The word ‘Guarantee’ attracts everyone. Especially in a scenario of Volatile Markets, when you are unable to see any certainty in the returns in the near future.

In these times when some company announces a Guaranteed product, it is bound to catch attention.

Mutual funds are prohibited to use the word Guarantee in their schemes and are mandated to disclose all the known and unknown risks in the Information documents. But Insurance companies can freely announce guaranteed products.

HDFC Life Sanchay Plus is one of those Guaranteed benefits products which is attracting many eyeballs these days. The company is also marketing it quite heavily. After all the tax-saving season is also going on. (Read: List of Qualifying Investments u/s 80C)

One of my clients who was seeing his portfolio in Red for quite some time has shared one SMS with me regarding this product. The message was so attractive that if one goes by the words only, you will say “This is it”.

This made me look into it, to check its Pluses and Minuses. So here I am sharing with you my findings in this Review

HDFC Life Sanchay Plus – In Brief

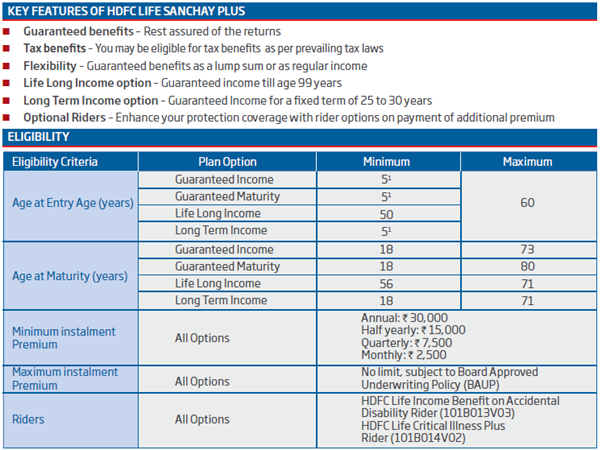

When HDFC Life comes with a product having a plus in the name, it clearly means a product with lots of variants in a single product. The same is the scene with HDFC Life Click 2 Protect 3D Plus term life plan. It’s bound to get confused there.

HDFC Life Sanchay plus has majorly 2 features – Investments and Distribution. In one of its variants, it is giving you a Guaranteed Maturity benefit and in other variants, it is giving Guaranteed Income (Regular payouts), after completion of the Premium payment term.

Maturity product is a normal endowment product where you pay the premium for a fixed term and then post the completion of the policy term you will get the sum assured back with some guaranteed additions, which has also been defined by the insurer already. So, you may know with certainty at the time of purchase as to what you will invest and what you will get.

However, in the Income distribution variants, the guarantee is in the form of annual payouts which in some variants are even 209% of the annual premium. And this is not all, in some variants, along with the annual payouts you will also get all your premiums back.

So, Income is the space where the actual action and sales pitch is happening in HDFC Sanchay Plus. Let’s dig deeper and find out what exactly is the product and how this works.

HDFC Life Sanchay Plus – Broad Features

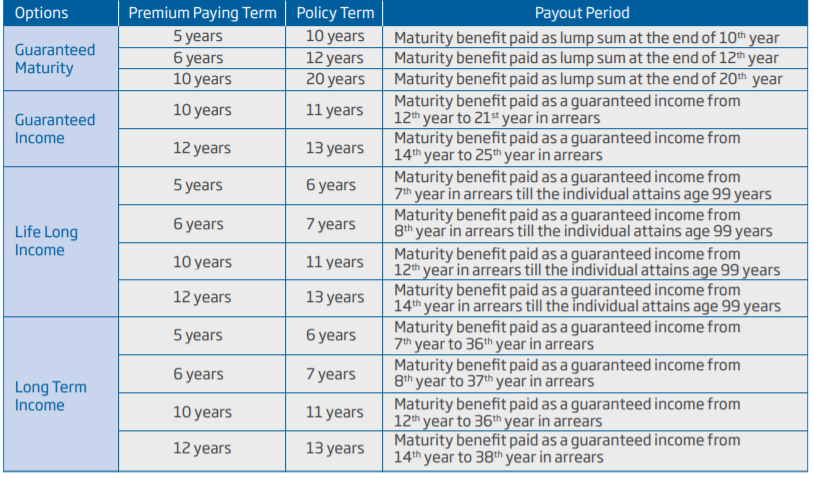

HDFC Sanchay Plus – How the Plan Variant Works?

