It was 8th November 2016, when Prime minister Narendra Modi, made the announcement on the Demonetization of Rs 500 and Rs 1000 notes, and since then Investment markets have been showing different colors. Where Equity markets are facing the jitters, debt market has been rising consistently. Though debt markets were already on a rise since long, but these last 13-14 days had been exceptionally well.

Rendering currency defunct may mean lowering of Real estate Prices, may also mean lower corporate earnings for some quarters and thus affecting the stock market, but it also means lowering of Interest rates, which is a positive sign for debt markets. And we are already witnessing the impact.

With the increasing deposits base of banks which in turn is expected to impact positively on government borrowing program and deflationary economy, yields on government securities have fallen sharply in last few days. Bank deposits rates are also impacted with almost all banks have cut down their 1-2 years bank FD rates.

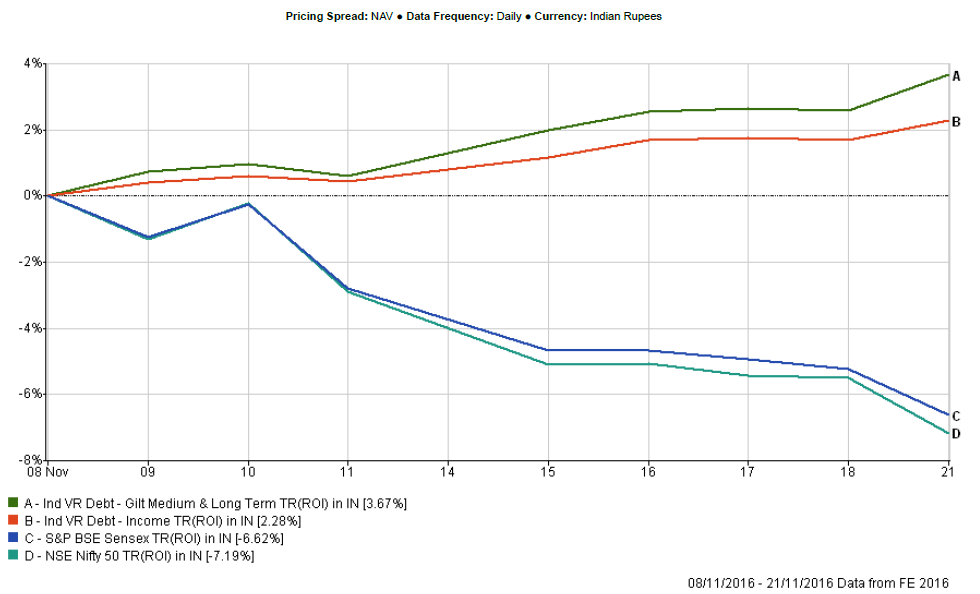

In last 14 days where Sensex and Nifty have delivered negative 6-7% of return, there long-term gilt funds have delivered positive 3-4% of the absolute return. To some, it may not sound that significant, but it is when you compare the returns with bank Fixed deposits. It is half the rate your small saving schemes and other fixed rate instruments generates in 1 year, and these long-term debt funds schemes have generated in 14 days.

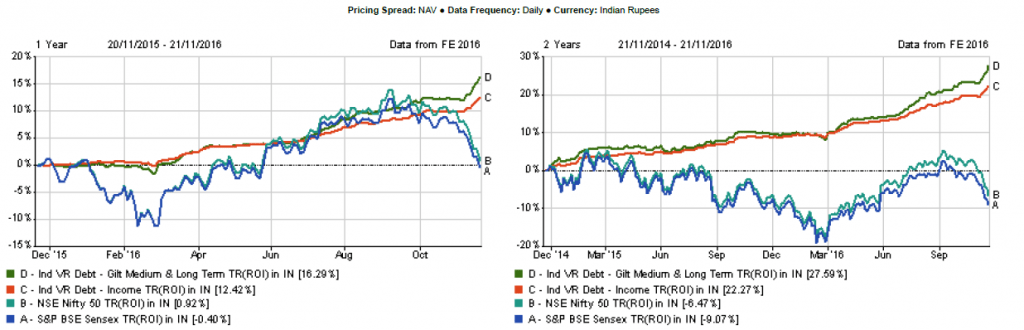

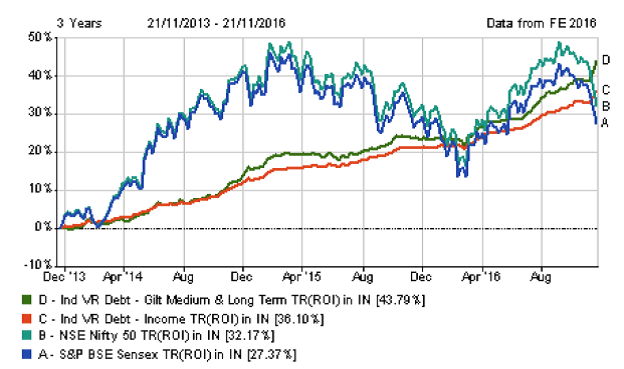

Not only in last 14 days, in last 1, 2, 3 years’ time, have debt funds on an average performed better than their equity counterparts(At least on point to point basis), otherwise the better way to look at mutual funds returns is on the Rolling returns basis

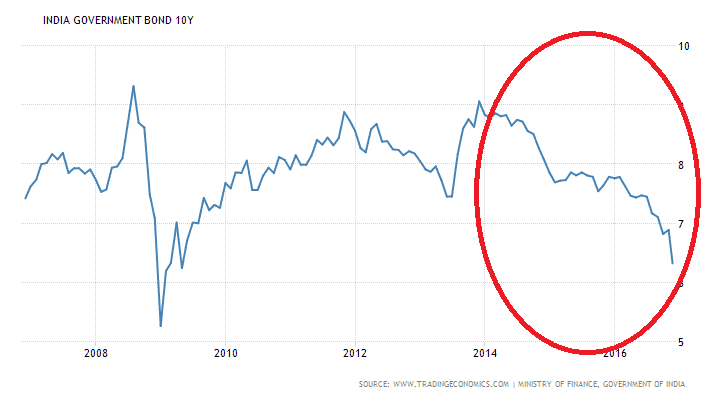

Long term debt funds and G-Sec yields

And the reason is this…the falling G-sec yields.In the below image you can clearly see the fall in last 3 years and also, the overall trend. In the last 10 years, it has once even touched 5% somewhere in 2009.

What is the point?

You must be thinking that what do I really want to convey. Am I anywhere advising you to get into long term debt funds now or want you to reduce the exposure from equities?

See, this is not the first time I am telling you the importance of long term debt funds in your portfolio. I told you this when I wrote on being friends with volatility in case of small saving schemes when I wrote on Asset allocation when I wrote on how you can protect yourself from stock market fall.

It’s all about having exposure to all asset classes, with a proper diversification within the same.

All this is to make you understand the importance of long-term debt instruments in falling market. Equity has always been a growing asset class, most suitable in the longer time frame. I compared the sector averages with large cap and more understandable indexes. But active equity funds have performed much better as compared to index and some categories like mid cap has done exceptionally well.

The whole point is to remind you of the importance of Asset allocation, and what should be a perfect investment portfolio look like.

(Featured Image Source : kiplinger.com)