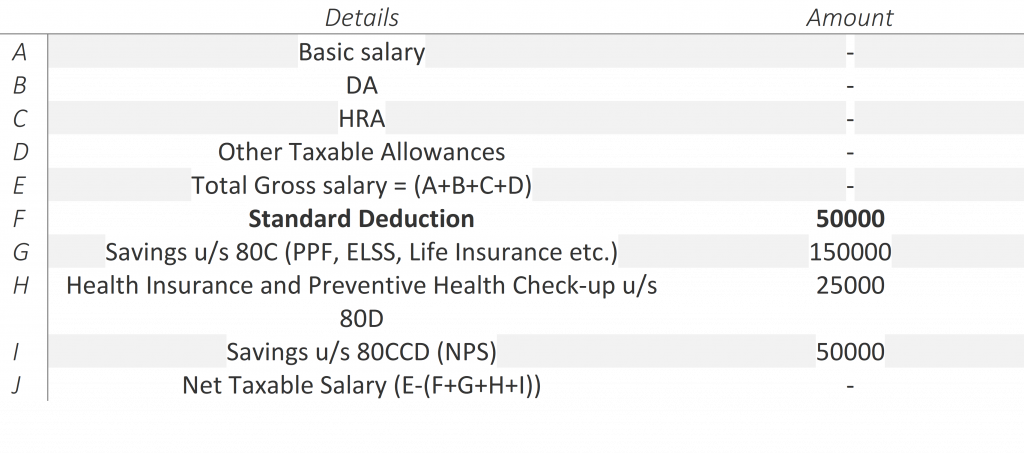

Any person who earns a salary Income is eligible to claim the standard deduction. It is a fixed amount of Rs 50000 (as increased in Finance act 2019), which is deducted from your salary to calculate the taxable income. This is over and above your Claimable savings u/s 80C, 80D, 80CCD, and others.

Technically, Standard deduction in 2019 is allowable to the extent of:

a) Rs 50000 or

b) Amount of Salary, whichever is lower

As per Union Budget 2023, the Standard deduction benefit has been extended to tax payments calculated under New Tax Regime (earlier it was allowed for Rs.50,000 in the old Tax Regime only).

Salary Income as explained very simply by Income tax is whatever is received by an employee from an employer in cash, kind or as a facility [perquisite] is considered as salary. So, you may also count wages, leave encashment, gratuity, advance salary, etc. for this purpose.

It means if your earnings are only from capital gains or Interest, you are not eligible to claim the standard deduction (Also Read: 3 Capital gain Rules, which you may not be aware of)

Is Pension Income eligible for Standard deduction in income tax?

Yes. Pension is considered as a Salary if it is being provided by your ex-employer and thus is getting taxed under Income from salaries. However, if you are getting a pension from an Insurance company then that is considered as Income from Other sources and is not eligible for claiming the standard deduction

If we go by this explanation, then if you buy an annuity (immediate pension) by transferring an NPS account balance to the Insurer, then also you would not be eligible to claim the standard deduction in Income tax.

Even the Family pension is considered as Income from Other Sources.

Relief to Senior Citizens

Considering this issue, and to extend such benefit to Senior citizens whose major income sources are from pension and Interest, section 80TTB was introduced which is meant for Senior citizens only. Under this section, a senior citizen can claim Rs 50000 or actual (whichever is less) as a deduction from the Interest Income earned. (Also Read: Other Tax benefits to Senior Citizens)

Section 80TTB is only available to Senior citizens, so they will be doubly benefitted if they are getting Pension from Ex- employer as well as are getting Interest income from bank deposits or Post office deposits.

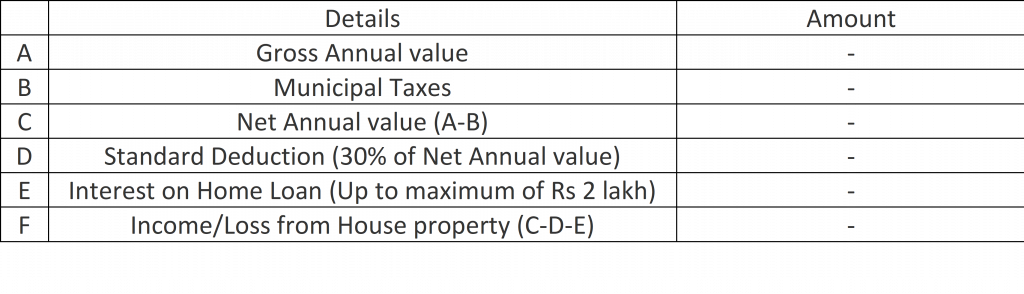

Standard deduction on Rental Income

This is the deduction that is allowed for repairs, rent collection, etc. irrespective of actual expenses incurred. The deduction is 30% of the Net Annual Value. No standard deduction is allowed in case of NIL Annual value as in the case of self-occupied property.

Conclusion:

The Purpose of Standard deduction in income tax is to take care of the expenses which are not allowed under Income tax rules. Reintroduction of this is expected to provide relief to the salaried people who pay taxes on gross income rather than net income unlike self-employed and the business person, where they are allowed to claim most of the expenses they make.

But still, Introducing Standard deduction by abolishing Medical and Transport allowance, though resulted in simplicity, provides little benefit to the salaried assessee. Had it been a percentage of income, then every assessee will get the benefit as per the Income levels. May be going forward government would like to review it and tweak upon it.

I am getting a monthly pension (the SMS which comes for credit into my Bank a/c clearly mentions it as “salary”) from PF Pension Scheme (my employer used to deduct 8.33% of maximum Rs. 6500 per month till the rules were revised to maximum Rs. 15,000 per month now a days) and this deducted money used to go PF account/PF Pension Scheme account.

I want to know whether I am eligible for Standard Deduction of Rs. 50000?

From your query we understand that the pension is received by you from your employer, so you are eligible for the standard deduction.