Today I will discuss home loan tax benefits available u/s 80C and Sector 24 of income tax act

Buying own house is one of the most important goals in everyone’s life. Looking at the rising property prices some purchase it as an investment and many wants to avoid the stay on rent and thus wants to have own accommodation.The increase in housing prices have in turn lead to increase in demand of home loan as very few can afford to buy property on cash/lump sum.

Along with the comfort of paying back the loan in installments home loan comes with lot many tax benefits. Many investors who even can afford to pay in lump sum prefer going through home loan route as the tax benefits reduce the net outflow of interest.

Understanding home loan tax benefits are very important as one can take multiple advantages from this if used rightly. Understanding income tax benefits of an interest payment under section 24, principal payment under Section 80C, benefits under joint home loan, second housing loan etc. makes this concept more interesting. (Read : Tax benefits on joint housing loan)

Before going ahead with the details on Income tax benefits on home loan, lets first understand the basic terms related to the housing loan:

EMI: Equated Monthly installment (EMI) is the term used for the monthly payments made for repaying home loan. EMI has 2 constituents – Principal and interest. Principal is the portion of loan capital amount and interest is what bank charges for that loan. In the early years of repayment, EMI consist of higher interest portion and lesser principal amount. But as time passes your principal payment increases and interest reduces.

Self-occupied house: As per Section 23(2) (a), a house property shall be termed as self-occupied property where such property or part thereof: (a) is in occupation of owner for the purpose of self-residence, (b) is not actually let out during the whole or any part of previous year; and (c) no other benefit is derived by the owner.

Deemed to be let out: If an assessee occupies more than one property, he is allowed to treat only one property as self-occupied at his option. The remaining self-occupied properties shall be treated as “deemed to be let out”.

Joint home loan: A Joint home loan is loan where there is more than one borrower i.e it is a loan taken jointly by more than one person. A joint home loan can only be availed by a minimum of two and maximum of six applicants. A joint housing loan is given to married couples or close blood relatives like parent and child. Usually, banks insist that all the co-owners of the home must be co-borrowers.

Pre-EMI interest: No EMI payments gets started, till the time loan gets fully disbursed. As happens in home loan with a construction linked plan, no EMI starts till the offer of possession by the builder. The Borrower just has to service the loan interest till then. So the interest amount which has been paid before the starting of EMI called as Pre EMI interest or Pre-construction EMI (which is only the interest part).

The Idea of explaining the above terms is to help you understand the taxation under housing loan in a much better way.

Home loan Tax benefits u/s 80C

As explained earlier that housing loan EMI consists of Principal and interest. The principal portion of home loan EMI paid in a financial year is eligible for Income tax benefit u/s 80C upto a maximum limit of Rs 1.5 lakh per year. Other Section 80C components for tax saving are PPF, ELSS, Life insurance premiums, NSCs, 5 year bank fixed deposit etc. The total cap of section 80C investment is Rs 1.5 lakh which is inclusive of this principal payment in housing loan.

Home loan tax benefits u/s 24

The interest portion of housing loan EMI paid in a financial year can be claimed as deduction u/s 24 up to a maximum limit of Rs 2 lakh per year. Interest payment is considered as deduction under the head “income from house property”.

The best part in tax benefit under section 80C and section 24 with respect to housing loan EMI is that there’s no limit on houses and it can be claimed irrespective of the fact the house is self-occupied or let out. Say for example you work in Delhi, but you have one house in Chandigarh and other in Mumbai, for which you are paying housing loan EMIs, You can claim benefit of Section 80C and Section 24 for both of houses under self-occupied category within the maximum limit u/s 80C which is Rs

Say for example you work in Delhi, but you have one house in Chandigarh and other in Mumbai, for which you are paying housing loan EMIs, You can claim benefit of Section 80C and Section 24 for both of houses under self-occupied category within the maximum limit u/s 80C which is Rs 1 1.5 lakh and u/s 24 which is Rs 1.5 2 lakh, combining the total principal and Interest payment of all the houses. Do note that both benefits can be claimed only after taking possession of house.