HDFC Sanchay Plus – Returns calculations

I am considering this product for Investment and income purpose only, so will not take into account the death benefit part. That matters here only from Tax benefit angle as that is making the Proceeds tax free for the Buyer (as per the Insurer). But if you consider investing in this product, do make sure to confirm the taxation of the maturity as well as Income. The Doubt has come to my mind with the reason of non-availability of any death benefit during the income phase.

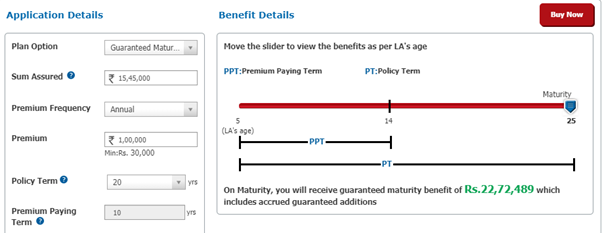

Plan 1 – Guaranteed Maturity

To understand the maximum, return this product may generate, I calculated with the minimum age i.e. 5 years and Maximum Premium Paying terms and Term. Since with lower age and maximum term, the accrued additions are looking to be going higher.

And this could be the answer to another pitch from the salesperson that one may buy a guaranteed product for a child to secure the future.

This Results into an IRR of 5.55%

Continuing a Product for 20 years and paying for 10 years, to get 5.55%, though Tax-free, does not make sense to me.

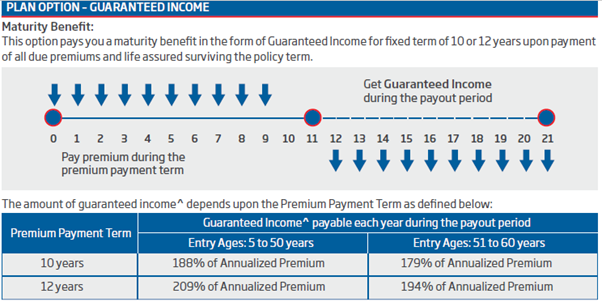

Plan Two – Guaranteed Income

This variant will get most of the sales pitch as it says to get 209% of the annual premiums back every year. So, it’s easy to get sold by thinking to pay Rs 100 p.a. for 10 years and then receive Rs 209 p.a. for the next 10 years.

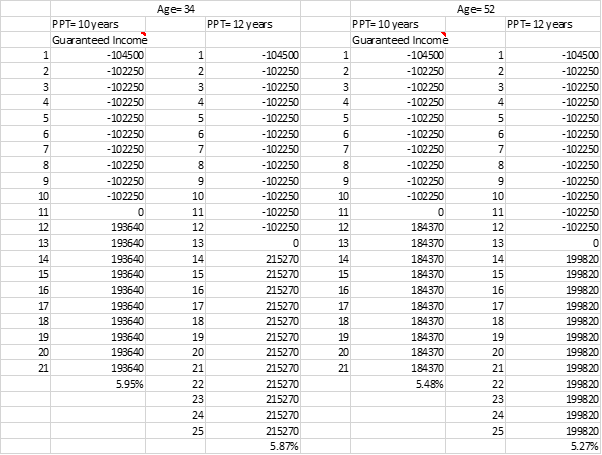

But when you calculate on Real numbers and do the maths to find out the actual return, you find something else

The above tables clearly show that even after getting 209% of annualized premium the net IRR in the full structure would be 5.87%, and remain below 6 in all other calculations

