Aap log hamesha bolte ho compounding-compounding… par Mutual Funds mein toh koi fixed interest nahi milti, toh kaise hoti hai compounding?

A client once asked me this during a review meeting. And you know what? It’s a very fair question — one that many investors silently wonder about but hesitate to voice. Because we’ve all grown up learning that compounding means earning interest on interest. But in mutual funds, where neither the returns are fixed nor guaranteed, how exactly does this “compounding” work?

Let’s break this down — not just with textbook definitions, but with real-life examples, logic, and some thought-provoking analogies.

What is Compounding? Let’s understand the Fixed Deposit Style.

To begin, let’s first understand what compounding means in the most straightforward sense.

Let’s say you put ₹1 lakh in a fixed deposit earning 7% annual interest. At the end of the year, you earn ₹7,000 in interest. Now, if you don’t withdraw that interest and let it stay invested, next year you earn 7% not on ₹1 lakh, but on ₹1,07,000. That’s ₹7,490. The year after that, it becomes ₹1,14,490 and so on.

The longer you let this cycle continue, the faster your money grows — not just because of the interest earned, but because of the interest earned on the interest already earned. That’s compounding in its purest form. Simple. Predictable. Visible.

But now let’s move to the world of mutual funds — especially equity mutual funds — where nothing is predictable or fixed.

Read more: What is a Mutual Fund: Types and Concept Explained

So, Can Compounding Happen Without Fixed Interest?

Yes, it can. And it does. But the process is more subtle and indirect.

When you invest in equity mutual funds, you are essentially investing in a basket of businesses. These businesses earn profits, reinvest those profits for growth, and over time, their valuations go up, which is reflected in the stock prices. These stocks are held by the mutual fund, and when they appreciate, the NAV of your mutual fund unit also rises. So you don’t receive a regular “interest” like you do in a fixed deposit, but your investment still grows over time.

This growth, when not withdrawn and allowed to stay invested, continues to earn further growth. That is compounding in action.

How Reinvestment Powers Compounding in Mutual Funds

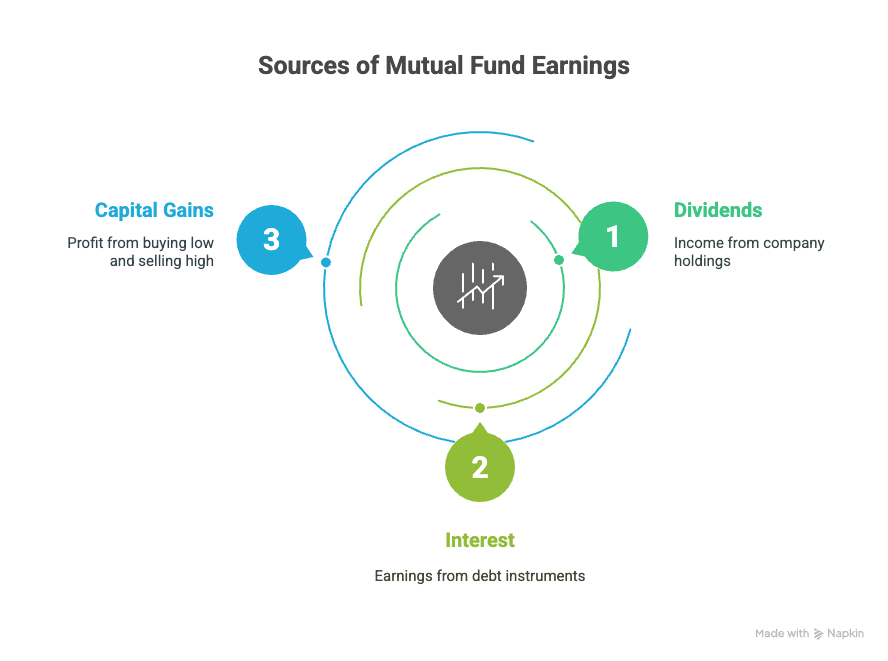

This is where things start to get interesting. In mutual funds, compounding works largely through reinvestment of dividends, interest income, and capital gains.

Related Articles:

Let’s say a mutual fund earns ₹100 crore this year through a mix of:

- Dividends received from companies it holds,

- Interest earned in the case of debt instruments,

- Capital gains booked from buying low and selling high.

Now, what happens to this ₹100 crore?

If you’ve opted for the Growth option, this income stays within the scheme. It gets reinvested, boosting the value of each unit you hold. In the IDCW (Income Distribution cum Capital Withdrawal) option, a part of this income is distributed to investors as a dividend — reducing the reinvestment potential.

That’s why, over time, you’ll always see the NAV of the Growth option to be significantly higher than the IDCW option in the same scheme. That difference is nothing but the result of compounding via reinvestment.

So even though you don’t “see” the compounding like you do in an FD, it’s happening right under your nose — every day, every month, every year — as long as the earnings are retained and reinvested.

Businesses Reinvest Too — That’s Where the Real Compounding Begins

Let’s go a step deeper.

