The current government has a focus on the development of women and the girl child. They have launched a slew of measures for the girl child under the name ‘Beti Bachao Beti Padhao’. As a part of encouragement for the girl child, the government has launched the Sukanya Samriddhi Yojana. Apart from the social benefits that this scheme aims to bring, it is an excellent scheme from an investment perspective. Let us evaluate the Sukanya Samriddhi Yojana scheme from an investment viewpoint- what this scheme has to offer and how it stands in comparison to other similar schemes.

TRY NEW Child Education Planner – Your Guide to a Secure Future

Every parent dreams of providing the best education for their child. However, with rising education costs, planning well in advance is critical. The Child Education Planner helps you estimate the future cost of education and determine the monthly savings required to meet that goal.

With this calculator, you can:

✔ Plan your child’s education expenses in a structured way.

✔ Factor in inflation to estimate the future cost accurately.

✔ Understand how much you need to save every month to meet that goal.

Sukanya Samriddhi Yojana – Basic details

– Where can the account be opened?

The account can be opened at any post office in India and all public sector banks.

– Who can invest?

Parents or legal guardians of a girl child can open the account in the name of the girl anytime after her birth till she attains an age of 10 years. For the first year, an exemption is provided for the age condition. The scheme was notified on 02/12/2014. All girls who have turned ten, one year before notification of the scheme are also eligible to get an account under this scheme. That means the account can also be opened for a girl who has attained the age of 10 years between 02/12/2013 to 02/12/2014.

Only one Sukanya samriddhi yojana account can be opened for a girl child. Parents/guardians can open accounts for up to two girls. If there are twin girls born as the second birth or triplets-all girls born as the first birth, parents/guardians will be allowed to open three accounts upon presenting the relevant documentary proof.

– How much can be invested?

The account needs to be opened with a minimum of Rs.1000. The minimum investment amount is Rs.1000 per year, and the maximum allowed is Rs.150000 per year. These amounts can be deposited any number of times in a year.

– What is the duration of the scheme?

Investments can be made till completion of fourteen years from the date of opening of the account.

– What is the rate of return?

The rate of return will be announced by the government every Quarter. In the current Quarter (Jul 2016-Sept 2016) the rate is 8.6%. The interest would be compounded yearly. Apart from the rate, the yearly compounding nature will help create a good corpus upon maturity.

With effect from 01.04.2020, the interest rate would be 7.6% p.a. compounded yearly.

There is also an option of monthly interest payout. Though this option is provided, it will be better to avoid it, to be able to have a sizeable corpus for your daughter’s higher education or marriage.

– Account operation

The account has to be operated by the parent/legal guardian of the girl. When the girl becomes 10 years old, she herself can operate the account.

The details of the transactions in the account will be updated in a passbook given by the post office or the bank where the account is maintained.

– What is the level of safety?

The level of safety is highest in this product as it is a scheme by the Government of India.

Sukanya Samriddhi Yojana account – Taxation

This is a tax-free scheme. When you invest the amount in this account, you get a benefit under Sec 80C. The interest received is tax-free; upon maturity, you can withdraw the amount tax-free. So it is under the EEE taxation level, the same as that of the PPF account. ( Read: tax saving – financial planning way)

When the scheme was launched, the taxation was unclear. The tax-exempt status was announced in the budget of 28 February 2015, which was later approved by both houses of Parliament.

(Also Read: Child Investment Plans - A Comprehensive guide)

Sukanya Samriddhi Yojana – When can the money be withdrawn?

The Sukanya Samriddhi Yojana account will mature after 21 years from the account’s opening date. All amounts in the account can be withdrawn on maturity. If the account is not closed on completion of 21 years from the Date of account opening, it will continue to earn the rate of interest that is announced by the government every quarter till its closure.

If the girl gets married before the account is due for maturity, the account will have to be closed. The girl will have to give an affidavit that she is above eighteen years of age if she is closing the account before maturity for this reason. This ensures that there is some support for child marriage using this scheme.

So if the account is opened for a girl 9-10 years of age today, the maturity will be at her age of 30-31 years. She can close the account if she gets married before this age or continues it for the full duration.