Some conditions to avail this benefit:

Maximum interest allowed in aggregate of Rs 1.50 2 lakh per year, if the following conditions are satisfied-

a) The Loan is utilized for construction or acquisition of house on or before 1-4-99.

b) Construction or acquisition of house should be complete in a maximum of 5 years (w.e.f 1.4.16) starting from the end of financial year in which loan is borrowed.

One more interesting point here is that section 24 tax benefit can be claimed even if the loan is raised from friends, family or relatives. If you have a good inflow of income and then by doing tax planning early in life you can create different tax files in the family and can use them for your own tax benefits. This way you can save on the interest payment to bank, and also be able to claim tax benefit on your own income.

Do note that this benefit can only be claimed against the certificate issued by the loaner and he has to pay tax on the interest received against this loan. (Read: tax planning Tips)

Special tax incentive announced for people taking the first home loan up to Rs 25 lakh in FY 2013-14 (Section 80EE). In this scheme, additional interest deduction of Rs 1 lakh is offered only for one year. If one could not exhaust the full Rs 1 lakh in 2013-14, then he can carry forward the balance to next year. Please note this is over and above the deduction of Rs 1.5 lakh and of course with many additional conditions.

Rules u/s 80EE is being revised every year in Budget. As per the last anouncement in budget 2016, Section 80EE allows additional deduction of Rs 50000 per year, over and above Rs 2 lakh u/s 24 on home loan interest portion, provided you satisfies the following conditions:

- Your Loan should be taken in FY 2016-17

- Home Loan must be taken from a financial Institution.

- At the time of sanction of loan, the borrower should not own any other residential property.

- The Value of property should be Rs 50 lakh or less and the Loan value should be Rs 35 lakh or less.

Pre EMI interest

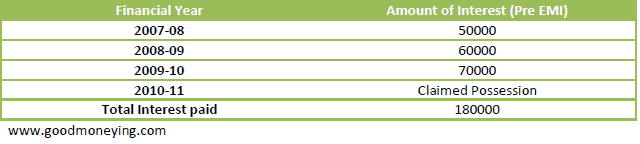

Pre-EMI interest can be claimed in 5 equal installments starting from the financial year in which possession has been taken. For example, you have paid pre-EMI interest as under

Starting 2010-11 till 2014-15, you can claim PRE EMI interest deduction of Rs 1,80,000(20%) which comes to Rs 36000/-, along with the interest you pay in those years. But do note that total interest payment benefit should not exceed Rs 1.50 2 lakh in any financial year.

No discussion on home loan tax benefits gets complete without mentioning about Home loan on second house and joint housing loan. But I think that these topics deserve a separate post. So let this post be to the basics only and we’ll discuss second and joint home loan tax benefits in the next post.

Also Read: Income tax benefits on joint housing loan

You may ask your queries on home loan tax benefits in the comments section below. Though I am not a tax expert, but still I will try to answer your queries to the maximum possible I can. But please take my replies as opinions only and not advice and better to consult a good tax expert before taking any decision.

What happens if I have a home in a different city. and i have a home loan for the home. also the home in the different city is rented.

Can I syill claim both the Principle & interest in the EMI’s paid.

As long as you are not staying in the same city where the house on loan is, you can claim Principal and interest benefit. Even if it is rented.

Hi Mani,

Do note that Pre-EMI interest is not eligible for interest deduction u/s 24 in any case. As per Income Tax Act, Pr-construction EMI is eligible in Five Equal installments. Normally we read a term in our Bank loan statement ” Pre EMI interest” but remember the Pre EMI interest term given in Loan Statement is not necessarily same meaning as Pre construction period as per income tax act.

As per Income tax pre construction period means:

Interest up to the end of Financial year ,immediate proceeding to the year in which house is completed.

suppose loan is taken on Jan ,2008 and House is completed on 31.01.2010, in that case pre -construction Interest is taken from Jan 2008 to March 2009.

