Let me share a moment that’s stayed with me for years.

A few years ago, I sat across the table from a young woman, nervous, tearful, and holding a folder stuffed with old papers. She’d just lost her father and was desperately trying to make sense of his finances. There were mutual fund folios she hadn’t heard of, a demat account no one in the family knew existed, and insurance policies that had matured years ago. The emotional burden of loss was now tangled with the stress of operational hassles. These kinds of stories used to be very common a few years ago; I have seen multiple such cases post-COVID days.

When people are busy investing money and searching for high-return investments, they forget to maintain the basic financial hygiene of keeping it simple and informing all the stakeholders with proper nominations in their financial records.

But Now with the advancement of technology and attention of regulators towards the growing unclaimed money in investments and bank accounts, things are becoming easier for the claimants and legal heirs.

And one such recent initiative by the government towards this pain point is through Digilocker.

Let’s understand this in more detail. What is this Digital Locker initiative for investments, how does it work, how to take advantage of it, and also why is this a must for NRIs? (Read: It’s Mandatory to link Aadhaar to Mutual funds. Here’s how to do it online?)

What Is SEBI’s DigiLocker Initiative for your Investments?

Starting April 2025, SEBI has teamed up with DigiLocker—a secure digital document storage platform backed by the Government of India—to create a system where your financial records gets recorded in a neat, centralized, digital vault.

Think of it as a tool that not only stores your investment documents securely but also knows what to do with them when you’re no longer around.

Here’s what it’s meant to solve:

India is sitting on over ₹2 lakh crore worth of unclaimed financial assets. Not because people didn’t care about their money, but because their families didn’t know where to look—or how. lost mutual fund statements, forgotten shares, dormant bank accounts. It’s a tragic waste.(Read: Your Investments Reflect Your Life: Learn from Mistakes and Rebuild Smarter)

This new integration between SEBI and DigiLocker wants to change that by digitizing your financial footprint and easing the burden on your loved ones in your absence.

How does this digilocker account help in your Estate Planning?

Let me put it like this: DigiLocker is the tool your family will be grateful for when you’re not there to explain your investments.

If you’ve ever worried that your spouse or kids won’t be able to trace your financial accounts—or even know they exist—this is your way of leaving behind a breadcrumb trail. Quietly. Securely.

Once you link your PAN and Aadhaar to DigiLocker, your mutual fund holdings (via the Consolidated Account Statement or CAS) and demat statements start showing up in your account. You can then assign something called a Data Access Nominee—a person you trust—who’ll be notified of your financial holdings only after your death is verified through official channels.

It’s not ownership—it’s access. And that’s the crucial first step in starting any claim process.

You can add up to 5 nominees in your digilocker account. Also, you may mention a 3rd person in “others” who may not be the legal beneficiary of your money. It could be your lawyer, your friend or someone who you think can work as and executor to your WILL.

And since the nominees gain access to the complete account, one may also store his/her WILL copy in this digilocker account, to give them clarity on your wishes too. (Read: Intestate Succession Rules in India)

Have Elderly Parents? Or Live Abroad?

Then this becomes even more important.

If your parents still manage their finances the old-school way—physical statements, handwritten folio numbers, or relying on a trusted agent—please talk to them about DigiLocker. Help them set it up, or at least start the conversation. Because when the time comes, you may not know where everything is, and even if you do, the system may not make it easy to access.

And if you’re an NRI? This is non-negotiable.

Being miles away makes it harder to intervene quickly when something happens back home. Having DigiLocker in place—whether it’s for your own investments in India or for your parents—gives you visibility when it matters most. It’s your way of staying connected to the financial picture without being physically present. (Read: How to find and claim unclaimed deposits with banks, Mutual funds, Insurance policies, EPF, dividends, shares, and post offices?)

“But I Already Have Nominees in My Investments…”

That’s great. But here’s what we’ve learned: having nominees in folios or demat accounts doesn’t help much if they don’t even know those accounts exist.

This new system is about visibility. It ensures your chosen nominee—maybe your spouse or adult child—gets a full picture of your financial life when the time comes, without old bank branches.

