Term insurance Plans are slowly becoming a sought-after product. Earlier people were reluctant to buy Life Insurance where they do not get anything in return, but things are changing, and nowadays, it is in demand, for whatever reasons.

However, when you go online to buy such policies, confusion is inevitable as you will find many additional features and variants. (Read: How to select a suitable online term insurance plan?)

You will find different premium payment terms with single premium, regular premium, and also Limited premium payment term options to select. Monetary benefits of saving on Premium cost also get highlighted, which adds to the confusion.

Besides the premium payment terms, the questions come on the Income feature of these term insurance policies. Buyers ask if they should go with a one-time claim settlement or it’s wise to get a claim in installments. I tried to answer that question in my earlier article.

In this article, I have tried to answer this question as to which premium payment term is better to opt for in Term Insurance Plans. I have analysed the premium and options at a specific age and have done some maths to come to a conclusion.

Term Insurance Premium Paying Options:

Before digging into the analysis, let us first understand the types of premium payment options available for term insurance plans:

- Regular Premium: In this option, you need to pay the insurance premium every year as long as the policy is in force. In other words, the policy term and the premium payment term are the same. For instance, if you are 30 and want the insurance coverage till you are 60, you need to pay the premium for the next 30 years.

- Limited Premium: In this option, you may opt for a lesser premium payment term, than the policy term. For instance, for a 30 years term cover, you have an option to pay a premium for say 5,7,10, or 15 years, but the policy will remain in force for the full tenure opted. So the Premium term and Policy term be different

- Single-Premium: In this option, you pay the premium for the entire policy term in the beginning and in one go. For a 30-year term cover, you need to pay a single amount at the start of the policy term to get yourself covered for the entire term.

What is the difference in cost?

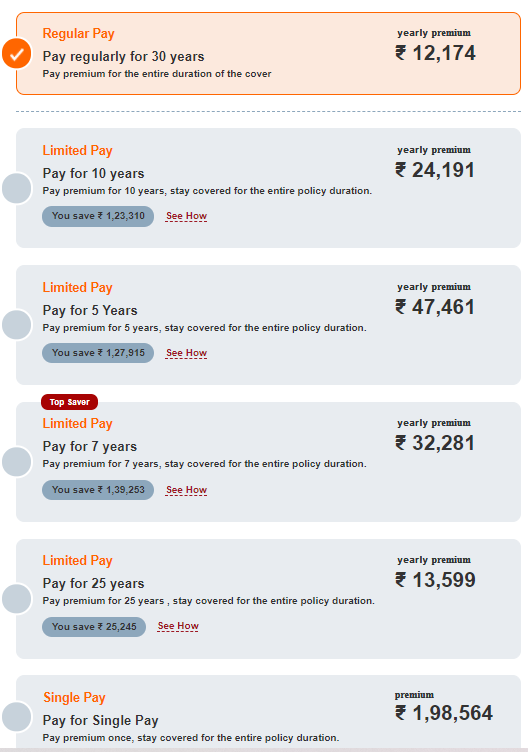

Let us take an example of a popular term plan, ICICI iprotect smart, and find out the difference in premium in all the above options. For a sum assured of 1 crore for a 30-year old male, non-smoker the premium under different options, for 30-year cover would be:

- Regular premium of Rs. 12,174 for 30 years;

- Rs. 24,191 for a limited premium payment term of 10 years;

- Rs. 47,461 for a limited premium payment term of 5 years;

- Rs. 32,281 for a limited premium payment term of 7 years;

- Rs. 13,599 for a limited premium payment term of 25 years;

- Single-Premium of Rs. 1,98,564.

If you look at the highlighted box in every option, this is where the whole confusion starts. It is normal to get attracted towards the premium payment option which is giving maximum savings. But is it wise? Does it really result in any savings? This is the question we are finding answers to here.

Which one is better – Regular Pay or Limited Premium Payment term?

Who does not want to save more? And when a Limited payment term offers more benefits why not to opt for the same.

When one sees benefits, every premium becomes affordable and one finds out the ways to pay a higher premium to get this instant savings.

But, a simple concept which gets missed here is nothing but the time value of money. By paying all the premiums in a limited term, you may save high on premium outgo, but what you will lose is the Interest earned on the same.

You may say what will the 5% – 6% of interest do here? How much will it help in saving?

Let us take two scenarios to understand this.

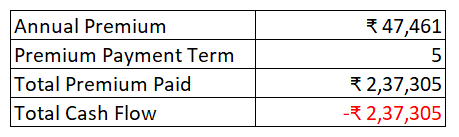

Scenario 1: You opt for the limited premium payment option, i.e., you pay Rs. 47,461 for 5 years.

Scenario 2: You opt for the regular premium payment option and invest the difference of premium in a product, let’s say with an annual return of 5.50% for 5 years.

So, you pay Rs.12,174 as premium and invest Rs. 35,287 for 5 years. After 5 years the money stays invested as it is in the fund giving 5.50%, and you withdraw the regular premium out of it every year.

Let us first calculate the Future Value of the difference in premium invested for 5 years:

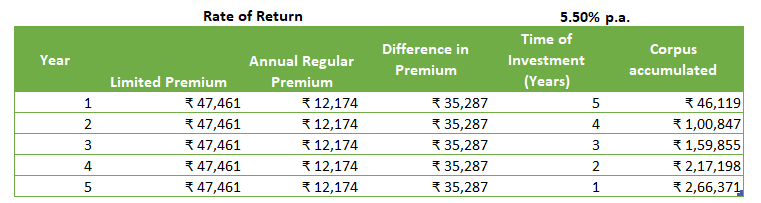

Now let us see if we withdraw the annual premium from the corpus, growing at 5.50% p.a. for the next 25 years, what cash flow scenario looks like.

As evident from the above calculation that by going with the 5-year limited premium payment term you are not saving Rs 1.27 lakh, but losing Rs 3.58 lakh. So, net savings if you go with regular pay frequency would be Rs 2.31 lakh.

Also Check: 5 lesser-known ways to use life insurance policies

Why is Regular Pay better than Limited Premium Payment term?

First thing as is shown in the above calculation that by paying high premiums in the beginning you will lose the opportunity cost of investing the money elsewhere.

Though I have used 5.50% as interest in the calculation, interest rates may rise in future as was in the past. So, in a high interest rate scenario your opportunity loss would be high if you use the Limited Premium payment term.

Second benefit of Regular pay is that it gives you flexibility, of discontinuing the premium once you have enough savings in your kitty, to take care of your financial dependents.

In the end:

The regular premium option is always cheaper as compared to the limited premium payment option in term insurance. However, the amount of savings may differ with different insurers and different options.

There is also a common-sense approach to understanding this, you do not have to do detailed calculations.

You buy insurance to cover up the uncertainty. In case of premature death during the policy term, the premium outgo for the regular premium payment option would be significantly lower than that of the limited and even the single premium payment option. Isn’t it? But we never want to get the policy claimed, its just we want to be prepared.

Also, you would have the flexibility to discontinue the policy in future, if your savings increase and you feel that you do not require that much life cover.

However, it may suit you if you have a limited job security or you feel that your income might not be certain after a few years, you may opt for the limited premium payment term, so that you pay the complete premium in the years with income certainty.

Though in this case also regular pay may be converted to monthly premiums to manage the cash flow crunch.

So, if your choice is cost-effectiveness, a regular premium payment term is the one you should go with.

What do you think? Can you suggest any scenario where a limited premium payment term finds fit? What does your experience say about this? Do share in the comments section. If you have any questions, feel free to ask.