This time in her Budget 24-25 speech, Finance Minister Ms. Nirmala Sitharaman emphasized the government’s commitment to simplifying the tax system, improving taxpayer services, ensuring tax certainty, and reducing litigation, all while boosting revenues to fund development and welfare initiatives. Referring to the new tax regime, she said that the government has been proactive in this regard, implementing several measures over the past few years.

She also mentioned that the government is undertaking a comprehensive review of the Income Tax Act of 1961, which will be completed within six months.

In short, taxpayers should prepare for potential changes, including revision of tax rates and fewer opportunities for tax savings. And also brace themselves for more announcements in the Budget 2025. (This is what I am presuming)

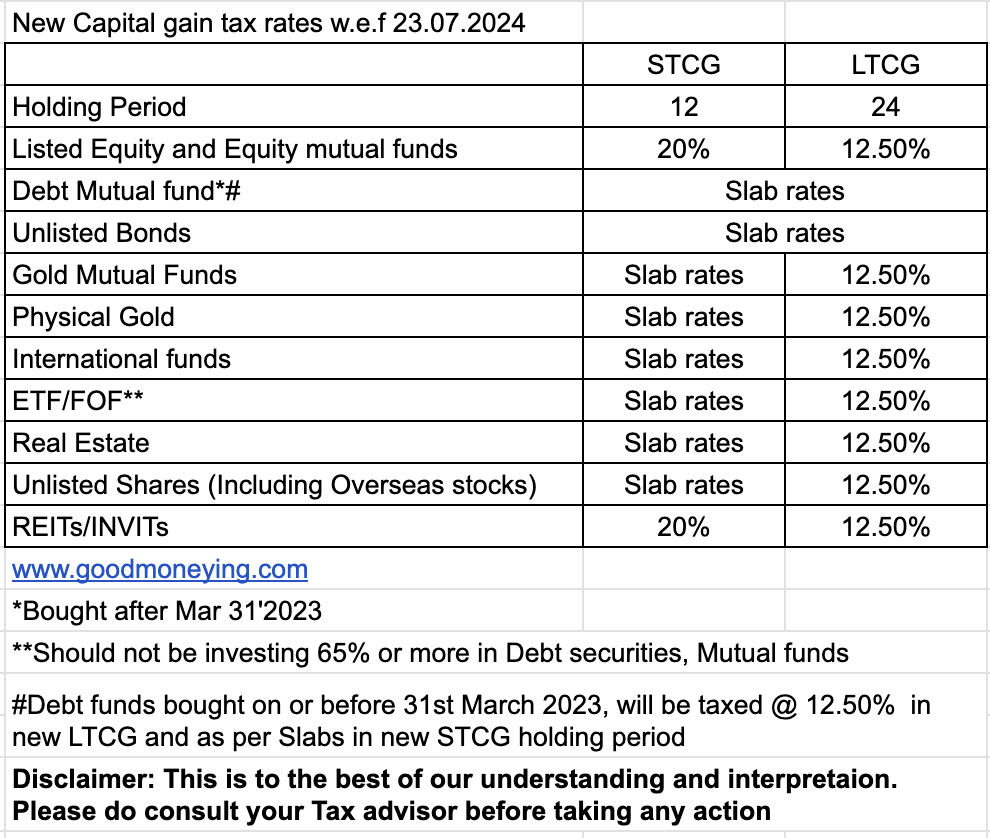

Here I am going to share some important tax provisions impacting your finances. The below table will give you a concise view of the capital gain changes. But for details go through the pointers.

Budget 24-25- 10 Important Direct Tax Changes

- New Tax Regime Slabs have been Revised again.

There’s a revision in the Income Tax slabs under the new tax regime. And the rebate u/s 87A, has been reduced to Rs 20000. Thus those with upto Rs 7 lakh of Income will not have to pay any taxes. (Past Revision: Old or New Income Tax Rates Slabs (FY 2024-25)–what to choose?)

- Standard Deduction

Those who file Taxes under the New Tax Regime can now claim a Standard deduction of Rs 75000, instead of Rs 50000 earlier.

(Related Article: What Income Categories are Eligible for Standard Deduction In Income Tax?) - New pension Scheme

The allowable deduction u/s 80CCD (2) for employer contributions towards NPS, has been increased from 10% to 14% of an employee’s salary for the previous year, provided the employee opts for the new tax regime for assessment.