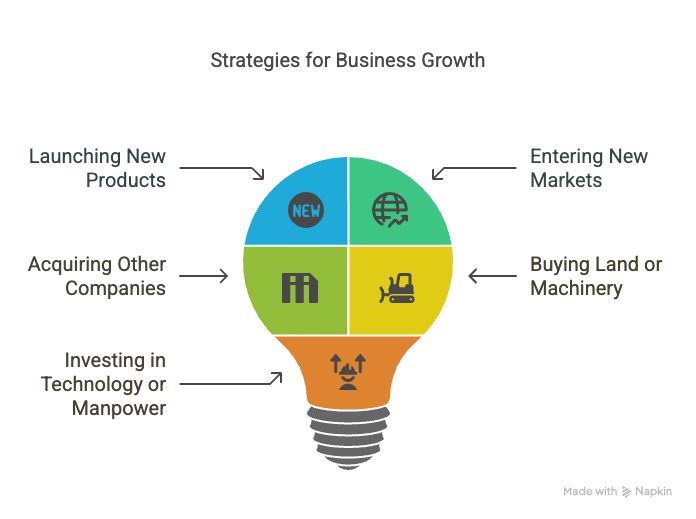

The listed companies that mutual funds invest in also don’t distribute all their profits as dividends. Most good businesses retain a large portion of their profits and reinvest them back into their operations. This could be:

Why? These investments are expected to generate more growth, more profits, and more value in the future. And as these businesses grow, their valuations rise, which then reflects in their stock prices, and ultimately in your mutual fund NAV.

So, compounding in mutual funds is not just about what the fund house does — it starts at the level of the businesses themselves.

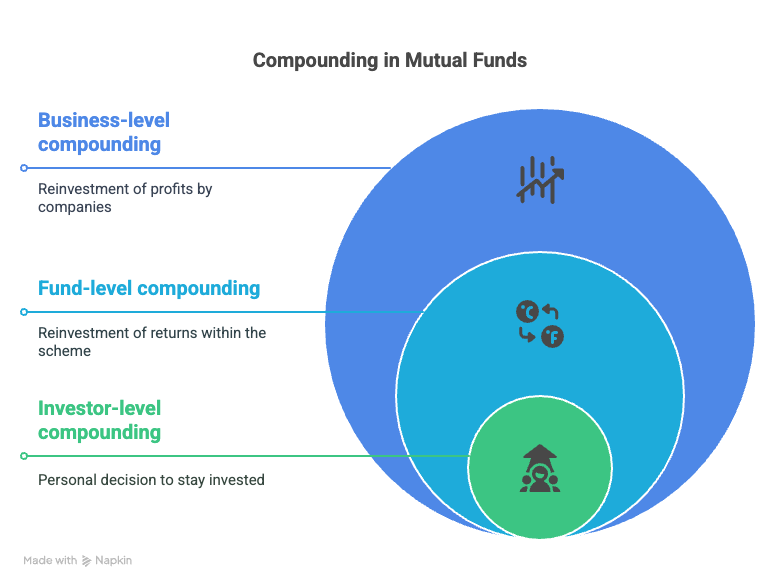

In that sense, compounding in mutual funds is multi-layered:

- Business-level compounding (reinvestment of profits within companies),

- Fund-level compounding (retention and reinvestment of returns within the scheme),

- Investor-level compounding (your choice to stay invested over time).

All three layers have to align for compounding to work its magic.

It’s Just Like Your Salary Growth (But With Ups and Downs)

Here’s another analogy to help make sense of this.

Let’s say you started working at the age of 25 with a salary of ₹25,000 per month. By the time you’re 40, your salary is ₹2.5 lakh. That’s a 10x jump in 15 years, which, on paper, looks like a 16.6% CAGR.

But did your salary increase by 16.6% every year, steadily?

No. Some years you get a 5% hike, other years 10% or 20%. Maybe one year, there was a freeze. Maybe you switched jobs for a higher hike. Maybe you even upskilled or pursued a certification that helped you earn more. In other words, you reinvested in yourself.

That’s exactly how businesses grow. They have good years and bad years. They make strategic investments. They pivot, experiment, struggle, and recover — but over a long period, the consistent reinvestment and performance create growth that compounds.

Now imagine if, at 30, you gave up working because the hike didn’t meet expectations, or you took a long break from learning and skilling. Would you still be at ₹2.5 lakh by 40? Probably not.

The same goes for your investments. Compounding rewards the disciplined, not the impatient.

If Businesses Don’t Perform, Who Will?

Let’s also address another important thought: “What if the Sensex doesn’t continue to deliver 14% CAGR in the future?”

The answer is — maybe it won’t. Compounding is not automatic. It’s a result of underlying business performance. If businesses don’t grow, there is no wealth creation. It’s as simple as that.

And if businesses stop doing well, debt instruments won’t do well either. Because companies will struggle to repay loans. Banks won’t lend. Interest rates may spike to compensate for risk. And that will affect returns from even the safest debt mutual funds.

Everything in the economy is interconnected. So if you’re fearful of investing in equities due to business risks, you’re essentially questioning the viability of even debt. And if businesses are truly that risky, wouldn’t it make sense to avoid even fixed deposits (because banks lend your money to those same businesses)?

But if a business is safe enough to take your loan, why not invest in its equity and benefit from its growth?

In Conclusion: Does Compounding in Mutual Funds really work?

Yes. Loud and clear — Yes, it does.

But it doesn’t work like a straight-line graph. It works like a growing tree — slow in the beginning, sometimes unpredictable, but powerful if left undisturbed.

Mutual funds compound not by paying you a fixed interest, but by reinvesting the earnings from dividends, capital gains, and interest. This reinvestment, combined with the underlying business growth, results in rising NAVs over time.

And most importantly, this entire mechanism only works if you, the investor, remain consistent — choosing the Growth option, staying invested for the long term, and allowing time to work in your favor.

Remember: compounding is less about numbers and more about behavior. Give your investments time. Give businesses the room to grow. And give yourself the patience to watch wealth quietly build, layer by layer.

That’s the compounding story in mutual funds — real, practical, and yes, very rewarding.