In above example ,even if House is completed on 31.03.2010 then also the pre construction Interest is considered From Jan 2008 to march 2009.

Hence, As per Bank Pre -EMI interest means ,Interest Due up to the start of payment of First Instalment..So term used in Bank statement or loan certificate is not similar as defined in Income Tax Act.

Suresh, I agree with the difference that you pointed out from income tax prespective and bank loan statement on the definition of pre EMI or Pre construction EMI. But i don’t agree with you on that PRE EMI interest is not eligible for deduction u/s 24.I think you wanted to say that no PRE EMI as per Bank loan statement but Pre construction EMI as per Income tax definition is eligible for deduction u/s 24. Is this you wanted to say?

As per Income Tax Act, Pre-EMI is the amount that you pay to the bank before your actual EMI gets started on your loan. This is basically the interest amount that bank charges before starting your principle EMI. That amount of interest is not eligible for deduction u/s 24. Hence, Pre-EMI consists of the interest portion only, so there would not be any tax rebate on the same. For tax benefit, you must be paying the principle amount. The provisions for deduction on interest paid during the construction are stated under Section 24 of Income Tax Act. You get the tax benefit on Pre-construction period, not Pre-EMI, once the construction is completed. After the construction is completed, you can claim the tax benefit for the amount of interest paid on the Pre-construction interest component in next 5 years. Despite the fact of pre-construction period clause, is not applicable for your principal component as you can claiming the same since its inception of EMI.

I have one question here on the additional 1 Lakh interest if the loan in under 25 lakh and property less that 40 Lakh.

The question is

1) Can i claim this benefit if the property is under construction ? Can this be claimed only for property whose construction is complete ?

2) How can once benefit if the property is under construction? (loan taken during 2013-2014)

Can someone please guide me about Income tax reclamation calculated in case of owning a house but staying in a rented house in same city.Owned house is vacated though and there is no Interest amount on loan which I can show this year.

I had claimed HRA(for time period before having possession) and interest+principal amount(After having possession) last year but can I claim HRA only this year as there is no Interest amount?

Apeksha, if you have lived even for some part of the year on rent and even paid interest and principal on your home loan, you can claim all from taxation perspective.

Thank you so much for your valuable time and information.

i have recently refinaced my house from lichfl to hdfc in the financial year 2013-14. can i claim deduction under 80EEE.

nope. it is applicable only on fresh loan cases.

If an assessee owns 2 houses in 2 different cities. He’s staying in one of the houses and the 2nd house in another city is vacant (not given on rent). Can he still claim the 2nd house as self occupied and the 1st (in which he’s currently staying) as deemed to be let out property?

Thanks in anticipation.

Hello Mr Mani,

I took a Home Loan (construction linked ) in April 2013. The possession of flat is expected around Nov 2017 ( i.e 3 years after the sanction of home loan). However as the loan is construction linked, i will be borrowing money from Bank during the period of Apr 2013 to Nov 2017. In this scenario will i be applicable for full 2 Lac interest benefit under Section 24 or only Rs 30000 ? Please note that right now i am only paying Pre-EMI and plan to start by EMIs from Nov 2017

Vibhu, you will claim full Rs 2 lakh or actual interest which ever is less as deduction, u/s 24 of IT act. Rs 30k limit is on the loan taken for renovating the house.

In your case the tax benefit can be claimed only after having possession of house and when you start paying the EMI. The interest paid during the construction phase will be totalled and can be claimed in 5 installments in next 5 years, along with the interest you pay for that particular year . Have explained this in the article under Pre EMI interest Para.

Pl. confirm if construction period condition of 5 years limiting to Rs. 30,000/- of intrest is applicable in case of let out residential property ( Not SOP) .Relevant link /extracts of IT section may be mentioned for showing in my office please,

In other words am I eligible for intrest component Rs. 30,000/- rebate or no limit for intrest component rebate in let out residential property . I got possession in Dec 2016 and housing loan was sanctioned in March 2011. Pl. guide

Dinesh Singh

Is there any Principal prepayment at fully discharge stage under housing loan ? property is let out during the year?

