Anmol, a young professional working in a reputed MNC was deployed to the company’s office in Singapore. The assignment may last a few years and it is also a possibility that the company might give him permanent employment there.

So, soon he is going to become an NRI. Although, the rules for NRI Status are different under the FEMA and the Income Tax Act.

As per FEMA rules, the day Anmol left India for the purpose of employment, he would be considered an NRI. But, Income Tax Law considers the period of stay in the foreign country to determine the residential status. (Read: Who is an NRI- as per Income Tax & FEMA Rules?)

No doubt, he was very excited about the opportunity, but at the same time confused about what steps he needed to take from the financial point of view before moving abroad. He approached us with this query.

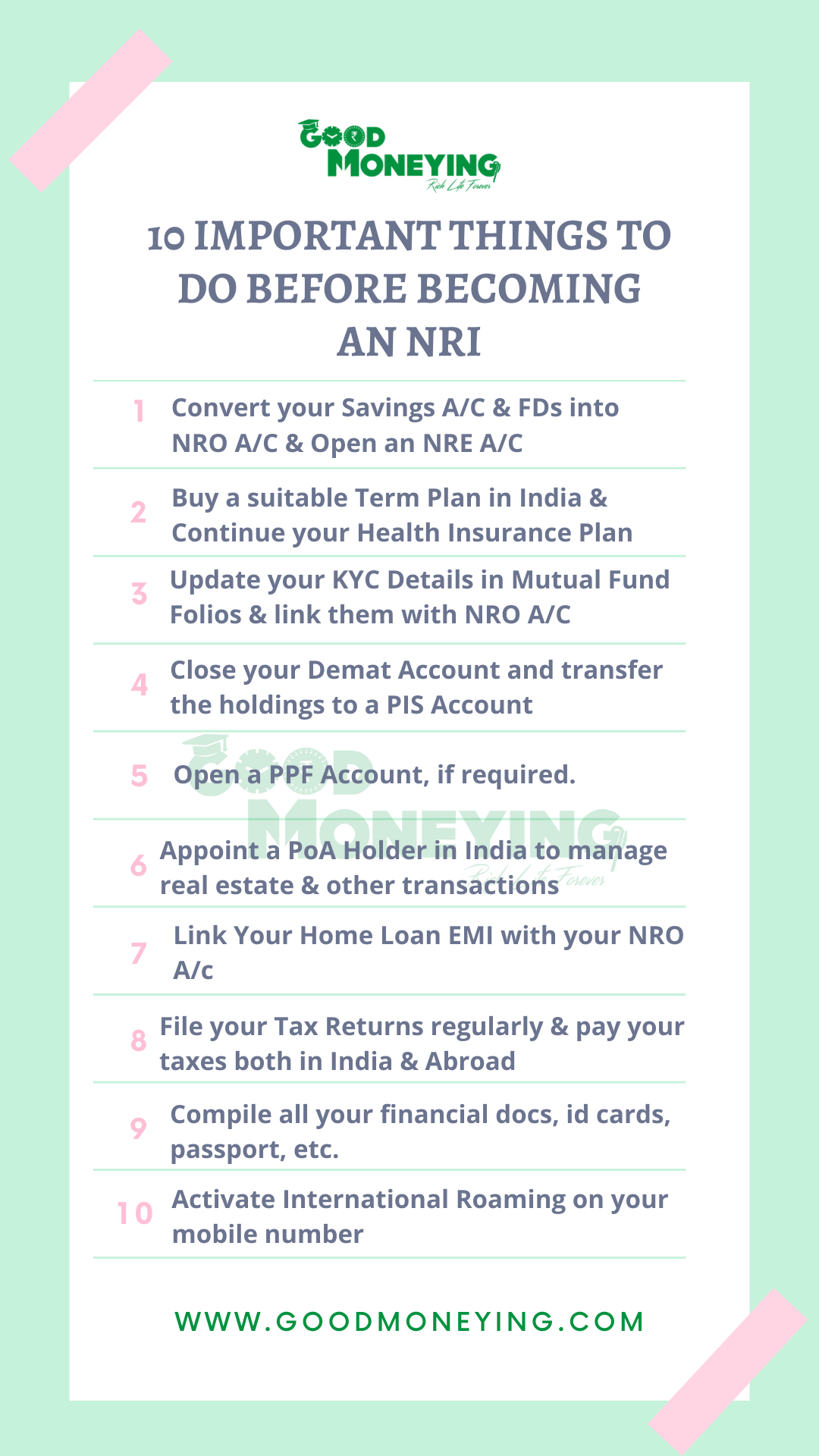

We explained to him the items on the NRI Checklist he should complete before he becomes a Non-Resident Indian (NRI).

Just like Anmol, many young professionals are moving overseas these days in search of better opportunities, for further studies, projects, etc., do not have much idea about what needs to be done and find themselves in a fix.

We decided to write a detailed post covering the items of the NRI Checklist for the benefit of our readers.

NRI Checklist or to-do list before becoming NRI:

Here is the list of important tasks to accomplish before moving abroad and becoming an NRI.

1. Bank Accounts:

The first and foremost thing to do before you move abroad is to convert your existing resident Bank Account to NRO Account. FDs also need to be converted. If you have multiple savings accounts or FDs, it would be better to consolidate them into one or two. This would make things easier to manage. (Read: All you wanted to know about NRI Bank Accounts)

This account can be used to deposit the income earned and for the payments to be made in India.

