NRE Fixed deposit is a very popular product among NRIs with very valid reasons. The first one is the Safety and certainty of return, being a bank deposit, and the other is the taxation.

Where almost all the Investment instruments in India are subject to TDS and are taxable for NRIs, the Interest earned in NRE fixed deposits is Tax-Free in India and thus attracts no TDS. (Please note that this is as per India tax law, your country of tax residency may ask for tax on Indian NRE deposits)

This makes it an attractive investment option for NRIs as most prefer to keep their savings in this instrument. Even Financial planners like me also prefer advising NRE fixed deposits as part of the debt allocation in NRI Investments.

But the question comes what would be the Taxation of NRE deposits for Returning NRIs?

Almost every NRI I speak with has NRE Fixed deposits in their name, and when we discuss on their retirement planning, this concern normally crops up as to if they can continue with their fixed deposits and keep earning Tax-Free Interest while in India.

I have tried to answer those concerns in this post.

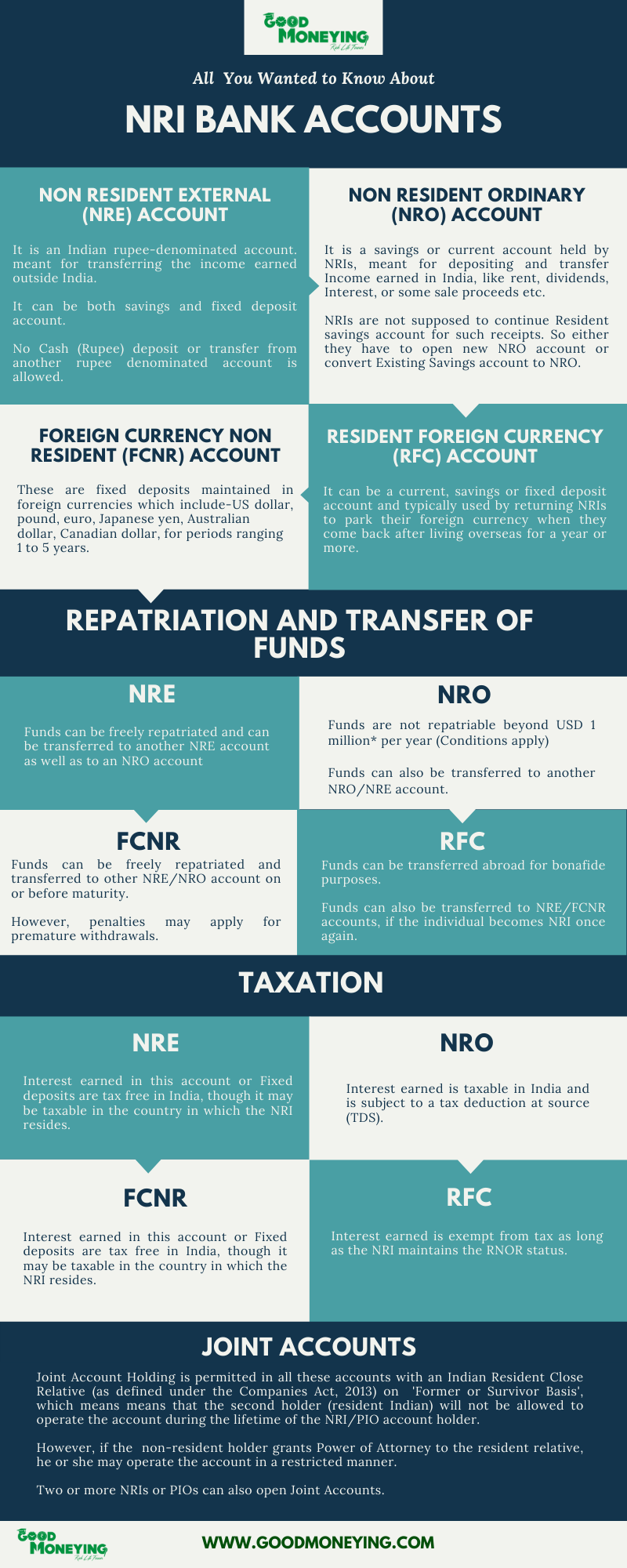

Before going ahead on the NRE fixed deposits taxation for Returning NRIs, let me give a brief on the Types of NRI bank accounts in India, so things become easy for you to understand.

The below Infographic will take you through the same. Here’s a detailed article on NRI Bank Accounts.

Now, coming specifically to NRE Fixed deposits.

NRE Fixed Deposits are only for NRIs

See, you can continue with your NRE deposits only till you are an NRI (As per FEMA), not as per Income Tax. i.e. You may not have completed the 182 days of stay in India, but your intent is to live in India then onwards

This means when you return to India for good, the moment you enter India you lose your Non-Resident India Status (FEMA). However, since you have spent so many years out of the country so you may not become Resident (Income Tax) immediately, but may be considered as “Resident but Not Ordinary Resident” (RNOR).

Is this confusing? I know, that’s why I have written a detailed post on this subject to give you a better understanding. You may refer the same here – Who is an NRI as per FEMA and Income tax?

