Why do you think Retirement is such an important Goal? I mean it’s too far and I have many other important goals to achieve before. Don’t you think we should plan for the near-term goals first? Varun asked me while we were discussing his goals’ priorities.

I insisted him to keep Retirement as one of the important goals to which he raised this specific question.

In my experience, this sort of question has never come up earlier, as most clients relate Retirement to Financial Freedom, and thus want to target Early Retirement. Whether they achieve it or not that’s a separate question but still, they aspire for it. (Read: Early Retirement- Planning for the second Innings Beyond Money)

But this one was different. Varun’s question led to a detailed discussion with him on the importance of starting saving towards retirement as early as possible, which I thought of writing in as a Blog so to share my views with all the young readers who might have the same question like Varun.

Youngsters generally do not consider Retirement as an important goal as it seems too far to them. It is but natural to consider only near-term requirements as important and delay the actions on something far off. In behavior finance we call it Instant Gratification. When you focus and achieve the near-term goals, it gives a natural high and motivation to list down other Important near-term goals and strive to achieve the same. And working towards the old age goal for which you have to keep saving for quite long seems quite boring.

Why is Retirement Planning Important?

When we talk of Retirement, we are actually talking about those years when there would be no active source of Income. You have to survive on the Passive income generated from your savings. Your working life may have a clear number of years visible i.e. from age 25-60 (35 years), but in the case of Retirement, you are not sure how long you are going to live. We may take the assumption of 20 years or 25 years, but what if you live longer. In other words, you may say that Retirement is a Certain goal, every person will go old and need to provide for the old age.

Expenses will surely increase going forward.

Retirement expenses are not going to be impacted only by the basic inflation but by the medical inflation too. The kind of medical facilities enhancement we are seeing these days, I believe can make us live longer. But the kind of lifestyle we have is badly impacting the health. So along with income for basic living, you may require money for high medical expenses. Yes, health insurance will take care of some major expenses but not every expense. So, you have to have other arrangements too.

(Read: How to Manage Post Retirement Income Flow – Bucketing strategy)

Unlike other goals, you will not get Loan to spend in Old age.

If you could not save much for your children’s education, you may ask for the bank loan which your child will pay off after getting employment. Children’s wedding may also be managed in lesser money than targeted, even the home, vacation, etc. all are manageable in lesser money or by loans or by postponing it, but old age cannot be postponed and no bank will give loans to oldies. So, you have to manage this specific goal on your own.

No one likes to be dependent on anyone.

Not having enough savings for retirement may make you dependent on your Kids. For whole life you may keep saving for your kids, their education and wedding, take them on vacations, pay home loan EMIs to provide them with good house and at the end become dependent on them, as you may not have saved enough to take care of yourself. So, then it would all depend on the kids if they want to support their parents (you) or save for their own kids or save for their old age.

(Also Read: 5 expenses that may derail your Retirement plan)

Hmm…I have to agree with you, but still why to start saving now, why not some years later. Varun looked partially convinced.

Cost of Delay:

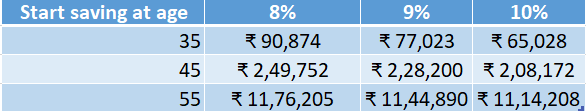

So here I have to bring in the numbers and explain the cost of the delay.

Varun age – 35; Retirement age 60; Life expectancy 85; Current Annual expenses (Basic+Vacations+specific others) Rs 720000 (60k per month); Inflation 7%; Post Retirement Return 8%. All this resulted into the Required Retirement corpus @60 of Rs 8.70 crore

It is clearly visible from the Maths above that if you delay your savings 10 years, you would have to save more than double from the savings required today, at whatever return you assume it to do.

The more you delay the more you have to shell out going forward. The numbers keep changing with every year you delay, with every percentage of extra or lesser return you generate in your savings.

Plus, if you still consider it as too far, then do remember that Retirement is not an event, but a journey and in this journey, you will meet many other near to medium-term goals that may not let you concentrate on your retirement goal. Like you have to save for children education, you may want to change your car every 5-6 years, you may like to buy own house, vacation may demand money every year, routine expenses, medical spending, children school fee, etc. will impact your cash flow surplus.

(Read: Is financial planning for the Retirees too?)

You may be thinking of your annual increment in the job, but do consider the other side of it too that no job is secure these days.

Conclusion

All in all, Retirement or you may say Old age planning is very important and you should start with it as soon as you get your first paycheque. and keep increasing the savings with whatever surplus you generate after providing for other important goals.

You have to keep a good balance between Near- and long-term goals, urgent and important goals. Your Financial Life and wellness depend on how good you maintain a balance between them.