Plan 3 – Life Long Income

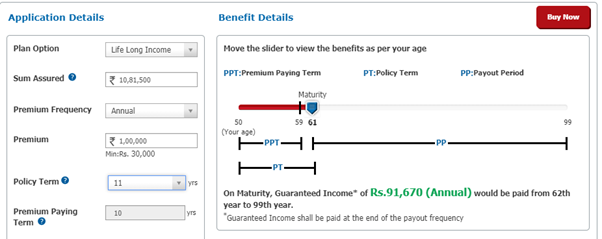

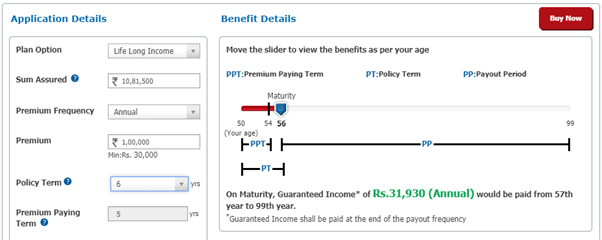

This variant is available to Investors in the age group of 50-60 years. This asks for the premium payment of 5/6/10/12 years, and after 1 year of break, the policy will start paying a fixed amount till 99 years of age.

If the Policyholder Survives till 99 years of age then the policy will also return the total Premium amount Invested.

This is not all, if at any time during the payout period, the policyholder wants to close the policy, then he/she may ask for Lumpsum withdrawal, which would be the Present value of all the future payout at the then prevailing rates. Today’s rate as per HDFC Life is 9% (This feature is available in all the Income versions of this policy)

The above case says, pay a premium of Rs 100000 (Before GST) for 10 years, and start getting Rs 91670/- per annum till 99 years of age. if the policyholder survives till 99 years of age, i.e. the time when the Annualized premiums are returned, then counting that the IRR in this structure would be 6.14%.

But if the Policyholder dies before completion of the tenure and even if the nominee keeps getting the annual benefit till the remaining tenure, then the IRR reduces to 5.67%

Here if premiums are paid for 5 years, then from 7th year onwards the policyholder will get Rs 31930/- p.a till 99 years. if the Policyholder survives till 99 years of age then the IRR is coming to 5.23%, but in another case, the Rate would go down to 4.60%