To brief on RNOR here. Returning Indian will be considered as RNOR If the person

- Has been an NRI in 9 out of the 10 previous years preceding to that year, OR

- Has, during the 7 previous years preceding that year, been in India for a period of, or periods amounting in all to 729 days or less.

Should you close your NRI bank accounts after Returning to India?

Once you lose your NRI FEMA tag, then you are supposed to close all your NRE, NRO accounts. NRO accounts are to be converted to a resident savings account. However, you may continue with the FCNR account until its maturity. Even the NRE Fixed deposit account may be continued till its maturity, since the closing before maturity may attract some penalty. But taxation will be different now.

Taxation of NRI accounts for returning NRIs

Though you are not supposed to continue NRO and NRE bank accounts after your return, so the question of taxation on NRI accounts does not arise, but still, it’s important to know that even if you continue, then NRE fixed deposit would no longer give you tax-free interest.

There are situations when if you break the FDs before completion of tenure, you may have to pay some penalty or lose on Interest, so in those cases, you may continue with your Deposits till there maturity but the Interest Income post your becoming of Resident (FEMA) will be taxable.

(Also Read: Mutual funds taxation – How it is different for NRIs?)

However, if you want to retain the tax-free status of your Deposit, you have to move the money from FCNR and NRE FDs to the RFC account. The Interest earned in the RFC account will be tax-free until your tax status is RNOR.

Should NRIs move their NRE and FCNR Money to the RFC account?

Well, looking at the interest rates being offered by banks, the RFC account may not look that attractive even if it is under tax-Free status. But there are other benefits of the RFC account which may make it usable for you.

Since the money will be in foreign currency which is fully repatriable, you may use it to make some expected near-term payments/remittance without worrying about currency fluctuations and conversion charges. The amount lying in the RFC account may be freely deposited in New NRE/FCNR account if you regain the NRI status.

RFC account may also be used to receive the credits from abroad like rent, sale proceeds of eligible assets, dividends, Interest, etc.

(Also Read: Tax planning Tips for Returning NRIs)

But if you are not expecting any debits or credits from the RFC account and you full-fledged have returned to your country with no baggage left behind, then its wise not to keep so many accounts that are of no use.

Conclusion:

Knowledge of Types of bank accounts available to NRIs is important to make wise choices, so you should not be on the wrong side of the law when you are out of India and even when you are returning.

NRE Fixed Deposit is an attractive fixed income option due to its tax-free nature in India but you should be aware of your resident country’s tax laws too, and also it’s status when you are returning to your home country.

In case you have questions on your NRI bank deposits, Feel Free to ask in the comments section.

TDS ON DEDUCTED ON NRE FD INTEREST AC YES OR NO

IF BANK DEDUCTED TDS ON INTEREST EARNED FD AC FOR NRE ACCOUNT THEN HOW CAN CLAIM FOR REFUND OF TDS AMT

While doing the self assessment of your income tax, you have to show the TDS deducted. It would get adjusted in your tax liability (if any), else it would be refunded.

A PIO comes back to settle down in India in the year 2020 What will his residential status be and can he continue with his NRE deposits

If the intention is to settle down in India, then clearly as per FEMA that PIO will be considered as Resident, and then he cannot continue with NRE deposits

I have come back after 7 yrs in UAE. Return on 1 Aug 2020. I will be RNOR for 2020-21. In this case will my NRE FD becomes resident FD? and its interest taxable?

to reduce tax liability, what are the tips

Bank deposits come under FEMA, you will become resident once you arrive in India for good, and in this case, Income tax rules consider FEMA residency for taxation purpose…so yes your NRE FD’s interest would be taxable. However, you may convert it into RFC to keep it Tax-Free for some more time.

I have few NRE deposits and I am planning to permanently return to India in October 2021 . How can I pay taxes on my NRE FD s if I want to continue until maturity.

Bank deposits come under FEMA, you will become resident once you arrive in India for good, and in this case, Income tax rules consider FEMA residency for taxation purpose…so yes your NRE FD’s interest would be taxable. However, you may convert it into RFC to keep it Tax-Free for some more time.

Sir,

I have been an NRI for the last 20 plus years in Gulf and returned to India in November 2021. Living in India for 50 days, I travelled abroad on 28th December 21 on a visit visa to Australia with multiple entries (Visa validity till 2023). I am planning to end my visit by April 2022. As per FEMA rules, will I be a resident from November 2021 or April 2022? I am a bit confused about declaring my status as per FEMA. Thanks for your advice in advance.

Dear Sir

I have been an NRI for the last 30 plus years in Gulf and now retired and reached India on 3rd November 2021. After spending about 55 days I traveled to Australia to visit my daughter. I plan to go back to India by April 2022. As per FEMA rules will be a resident from November 21 or April 22?

Hello Mr. George,

Since you are not visiting Australia for employment purposes or permanent stay, as per FEMA Rules you would be considered an Indian Resident from November 2021 onwards, i.e., when you returned to India from Gulf.

Hope it helps.

Thanks.