After the girl turns eighteen a partial withdrawal is permitted to provide for her education/marriage. An amount equal to 50% of the balance at the end of the preceding financial year will be allowed to be withdrawn.

Premature closure of accounts will be allowed only under two conditions

- Death of the account holder

- If the account holder is suffering from life-threatening diseases for which the funds might be required.

Sukanya Samriddhi yojana – Documentation required to open the account

- The birth certificate of the girl

- Address proof

- Photo identity proof of the girl

- Photo identity proof of the parent/legal guardian

How much can you accumulate?

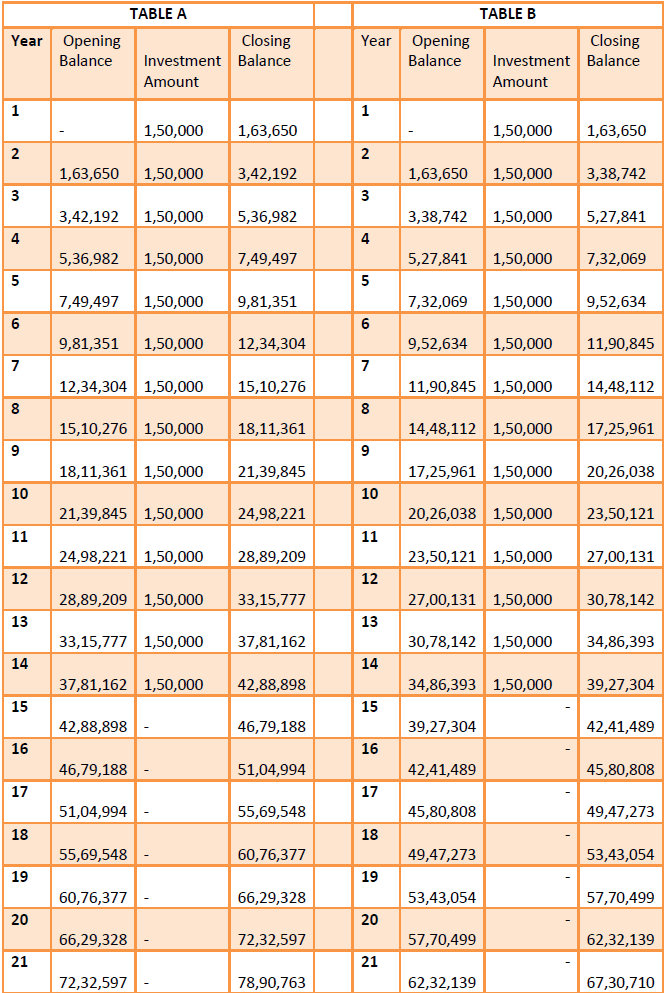

Table A shows the possible accumulation if the interest rate continues at 9.1% ( the rate when the scheme was announced) Since the rate will be announced every year and might be different for the years to come, another working of the accumulation assuming the rate to be 8% from year two is shown in Table B. So we see that a good accumulation of Rs.60-80 lakhs is possible until maturity under this scheme.

Check out the Financial calculators, and find out how much you can grow your corpusSukanya Samriddhi Yojana account – Comparison with PPF/FD/RD/Equity MF SIP