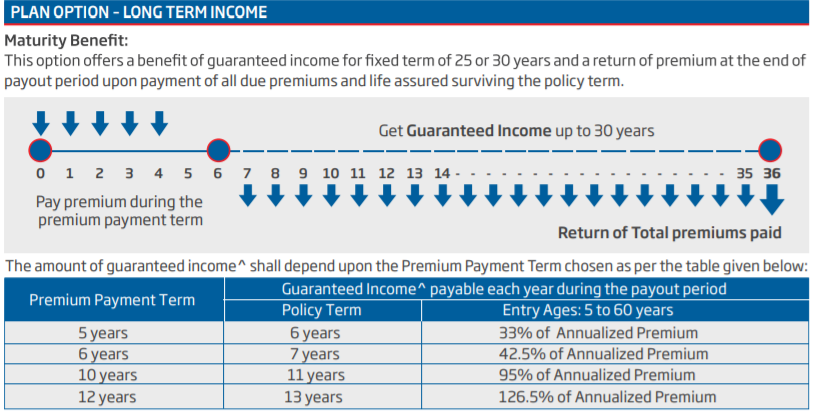

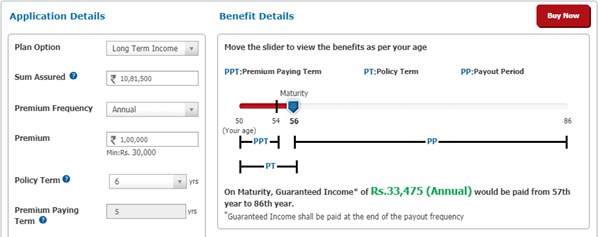

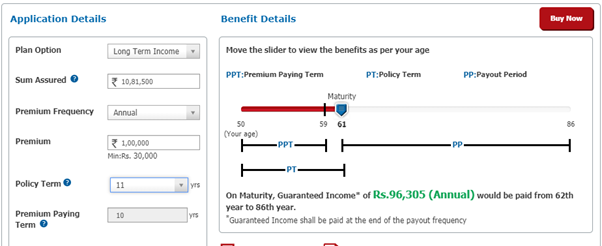

Plan Four – Long Term Income

Unlike Lifelong income as explained above in the third variant, here the payout will be for a particular tenure and at the end if the policyholder survives then the total premiums paid will be returned.

Since I am of the view, income security is something one likes to have Post retirement years, so for this variant calculation, I took the age of 50 years. Though Payout does not vary as per the age…so all ages will get the same payout

With 6 years Policy term and 30 years payout term, if the policyholder survives till the end, then the IRR would come to be 5.35%, and if does not survive the complete term then the IRR would be 3.88%

And with 11 years term and 25 years payout, on survival, the policy’s IRR would be 6.15% otherwise 4.88%

HDFC Life Sanchay Plus – Should you Buy?

I never liked Lock in products and especially which at the end are not even that paying. But then I think that it depends on the Investor also if he is in Accumulation phase (Pre-Retirement) or distribution phase (Post Retirement).

Besides this, how conversant the person is with Investment products. Is he doing it himself or has some expert by his side to guide on the finances? And to top it all the behavioral biases in an investor play a major role in his investment success.

I do not find this product that attractive in accumulation phases like in guaranteed maturity or Income variants, unless the word guaranteed attracts to someone and looking for a safe investment option, as 6% Post-tax return results into 8.5% Pre-Tax number (For high-income bracket)

But from the Retirement Income angle, where safety and guarantee may become a concern for many, I find the Long-term Income variant suitable (in general). It may be compared to an Immediate annuity plan, or say Senior Citizen Scheme. Both generate taxable income and pre-tax return is very much comparable to this product.

But we are talking of deferred income here, and we are not sure what rate we get during our post-retirement years. But here, just a rough calculation, If a 50 years person, buy the 10 years product in long term income plan today then he kind of has ensured 8.5% pre-tax return for his savings (assuming he lives till 85 years of age), whereas if you save first and then buy immediate annuity plan post-retirement then the return may vary.

This product may find a fit in the second bucket when I talk about the bucketing strategy to provide for retirement income. In a closed structure of insurance, there is no question of behavior Management, as you will not be able to play with the product, and have to be satisfied with whatever you are getting.

Also, it is important to note that no single product will satisfy all your requirements, as Inflation is your biggest enemy, and these fixed income structures may not prove to be that suitable. Plus, in the life journey, you have many other goals to manage. So, things need to be considered from all angles.

Have a 360-degree view of your life, current finances, and future requirements and then decide, if HDFC Life Sanchay Plus is finding any place there or not.

If you have any question on this product or you like to share your thoughts, Feel Free to ask in the comments section

This product Review is done by Mr. Varun Baid

Like my wife, who started her career with a bank, always says “never take any product from a bank”!

It good to investment in HDFC life Sanchez plus

It depends upon your financial goals, requirements etc. We have already reviewed this product, please go through the same and decide accordingly or speak to your financial adviser.

Here’s the link of the product review:

https://www.goodmoneying.com/hdfc-life-sanchay-plus-review/

Life annuity plan with RoPP in hdfclife. I am surrendered that policy. But surrendered amount is not given.

please help me

What is single premium pension policy

In Single Premium Pension Plan you pay a lump sum money to the insurance company and the insurance company starts giving you a fixed pension in annual/monthly/half-yearly as desired. If the pension starts immediately (from the next month/year), then it is called an immediate annuity plan. If it is delayed by a few years, then it is called a deferred annuity plan.