Is there any Deduction for rent out property if it is Principal prepayment at fully discharge stage under housing loan ?

can you please elaborate your query?

Hi

I wanted to confirm something real quick. Me and my wife are taking a home loan and are co-borrowers and co-owners in the loan. If EMI is only getting deducted from my account, will my wife still be able to take benefit of interest and principle paid or she also need to have transactions from bank getting amount deducted in same share from her bank account?

Though it is advisable to get your account joint to avoid any issue in future, for now, if the condition of co-borrower and co-owners is getting met, yes, she can claim the tax benefits. Still, keep your tax person in confidence.

R/sir,

I have taken 3.25 lacs home loan from my government department in 2002.

And complete repayment of principle amount in march 2018.

Now i have doing renovating and construction first and second story .for that i have taken 20 lacs loan from PNB housing finance.and for that i have paid whole pending interest of 1.97 lacs in single installment.

Can i claim this whole interest amount for tex rebate from my employer and income tax department?

Vipul, its better you consult a Good CA for your this query

Whether principal repayment of housing loan paid during preconstruction period deductible u/s 80c?

In Preconstruction period you do not do principal repayment. Only Interest is paid.

Is it in order to ask depositing rent directly in the housing loan account by tenant? Or house owner/borrower is supposed to receive the rent amount and deposit the amount in the loan account from his personal account? I am asking this point because for getting any Income-tax rebate one is supposed to repay loan from own income/sources.

There is no connection between receiving rent and paying loan emis. You may receive rent in another account and pay EMI from other.

If I pay my outstanding home loan amount of Rs. 95000/- on 1-04-2018, will that pre payment of capital amount be eligible for deduction under Section 80c

Yes, you will get the 80C benefit. Provided this prepayment is not happening in the first 5 years of taking a loan.

I have a home loan on my property, with my wife as co-owner as well as co-applicant for the loan. I have financed from the fund I took as loan and I am repaying from my salary, (My wife is a home maker ) and availing incometax benefits. But major part of the financing was due to my wife , and in-laws. But we have not made any documents regarding proportion of investments for the construction of house.

Recently we decided to rent out a floor. I want my wife to receive the rent completely. But I am told that in any case, I will have to pay the incometax. Is there any alternative arrangement so that I can save on incometax? Anyway I want my wife to invest the rent proceeds for the long term and repay the amount to my in-laws. You may please advise / contact me on my email.

I am not a tax expert, but here is my take on your query.

If you can prove by showing the gift deeds which you may prepare now also, that the share of the wife in the property was completely funded through the Gifts given to her by her parents, then the part ownership may be considered of her, and she may receive part of the rental as her own income.

But take action only after speaking with some Tax expert.

I have a home loan of rs 10L.. got through my salary certificate… my father is a co-applicant of this loan because he is the owner of the property, but emi has been paying by me through my bank account.

So am i eligible for tax benifits ( principle nd interest)…???

Technically, if you are not the owner of the property, you may not claim the tax benefit.

Hi, I have 2 homes. 1st home – Self occupied, 2nd home – let out

2nd home was bought in Sep 2017 as under construction property and i received its possession in Dec 2018. On 2nd home – I have paid pre-emi interest of 1.5 lakhs from Sep 2017-Mar 2018 and an interest of 7 lakhs from Apr 2018 to Mar 2019 and on my 1st home – i had paid interest of 1 lakh from Apr 2018-Mar 2019 . So in total i paid interest of 9.5 lakhs. My company has given me deduction of 2 lakhs on interest in form 16 as a loss from housing property. How and when do i claim tax deductions for my remaining interest amount ?

You can claim the pre-emi interest in 5 installments, seems that,one of which you have already claimed. remaining 4, you may claim in the subsequent financial years. But as per new rules, the maximum limit for the same is Rs. 2 Lakh per financial year.

Although you may carry forward the other losses for 8 years. So, every year, you have to do the calculations and see what is the remaining loss, for carrying forward.