And don’t worry—while you’re alive, they can’t see a thing. Your privacy is fully intact.

“Also, I manage my investments through secure software, with all data in one place.”

This tool is not about managing your investments, it’s about compiling all the records in a single place and informing the nominees in case of any eventuality. Being a government platform, it doesn’t have any business interest and you can rely on this for a safe record keeping.

A Few Gentle Reminders

Like all good tools, this one works only if you use it right. And I say this not as a caution, but as someone who’s seen even the smartest investors stumble over small things.

First, update it. Don’t assume that just because you linked your mutual funds once, it’s set forever. If you start a new SIP, buy new shares, or switch brokers, log into DigiLocker and refresh your documents. Just like reviewing your tax documents, think of this as an annual ritual. Your “digital estate check.”

Second, tell your nominee. Don’t let your child or sibling get a random notification one day and wonder what to do next. Have a conversation. It may be a little uncomfortable, but it’s also deeply responsible.

Third, don’t skip the legal stuff. DigiLocker won’t replace your will or override nominations in your investments. It’s an access tool, not a legal instrument. You still need an estate plan—a clear, updated will that matches the names and intentions in your financial documents.

Is DigiLocker Safe?

We are non-technical people to comment on this. Still, because it’s backed by the Government of India, uses end-to-end encryption, and requires two-factor authentication every time you log in, you may call it safer than others. And your nominee won’t get access unless your death is confirmed through SEBI-authorized KYC verification.

But like with any digital tool, your vigilance matters. Use a strong password. Don’t access it from public computers. And turn on extra layers of security, if available.

SEBI’s DigiLocker Initiative -A New Chapter in Financial Planning

We often talk about wealth building, asset allocation, and tax saving. But real financial planning? That’s about legacy. About making sure the people we love aren’t left confused or helpless in our absence.

DigiLocker isn’t a silver bullet, but it’s a powerful step in the right direction. And it’s incredibly simple to start.

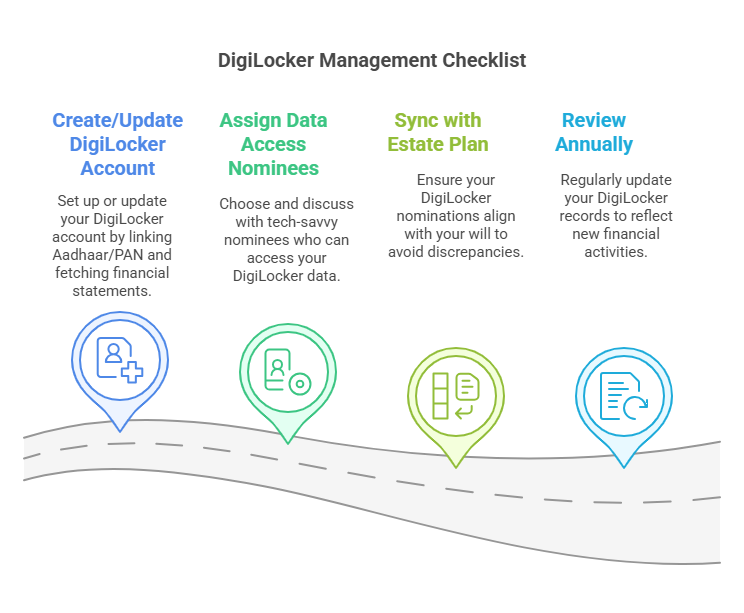

So here’s my suggestion: block out 30 minutes this week. Set up your DigiLocker account, link your PAN and Aadhaar, and fetch your CAS. Choose your data access nominee. And make it a part of your annual financial review.

If you’d like help fitting this into your broader estate plan—or you want to help your parents or relatives abroad get started—schedule a call with us today

P.S. Forward this to someone you care about. Especially your parents, or any friend living abroad. This isn’t just for “older” investors—it’s for anyone who wants to leave clarity, not chaos. ( Read: How Young and New Investors Should Set Their Financial Goals?)