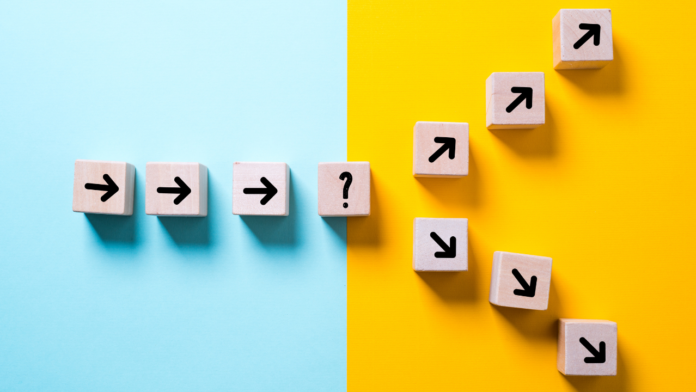

In today’s fast-paced world, two contrasting financial philosophies—FIRE (Financial Independence, Retire Early) and YOLO (You Only Live Once)—have gained significant attention. Both represent extremes in how we approach life and money. On one hand, FIRE promotes aggressive saving and early retirement, promising a future free from financial concerns. On the other hand, YOLO encourages living in the moment, spending freely, and embracing life’s uncertainty.

The promise of complete financial freedom at a relatively young age has fueled a movement that’s rapidly gained momentum, with countless blogs, podcasts, and influencers touting it as the path to happiness.

While both movements appeal to people’s desire for control and freedom, they raise important questions: Is the pursuit of FIRE the key to a meaningful life, or does it come at the cost of joy and fulfillment in the present? And, is YOLO just an excuse for reckless spending, or does it represent a deeper need to truly live in the moment?

At its core, the question isn’t whether achieving FIRE or YOLO is possible—it’s whether it’s truly the best route to a meaningful life. Are both these concepts genuinely about enhancing the quality of life for those who pursue it, or are these simply cleverly packaged marketing goals designed to prey on the financial anxieties of people who feel stuck in their careers? (Also Read: 20 Hidden Risks to Your Retirement Plan)

In this article, we’ll explore the promises and pitfalls of both FIRE and YOLO, digging into whether either philosophy can truly enhance your life—or if the real answer lies somewhere in between.

Financial Independence Retire Early – A Shiny promise

FIRE advocates for extreme saving and investing, often requiring individuals to live on a small fraction of their income for years. The goal is to accumulate enough wealth to retire early, free from financial concerns. For those feeling trapped in unfulfilling jobs or burdened by financial stress, the promise of FIRE can seem like a beacon of hope.

However, the reality is far from simple. Achieving FIRE often demands significant sacrifices, potentially leading individuals to forgo important life experiences, relationships, and personal growth. The pursuit of early retirement can create tunnel vision, where the focus on financial independence overshadows other meaningful aspects of life.

The Hidden Costs

While FIRE offers the allure of financial freedom, it also comes with hidden costs. The pressure to save every penny can lead to a life of extreme frugality, where the joy of spending on experiences, hobbies, or even small luxuries is sacrificed. This can create a life that, while financially secure, may lack richness in other areas.

Moreover, the lifestyle promised by FIRE may not be as fulfilling as it seems. The endless free time that once seemed so appealing can become monotonous without meaningful activities to engage in.

The Void Left by Early Retirement

Beyond financial considerations, many who pursue FIRE struggle with a sense of identity and direction once they retire. Work isn’t just about earning money; it’s also about contributing, growing, and connecting with others. When you suddenly remove that from your life, it can leave a void that’s hard to fill. The structure, purpose, and social interactions that work provides are not easily replaced by the freedom of retirement.

This void can be particularly challenging for those who achieve FIRE without a clear plan for how to fill their time. The sudden absence of work can lead to boredom, a loss of purpose, and even depression. The freedom that FIRE promises can quickly turn into a burden if not managed carefully. (Read More: Early Retirement – Planning for your Second Innings Beyond Money)

Moreover, financial worries don’t simply vanish after early retirement. They can grow. The fear of outliving your savings, particularly during market downturns or unexpected life events, can be a constant source of anxiety. The pressure to stick to a strict budget can undermine the freedom that ‘Financial Independence Retire Early’ is supposed to bring.

Why FIRE Appeals to Younger Investors

Younger generations, especially millennials and Gen Z, are particularly drawn to the idea of FIRE. This is a generation that has witnessed economic instability, rising living costs, and an uncertain job market. The promise of escaping this uncertainty by accumulating wealth quickly and retiring early is understandably appealing.

However, this mindset can lead to risky financial behavior. The desire to achieve FIRE can push young investors towards high-risk investments, such as speculative stocks, cryptocurrencies, or other volatile assets. The idea of making money fast can overshadow the importance of long-term financial planning and stability.

For instance, consider the recent surge in interest in Derivatives among young investors. The same group was interested in Cryptos a few years back. While some have made significant gains, many others have faced substantial losses, driven by the fear of missing out (FOMO) and the allure of quick wealth. This speculative approach to investing is in stark contrast to the disciplined, long-term strategies typically associated with achieving FIRE.

