Mutual Fund Expense Ratio has never been a topic of interest until the Direct Mutual funds came into existence in 2013.

The Regulator SEBI wants to make Mutual funds a transparent product for the Investors and thus have taken many steps to increase its acceptance among the public.

Besides the direct options, the other such step was, to help investors track the changes in TERs (Total Expense ratio), and to further increase transparency in costs, SEBI has mandated AMCs to disclose the actual TERs on a daily basis on their websites.

Also, whenever there is a change in the TER, AMCs are required to inform the investors of the scheme through Email or SMS, at least 3 days prior to the change. This is applicable since March 1, 2018.

So, Post that Investors have started receiving emails and SMS whenever there is an increase or reduction in the TER of a fund, which increases confusion among many investors who are not aware of what Mutual funds expense ratio is all about.

Since expenses have its impact on returns too, so the aware investors are among a worried lot about the costs of Investments.

In this post, I would be throwing light on the Expense Ratio in Mutual Funds and how it impacts the performance of mutual funds.

What is the Expense Ratio in Mutual funds?

Just like any other Business, Running an Asset management company has its own costs, plus they have to make profits too. And both of this have to be generated through the products they sell, which is Mutual funds.

The service they offer in those products is its proper management, so Investors can make profits from their investments, and Invest more. For all this AMC charges its Fees, from where it pays the fund manager and makes a profit too.

Plus there are Marketing expenses, Distributors Brokerage, Auditor fees, Custodian charges, RTA cost, and many others as allowed by SEBI.

All these charges clubbed together are called the “Mutual Fund expense ratio”.

It is expressed as a percentage of the total assets (total invested money in the fund) in annualized terms and is disclosed on a daily basis by the Fund House. It is charged on the daily net assets of the fund.

It is a kind of cost of investing in mutual funds, to be borne by the investor. This is popularly called as TER (Total expense Ratio)

(Also Read: 5 important Mutual Fund changes in recent times.)

Let us understand it with the help of an example:

Expense Ratio in Mutual Fund- illustration:

Let’s say, you invest Rs. 1 lakh in ABC Equity Fund which has an Expense Ratio of 1.75%, which means you are giving Rs. 1,750 to the fund house to manage the money.

In other words, if a fund earns a gross return of 10% p.a., and has a 1.75% Expense Ratio, it would mean that you would get a net return of 8.25% out of the fund.

Please note: this Rs 1750/- is not an upfront fee (entry load) and will be charged to the investments over a year. Plus it’s not on the investment amount, but the daily net assets. So, if the Investment value goes down they will get less in rupee terms and if it goes up they will get more.

That way improving the performance of the scheme is to their benefit too.

You can find this Expense Ratio or Total Expense Ratio (TER) for every mutual fund scheme on Fund fact sheet, Scheme documents, Research websites, fund house website, etc. (Also Read: How to interpret an equity mutual fund fact sheet?)

SEBI Prescribed Limits on Total Expense Ratio:

The expense Ratio of a Mutual Fund largely depends upon two factors,

The type of fund and

The quantum of Assets managed by the fund house under that particular mutual fund scheme. Assets mean the total money invested in that fund by all the investors.

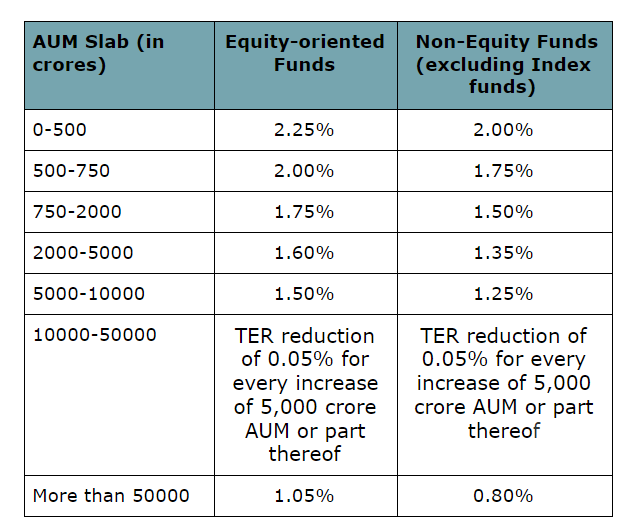

When the scheme Assets are low, it generally charges a higher expense ratio as the expenses of the fund house are higher at the initial level, and as the Asset size grows, the expense ratio comes down.

Expense Ratio also depends upon the type of fund. Different types of funds have different expense ratios. Equity funds have a higher expense ratio as compared to Debt funds. Actively managed funds have a higher expense ratio to Passive funds (Index funds).

