Estimated reading time: 10 minutes

What are you saying? “The Stock Market Fall??” Do you foresee any fall soon? Don’t scare me! I have recently invested a Big sum in the markets looking at the recent performance and expected election outcome.

These were the words of one of my uncles who was a New entrant in the Stock markets and asked my opinion on his investments…to which my reply was “Your Success in Investments depends on how prepared are you for the Stock market fall”!

I wrote an article with the title- ‘Are You Prepared for the Stock Market Fall? ‘, in June 2015, when also there were euphoric sentiments prevailing, though unlike today’s times. The reasons were different than today, but positiveness was there due to the new government, bullishness on the Make in India campaign, etc.

In that article, I mentioned, how having International allocation and Debt funds in your portfolio will help you protect and even gain the portfolio valuation.

And you all agree with me that it all really paid well. Those who have been investing in US-oriented funds and also in debt funds, since then, must be seeing stability in their portfolio with decent returns. Actually, What I wrote was about Asset Allocation only. (Also Read: How to decide the ideal Asset Allocation?)

I agree, it was not a smooth ride and there were hiccups when in 2017, the US raised the Interest rate which did not go well with International Investors and they started pulling money out from Indian equities and debt, but the International allocation took care of the broad portfolio valuation. and later with the War situation going around with inflation hitting globally, the US markets had been impacted badly.(Also Read: What is Equity?- it’s more than just stock market investment)

There were some Corporate Debt defaults that happened in 2018 which raised the question on Fund managers managing the money, and then the Covid shock with Franklin winding up its schemes in April 2020, which badly impacted the Credit funds’ performance.

(Also Read: What is Side Pocketing in Mutual Funds?)

Indian equities were giving a polarised performance with only a few top stocks and thus Large-cap index funds doing well, but not the diversified ones. The other reason for this was the Recategorization of the funds in 2017, which resulted in PMS products look better in comparison. (Read: What is PMS and how is it different from mutual funds?)

And this was where the second strategy of Diversification helped a lot in maintaining the portfolio valuation. Good quality debt papers and adding Index funds in the portfolio took the lead and generated enough returns for the broad portfolio, which kept the overall returns in line. (Also Read: Asset Location is as important as Asset Allocation)

All this was till March 2020, and post that we have witnessed a big fall due to Covid lockdown and then a strong bounce back. At this moment we are again in euphoric times and witnessing daily new highs in the stock market.

But, now again, we are at the end of 2023 (All time high of Sensex – 71600), why am I saying that- be Prepared for another Stock Market fall? Do I really foresee something?

Well, the answer is NO. In fact, no one can predict market movements. It’s only in hindsight one can say, “I Told You So”.

Bulls will remain Bullish and Bears will stay Bearish, and both have their days. But you have goals, your money is in Limited supply which needs to be managed well. The excitement in bullish times and Fear in Bearish times, both are not good for your money.

Different asset classes don’t perform the same way for a long period of time. If you are overallocated in one specific asset or strategy which has paid well or have been doing well, then you should also be ready for the opposite. Else, design your portfolio in such a way that the pain of fall should be less, and your goals don’t get bothered by all your actions and inactions.

Those who have participated in the “debt bull markets” resulted due to falling interest rates, and have seen 10-12% kind of annual return are now seeing high return in equities. International equity markets are kind of stable, and Indian debt markets are also doing fine.

Gold investments react only to crises and thus is also touching highs due to uncertain global scenario.

You should not increase or decrease your Investment allocation seeing the recent movements, but your portfolio composition should be guided by your Risk tolerance and Goals. This is a proven behaviour issue that Pain of loss is always more than the pleasure of gain, and thus the Panic of the stock market fall will surely be higher than the excitement of this Rise.

So, what actions could you take at this point in time to manage the portfolio risk:

Rebalancing of Asset Allocation:

First thing is take advantage of this rise. Rebalancing means bringing the Asset Allocation back to the Acceptable Ratio, as per the risk profile. Say for example you decided on the asset allocation of 60:40 at the time of Investments, and now with equity growth, you are at a 70:30 ratio, this calls for reducing 10% in equity and adding into debt.

I understand this is a difficult part since coming out of growing asset class and adding into the slow one is something no one would like to do. But it is way better than seeing the portfolio rebalancing itself when the market falls. Unless you have started considering yourself a “Smart player” in this investment market. (Also Read: Luck or Skill – What matters more in Investment Success?)

You should look at it as following the important investment rule of Buying Low and Sell high.

By moving from equity to debt, on one side you are doing profit booking at these high levels, and on the other, you are preparing yourself to buy more of equity in the downfall.

When the markets are going one direction and that too so fast, do Rebalancing every quarter. In Regular times, make it a habit of doing it every year. (Also Read: When is the right time to exit your investments?)

Rising Interest rates are not good for debt markets:

Interest rates are stable these days and are expected to stay in this range till we don’t see any unacceptable inflation range in the economy. If interest rates remain at these levels then its fine to maintain the allocation for a longer time. Even with the Changes in the debt funds taxation, Debt mutual funds are still good to keep vis a Vis traditional bank deposits. recent at low levels like today for some more years then your debt Investments may not yield much but if the purpose of low rates gets achieved then your equity allocation will take care of the portfolio growth.

Low or growing interest rates are not good for debt investments, but that also makes a point of keep buying when markets (debt) are low, so you have decent corpus in the debt schemes when the trend reversal happens in the future.