Living Life Purposefully, Not Just Financially

Rather than focusing solely on early retirement, it may be more beneficial to consider how to live a meaningful and purposeful life. Engaging in work that you find fulfilling, nurturing relationships, and contributing to your community can provide a sense of purpose that far outweighs the benefits of early retirement. A life driven by purpose, rather than just the pursuit of financial independence, is likely to be more fulfilling, regardless of when—or if—you choose to retire. (Explore: 21 Good Money Habits for a Great Financial Life)

For those considering FIRE, it’s important to ask: What will you do with your time once you achieve financial independence? How will you continue to grow, contribute, and connect with others? Without clear answers to these questions, early retirement may lead to dissatisfaction rather than fulfillment.

The Other Philosophy – You Only Live Once (YOLO)

While ‘financial Independence retire early’ concept advocates long-term sacrifice for future freedom, the YOLO mindset embraces the present with the belief that life is too short to delay enjoyment. YOLO encourages spending on experiences, living boldly, and prioritizing happiness today, often at the expense of saving for the future. This philosophy has resonated with many, especially younger generations who’ve witnessed the uncertainties of life firsthand. However, the YOLO approach can easily spiral into impulsive decisions, piling up debt, and neglecting the financial foundation necessary for long-term stability. Though it promotes seizing the moment, an over-reliance on YOLO can lead to stress and regret when financial consequences catch up. Just like FIRE, YOLO presents its own set of challenges that require careful consideration.

Finding the Balance Between YOLO and FIRE

It’s also important to recognize that extreme financial philosophies like FIRE and YOLO (You Only Live Once) both have their drawbacks. The YOLO mindset, which encourages living for the moment, often leads to overspending, instant gratification, and accumulating depreciating assets. This can pull you away from financial prudence and result in heavy debt and EMIs, creating long-term financial stress.

On the other hand, FIRE can put you into the grind of saving, where the focus on financial independence overshadows the joys of living in the present. Both approaches are extreme in their own ways, and neither may lead to a truly balanced, fulfilling life.

The allure of YOLO, particularly among younger people, stems from a desire to make the most of life now, in an uncertain world. However, this mindset can be dangerous if it leads to neglecting long-term financial health. A more balanced approach, which involves enjoying life today while also planning for the future, is likely to lead to greater overall satisfaction.

A Balanced Approach to Financial Planning

The key lies in finding a balanced approach to life and financial planning. It’s about saving and investing wisely while still enjoying the present. It’s about pursuing financial goals that align with your personal values and life aspirations, rather than being swayed by popular trends or extreme philosophies. (Explore: Is Rs.1 Crore really enough to retire in India (Comfortably)?

This balanced approach considers both short-term joys and long-term security. It allows you to live a life that is both financially prudent and personally fulfilling, without the need to adhere strictly to the dogma of FIRE or YOLO. For younger investors, this balance might involve a more diversified investment strategy, one that includes both safer, long-term investments and some higher-risk, higher-reward opportunities. The key is to avoid putting all your eggs in one basket and to maintain a focus on long-term financial health. (Discover More: How will your Post Retirement Life look like?)

Conclusion:

At first glance, FIRE and YOLO might seem like opposing forces—one rooted in discipline and future security, the other in spontaneity and living for today. But both share a common goal: the pursuit of happiness and freedom, albeit in very different ways.

FIRE offers the promise of financial independence and the ability to live on your own terms, but its rigid focus on saving and sacrifice can sometimes lead to missing out on the joys of the present. YOLO, on the other hand, celebrates living fully in the moment, but without the discipline of long-term planning, it can lead to financial instability, stress, and regret down the road.

In reality, both approaches, taken to extremes, can rob you of the balance that’s necessary for a fulfilling life. The key is finding a middle ground where you’re both financially responsible and able to enjoy your life as it unfolds. Save diligently, but don’t forget to treat yourself now and then. Plan for your future, but don’t lose sight of the beauty of today.

Ultimately, the best financial goal is one that supports a life of purpose and fulfillment. By keeping your brain active, staying engaged in meaningful activities, and maintaining a balanced approach to financial planning, you can create a life that’s not just financially secure, but also rich in experiences, relationships, and personal growth.

For younger investors, the lesson is clear: don’t be swayed by the extremes. Both FIRE (Financial Independence Retire early) and YOLO (You only live once) have their appeal, but neither offers a one-size-fits-all solution. Instead, strive for balance—save and invest wisely, but also make time for the joys of life today. In doing so, you’ll find that financial independence is just one part of a much larger, more fulfilling life journey.

(See More Insights: Why is Retirement considered to be the Most Important Goal?)

Excellent article. I always suggest this to my clients. Don’t live today as if there is no tomorrow. Similarly, don’t sacrifice the basic luxuries of life today. Balanced approach is better for a meaningful and purposeful life.

Sharing your article in social media. Keep writing.

Hi Melvin. Nice to have your comment on this.