Also, NPS vatsalya has been introduced for Minors. (Details Awaited). (Discover More: SWP in NPS – Systematic Lump Sum Withdrawal in New pension Scheme) - Securities Transaction Tax

STT on F&O Trading has been revised on the sale of an option in securities from 0.0625 percent to 0.1 percent of the option premium, and on the sale of a futures in securities from 0.0125 percent to 0.02 percent of the price at which such “futures” are traded.

- Capital Gains

This is where the major changes have been announced. They have termed it as Rationalization and Simplification of taxation of Capital Gains.

It is proposed to have only two holding periods to calculate long-term and short-term capital gain, which are 12 months and 24 months.

For all Listed Securities the holding period shall be 12 months and for other assets 24 months.

The holding period for bonds, debentures, and gold will reduce from 36 months to 24 months. For unlisted shares and immovable property, it shall remain at 24 months. - Capital gains on Listed Equity and Equity MFs

Short-term Capital gain tax has been revised to 20% from 15% earlier.

Long-term capital gains taxes will now be 12.5% instead of 10% currently.

Also, the basic exemption limit on LTCG Equity has been revised from Rs 1 lakh to Rs 1.25 lakh. - No Indexation on Real Estate

With the changes announced in holding periods and tax rates, the indexation benefit for property transactions has also been eliminated. This means you no longer can Index the cost of property with CII numbers, to calculate the capital gains tax at the time of sale.

Now, you will have to pay a flat 12.5% long-term capital gains tax for holding periods exceeding 24 months, while short-term gains will continue to be taxed as regular income. (Also Read: Why Simple is Better: Understanding Complexity Bias) - Physical gold

The Holding period definition applies to Physical gold also. And with this, the STCG tax (holding period < 24 months) in Physical gold, will be as per the slab rate, but the LTCG (>24 months) will now be 12.50% without Indexation, which earlier was 20% after indexation (for holding 36 months) (Read More: How good is gold as an investment?)

- Debt Mutual funds

The Indexation benefit is completely done away with on all the applicable Assets. In Debt funds, it was already removed last year, but for the schemes purchased before 01.04023, it was applicable till yesterday. In the new rule, even if debt mutual funds were bought before 01.04.23, will also not be able to claim the indexation and have to pay taxes @ 12.5% if held for more than 24 months. And for the schemes bought after 01.04.23, their gain will anyway be added to the Income and taxed as per slab rates.

- Gold funds/ETFs/International Funds

On the debt Mutual funds purchased after 01.04.2023, the Indexation benefit was already removed in Budget 2023, but there was confusion in the definition of “Specified Mutual funds”, as it what other schemes may come under this new taxation.

It was interpreted that the Indexation benefit has been removed from all “Non-Indian Equity funds” including Gold funds, ETFs, FOFs, and, even International funds. In this Budget 2024, it has been clarified that

a) Mutual Fund by whatever name called, which invests more than sixty-five percent of its total proceeds in debt and money market instruments; or

(b) a fund that invests sixty-five percent or more of its total proceeds in units of a fund referred to in sub-clause (a)

will only be considered as a Specified Mutual fund, and cannot claim Indexation benefits.

This means Gold funds and international Equity funds are no longer part of the old assumption.

However, at this point, it is important to note that Indexation has been completely abolished, on all the asset classes. Thus those schemes that were earlier used to be indexed for long-term gain calculation, need to pay 12.5% tax if Long-term i.e. holding period greater than 24 months, and for lesser holding the gain will be added to the Income. (Explore more: How many Investment Products should you have in your Portfolio?)

Conclusion:

This is very clear that with simplicity and rationalization, government means no deductions, no rebates, maybe with low tax rates. Doing away with Indexation and reducing the capital gain tax rate is one of those steps.

This budget may have disappointed many investors, especially the real estate holders who were planning to sell their property in the near term, and also those who were holding their debt funds (bought before 01.04.2023), with an understanding that they will continue getting Indexation benefits for all the periods…and we can discuss, debate on many things…but the reality is what has been announced. And the way FM has announced, with a focus on a new tax regime, and now capital gain taxes…you will find many other BIG changes in the next budget.

So accept the fact and sit with your financial planner, to understand the impact on your financials, and how to move forward.