SEBI had reviewed the Expense Ratio structure in the Board Meeting in October 2018 and asked all mutual fund houses to revise their Total Expense Ratios (TERs) from 1st April 2019, as per the new slab limits, described as under:

Base Total Expense Ratio limits for Open-ended funds:

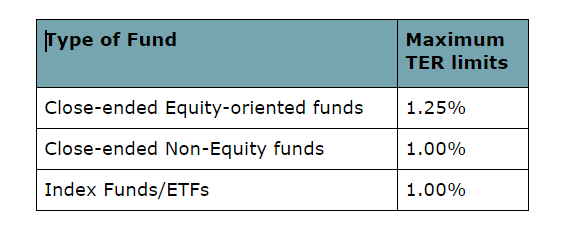

Base Total Expense Ratio limits for Other funds:

The additional expenses over and above the base TER are as under:

- Additional expenses, not exceeding 0.30 percent of daily net assets, subject to new inflows from B 30 cities;

- Additional expenses, not exceeding 0.05 percent of daily net assets, due to credit of any exit load to the scheme.

- Goods & Services Tax (GST) on Management Fee is charged over and above the TER limit.

Direct Mutual Fund Plans and Expense Ratio:

Because the distributor commission is also part of the overall expense ratio, to reduce the cost of Investment for the aware investors who don’t need any kind of Investment Support, plus to increase the transparency on the costs of distribution SEBI has come up with Direct Plans of Mutual Funds in 2013.

Since then, all Mutual Fund Schemes come in two avatars, Direct Plan and Regular Plan.

Direct Plan: When the investor invests directly through the Mutual Fund House or it’s website, without involving any intermediary in-between, it is a direct plan. It is just like purchasing a product directly from the manufacturer.

In this Plan, the TER charged does not include the Distributor commission, so It saves the cost paid to the intermediary. The TER in these funds is lesser as compared to the regular ones. and thus these funds have separate NAVs

(Also Read: Invest in Direct, the Financial planning way)

Regular Plan: In this plan, an intermediary is involved, between the investor and the fund house, whether a Banker, Broker, or a Distributor, who earns a commission from the fund house. Technically this commission gets paid by you through a higher expense ratio charged on your scheme.

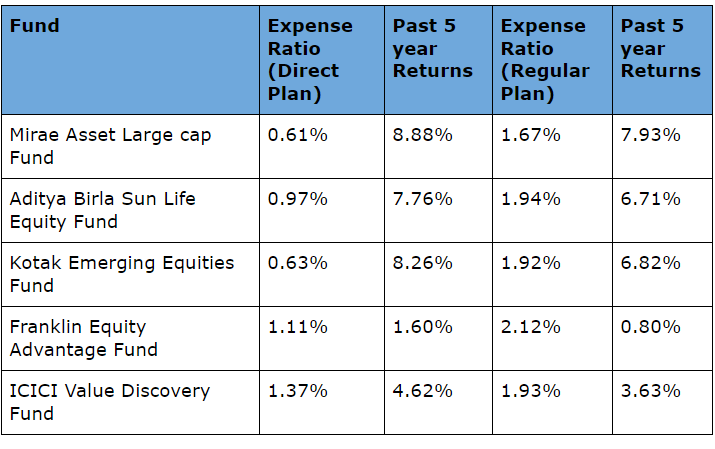

Since you are dealing with a product distributor and taking his/her services so the commission is the service cost for you. Due to this cost, the expense ratio of a regular plan is higher than the Direct Plan. The below table illustrates the fact:

Expense Ratio in Mutual Fund- conclusion:

Although a higher expense ratio might mean a lower return, it would not be wise to judge a mutual fund only on the basis of this criterion. Do remember, it doesn’t mean that a fund with a lower expense ratio is a better-managed fund.

This can surely be a point of comparison between 2 funds and if you see two funds with a similar management style and same kind of portfolio then the expense ratio may create a difference.

(Read: 5 ways to compare mutual funds)

Here, you may go with the fund with the lower expense ratio to fetch good returns on your investment.

(Also Read: How Mutual Fund Benchmarks may help you select the Right funds?)

Direct plans are basically meant for the aware and knowledgeable investors which can manage their portfolio well, or these plans can be taken by the Investors dealing with SEBI Registered Investment advisors who may be acting as Fee-based or Fee-Only advisors.

(Read: is your advisor SEBI Registered?)

What are your thoughts? Feel free to ask your questions in the comments section. If you like the article, share it with your family and friends.

This article is written by Mr. Varun Baid

very good article for new person about MF

Thanks, Mr. Daswani