Your debt investments always act as shock absorber, and provides you with the opportunity to buy more equity in the falling markets.

(Also Read: Why should Debt Investments be a part of your long-term portfolio?)

Have a pinch of Gold in your portfolio:

Gold needs a crisis to perform well. In other words, when no asset class gives returns then gold will take the centre stage. As Investors need someplace to park their money, and they prefer gold in difficult times.

If you don’t see the economy recovering soon, or different corona strains keep coming, or if something unexpected comes up, then you will see decent movements in gold.

In today’s kind of market environment, you may find it difficult to accept it, but this is true. All asset classes have their own reason to perform. (Also Read: How good is Gold as an Investment?)

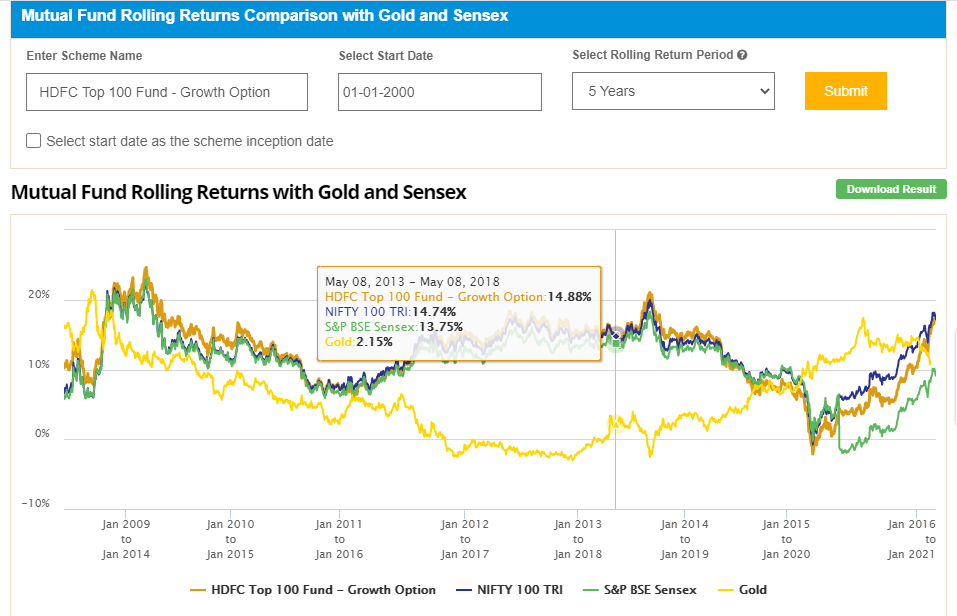

If you look at the Point-to-Point return of Equity Vs Gold in the last 20 years (2000-2020), both have generated almost similar Returns. Because both find their triggers to rise and fall at different points in time.

But there were times when the past 5 years return of Gold (On a Rolling return basis) had been in negative territory. That’s why I said have a Pinch of gold. Don’t overdo it. So, its long lull should not bother you much, but when the time comes it should help your portfolio to recover well.

Diversify in Different Countries:

Just review your international allocation. If you are overallocated on US investments, then it’s time to trim it and diversify in Emerging Markets.

US investments have been performing well for the last 10 years, since 2010 i.e., post subprime fiasco, when Federal Bank started with Quantitative Easing. It’s difficult to accept that one market can sustain such growth for another 10 years.

Nowadays there are various schemes in Mutual funds that can give you exposure to a specific country (Like China, Japan) or diversified International exposure or specific Sector like Gold, Mining, agriculture, IT, etc. You may invest in Asia or Europe or Emerging economies, ASEAN countries or select a theme like ESG or Consumption. (Also Read: Should you invest in International Mutual Funds?)

REITs can also be a good option to explore. Read more about REITs in this article.

There are many kinds of flavours present now. Speak to your Financial Advisor and diversify your holdings. Don’t stick yourself to the US only; and also, don’t over diversify so it becomes difficult to manage.

Try Balanced Advantage Funds:

I still remember, in 2009 the only schemes that were showing positive returns were the Asset Allocation funds. These were less into equity at the time of stock market fall, unlike the investors who were overexposed to equity, many were through derivatives, all to make quick money, which got lost more quickly then.

If you are not disciplined enough to do the Rebalancing on your own or at today’s kind of exciting times, you find it difficult to move money into debt or gold, then you may try these balanced advantage funds. Read more about them here.

They will take care of the rest, by giving necessary protection to your money by having the right allocation on the debt side, plus not compromising with the return by not moving away completely from equity.

However, do note that some balanced advantage funds, work like Balanced (Hybrid) funds only and are aggressive enough like equity. So, you need to be very clear on which funds you want to go with and WHY. Be clear on the strategy the fund houses follow.

(Also Read: When should you invest in Balanced Funds?)

Conclusion:

It’s about being practical with your investments, being sensitive towards your goal, and accepting that nothing is permanent. If you are a new investor and have experienced this upside for the first time, then please beware as the downside is going to be more painful.

When you are prepared for all what-ifs and manage your money well, by taking a calculated risk, then you are in a position to take advantage of every big market movement and participate in the country’s growth with Confidence. (Also Read: Are you prepared for all what-if scenarios?)

But not following the basic investment rules, and taking investment calls without keeping the backend secure is surely a recipe of disaster.

As an Investor you should always prepare for up and down. With time and strategy this will work for you amazingly (of course there maybe some calculated risk and all).

I’ve read your article which is very useful and informative for everyone. Thank you for sharing this post.