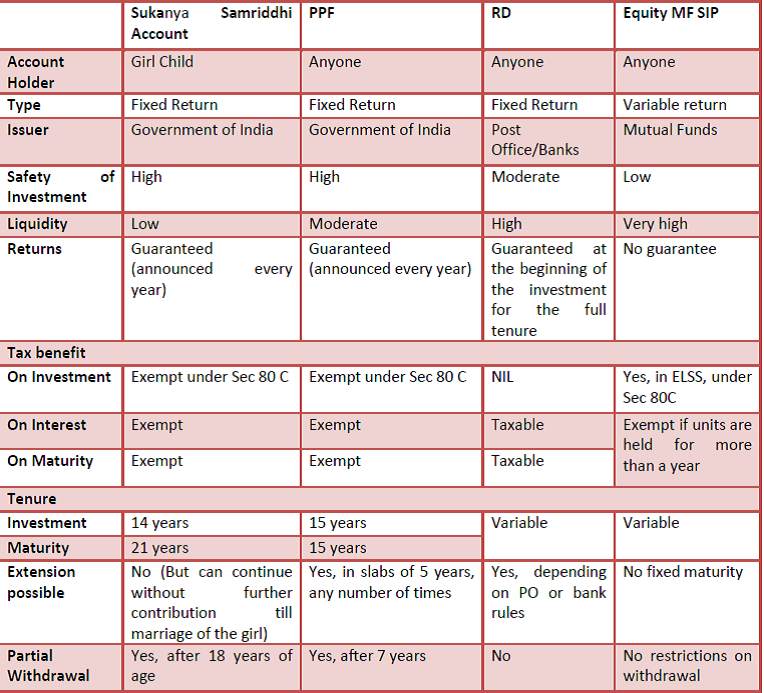

It would feel strange to see equity mutual fund SIP in the comparison table because it belongs to a totally different asset class. The reason for putting that in this table is that equity mutual funds are a great source to build wealth for long-term goals, education, and marriage of children being amongst them. Though equity mutual funds may be perceived as risky, in reality, they are more volatile than risky and have shown to perform very well over long durations. Schemes like Sukanya Samriddhi and PPF have their own place in the creation of the portfolio for goals, but they should be looked as a part of your portfolio composition and should not be relied upon entirely to fund your goals as they have their own restriction in terms of investment amounts and tenure.

Also Read : Child Plans of Mutual funds

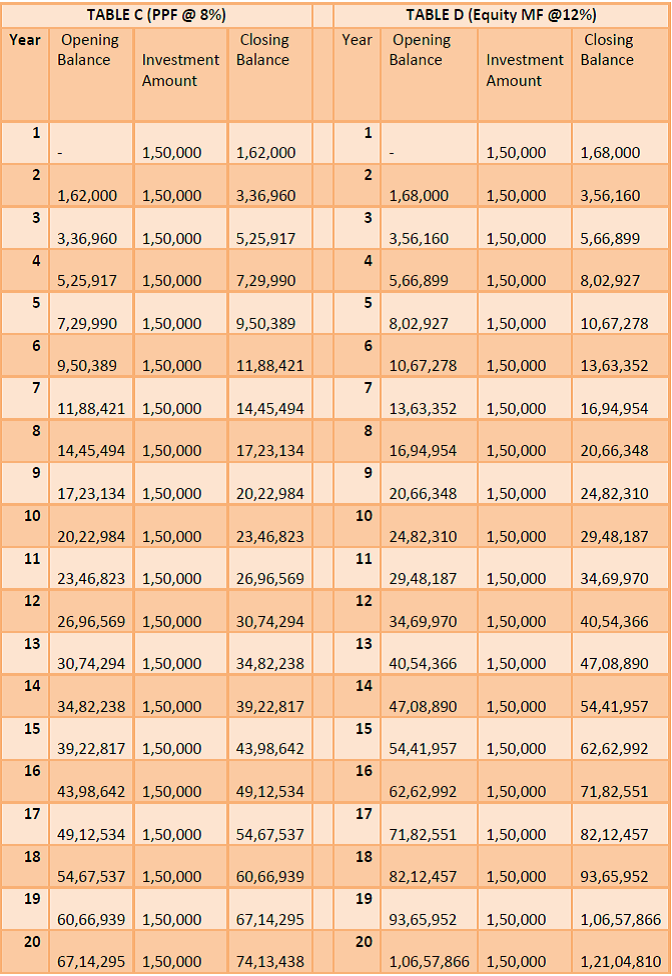

We have already seen the kind of accumulation possible in two different interest rate scenarios in the Sukanya Samriddhi Yojana account. Table C below shows the possible accumulation in the PPF account assuming an interest rate of 8% over the tenure (the current rate is 8.7% and changes every quarter). Since PPF allows extension in a slab of 5 years, we have stopped the calculation at 20 years. ( Here’s everything you want to know about PPF)

Table D shows a scenario for a similar investment in equity mutual fund assuming a rate of return of 12% per year. In equity investments, there is no guarantee on the rate of return and returns do not follow a linear pattern, they tend to be lumpy. ( Read: Best Mutual funds to invest in 2015)

Sukanya Samriddhi Yojana – Pros:

Tax Exemption: The biggest benefit of this scheme is that it has a tax-exempt status at all stages of investment. In any investment, we have to ideally look at the expected returns post-tax to be able to comment on its suitability for our goals. A fixed deposit of 10% will mean only a yield of 7% to someone who is in the highest tax bracket. ( Read the perfect ingredients in a perfect investment portfolio)

Guarantee: Both safeties of your principal and guarantee of the interest payment is the highest level.