To deposit the income earned outside India and make them easily repatriable whenever you need it, you have to open an NRE Account. This account earns tax-free interest in India. However, please check the taxation in your resident country too. Funds are easily repatriable. NRE FDs can also be opened. (Also Read: Taxation of NRE FDs for Returning NRIs)

2. Insurance Policies:

The next important step on the NRI Checklist would be to evaluate the status of your insurance policies and see which one would be beneficial for you to continue.

Continue the plans which you find beneficial and surrender those which you cannot continue further or you find non-beneficial to continue. (Also Read: When & How should you Surrender your LIC Policy?)

If you have a term plan, it can be continued. Just you need to update your residential status with the insurance company.

If you have financial dependents or you may have in the near future, it is advisable that you purchase a term plan of adequate sum-assured before leaving. The procedure of getting insurance in India once you become an NRI is a bit lengthy and cumbersome. (Also Read: How to select a suitable online term plan?)

As far as health insurance in India is concerned, it may not be wise to discontinue it immediately.

Although most of the health insurance plans do not cover treatment outside India still it would make sense to continue your health plan because some specific diseases or pre-existing illnesses would involve a waiting period of some years and there might be a possibility to return back to India in future. (Also Read: How to select the Best Health Insurance Policy in India?)

3. Investments:

Mutual Funds:

It is important that you submit the new KYC details and update the FATCA status so that your new residential status gets updated in the mutual fund folios. Ensure that your NRO Account is linked to each of the folios so that recurring transactions like- SIPs, STPs continue without any hassles. (Also Read: All you wanted to know about SIP in Mutual Funds)

However, if you are moving to certain countries like- the US, you may not be allowed to invest in the Funds of Certain AMCs. Also, from the taxation perspective, in countries like- the US, Indian mutual funds may not be very efficient instruments to hold in your name. Still, it’s wise to be in touch with a tax expert in your country of residence to keep abreast with the tax laws there and make the investment decisions accordingly. (Read: A detailed guide on Mutual Funds for NRIs in India)

PPF Account:

Once you become an NRI, you are not allowed to open a new PPF Account. But you can continue your existing PPF Account opened as an Indian Resident and contribute to it through NRE/NRO Account. If you do not have one, open it before you become NRI. (Also Read: 8 important PPF Rules, every investor must know)

Direct Equity:

As per RBI guidelines, to directly invest in equity shares, you need to open a PIS or PINS Account. If you already have a Demat account and hold equity shares in India, you need to transfer your holdings into the PIS Account to access them and do any transactions.

4. Real Estate:

Once you become an NRI, managing real estate in India can be a difficult task. Nominating a Power of Attorney holder in India would be helpful. He/she would be legally entitled to carry out real estate transactions, rent out the property, etc. on your behalf. In addition, the PoA holder can also operate bank accounts, file Income Tax Returns, carry out investments, etc. (Read: How NRIs can make the best use of Power of Attorney in India?)

5. Bank Locker:

If you have some documents or valuables to store in the bank locker, you can continue to use it. Else, it would be a good idea to close the locker as you would be unnecessarily paying the locker fee, without any usage. (Read: All About New Bank Locker Rules)

If you want to continue with it, you can appoint an Indian Resident family member as the Joint Holder who can operate the account, in your absence. (Also Read: Can NRIs open Joint Account with a Resident Indian?)

6. Home Loan:

You can continue paying your Home Loan EMIs through your NRO Account. Give the new cheque to the Bank so that your ECS can be linked to this account. If the amount of outstanding loan is small and you have the required amount, it would be better to close it before leaving.

7. NRI Taxation:

Taxation is also an important element of the NRI Checklist. It is important for you to file your income tax returns in India if your annual income in India is more than Rs. 2.50 Lakhs and pay all your taxes. Generally, NRIs have to file returns in India using ITR Form-2. (Also Read: Which ITR form you should use to file your Income-tax return?)

Once you become an NRI as per Income Tax Rules, incomes earned or accrued in India would be taxable in India. If your tax liability is more than Rs. 10,000 in a financial year, you may have to pay advance tax as well. (Read: NRI Income Tax Rules in India)

On some incomes, the tax liability can also accrue in your country of residence depending upon the country-specific tax rules. However, as per the Double Tax Avoidance Agreement between countries, you need not pay taxes on the same income twice. (Read: What is Double Tax Avoidance Agreement (DTAA)?)

I have seen people who try their best to avoid the taxation and thus do not convert their Indian Savings account to NRO, and also do not update the tax status on different investments, and the reason for this is that all NRI investments are subject to TDS. This is the wrong thing to do. You should always be on the right side of the law, evading tax may put you into more trouble. (Also Read: TDS Rates on NRI Investments)

Other Key items:

8. Ensure that all your financial documents, identity cards, passport, etc. are compiled in a single place as you may need them anytime. Along with hard copies, store the soft copies into a safe & secure digital locker.

9. Remember to activate international roaming on your number so that you can communicate to your family members or relatives in India without any roaming charges.

10. Also, discontinue all the additional subscriptions that you may be having in India like- Newspaper or Magazine Subscriptions, Cable TV, Club or Gym Memberships, etc.

NRI Checklist- Conclusion:

Of course, it is not a comprehensive list of tasks on your NRI Checklist. There could be many things that need to be taken care of in India as well as the new country where you are going to settle.

If you find things overwhelming, do not hesitate to take professional help in India as well as overseas. This would help you take appropriate steps in the right direction and your transition becomes smooth and hassle-free.

Check- Financial Planning Services for NRI Families

If you have any queries or suggestions on the NRI Checklist, please feel free to use the comments section below.

This Article is written by Mr. Varun Baid, CFP Professional