Interest to be announced every year: (From April 2016, all small savings rates will be announced every quarter)The interest amount, though not fixed guaranteed, will be in line with the general investment scenario. This is a safety in itself because it will ensure that sukanya samriddhi yojana scheme sustains over different interest rate scenarios.

Some years back, many people had invested in schemes like the Rajlaksmi Unit Scheme from UTI which had guaranteed maturity amounts with returns working out to a little more than 16%. As the interest rates started tending down the scheme it was not possible to fulfil the promise of such high interest rates. The scheme was launched in 1992-93 and prematurely withdrawn in the year 2000… Many parents who had trusted such schemes to provide for their daughter’s education/marriage were left bitter by this experience. Sukanya Samriddhi yojana by design will avoid such experiences.

Illiquidity/Liquidity: The lock-in can be both a pro as well as a con. Discipline in investing is one of the main requirements to build a decent corpus. Many people are tempted to pull out amounts from investment accounts to cater to various wants which might seem very urgent at those particular points. This robs them of the wealth they can create for their goals. This scheme allows by default of building of the investment discipline.

Investment limit : PPF has a limit on investment of Rs.1.5 lakhs per year. If both the husband and wife are earning, they can each invest up to Rs.1.5 lakhs in their own PPF accounts. IF they wish to invest in PPF in their child’s name, the rule says that the total amount allowed per year is RS.1.5 lakhs combined with the parent. So effectively the rule says Father+Child1+Child2= Rs.1.5 lakhs or Mother+Child1+Child2=Rs.1.5lakhs. In such a case Sukanya Samriddhi Scheme account becomes an excellent option to invest additionally if the child is a girl.

Sukanya Samriddhi Yojana – Cons:

Limited Investment: There is an upper cap on investment. So if you want to send your daughter abroad for studies, this in itself will not be sufficient to meet the requirement.

This being a fixed return scheme, it is bound to have an upper cap on investment.

Age barrier: The opportunity is lost for girls who have crossed 10 years of age. This probably is from the social perspective where there is an attempt to protect little girls who might otherwise be married off early and will not have a chance at pursuing higher studies.

Illiquidity: For parents who will have to stretch their resources to make savings in this scheme this might prove to be tough if their financial situation deteriorates. The money will not be able to be withdrawn before the girl turns eighteen.

Sukanya Samriddhi Yojana – Should you invest?

Sukanya samriddhi yojana is an excellent scheme for the girl child, both socially and from an investment point of view. Parents having daughters should evaluate this option in their investment portfolio. If the debt component of your asset allocation permits and you can invest, the full amount should be invested in this scheme for the complete duration of the scheme. You must watch out for big dips in interest rates or any negative changes on the taxation front to decide to invest further amounts in this scheme. A very low-interest rate or the scheme being made taxable would mean that you should look at reducing investment in this scheme.

On the social side of things, we must encourage people in our community support structure to take benefit of this Sukanya samriddhi yojana scheme. Domestic help, drivers, cleaners, etc. can be helped with the knowledge about this scheme so that their daughters can also benefit when they grow up. The lock-in structure of this product will ensure that they provide for their daughters as they grow up.

Parents with little boys would be wishing that they had this opportunity for their sons too!

If you have any questions on the Sukanya Samriddhi Yojana account or any other investment product, please feel free to ask in the comments section below. Would also love to see your views about this new yojana.

Very well explained Kiran.

Recently I have visited my nearby post office and form there I found that Post offices with savings account opening facility can open a Sukanya Samriddhi Account. Regarding banks Andhra bank, PNB has no idea about this scheme. And again for banks also only few special branches of every bank in a city will be facilitate in future to open this account. But we have to wait for next step.

Definitely a great scheme as the purpose is to accumulate money for the girl child education and marriage. Although there could be other options, I believe for them there is no motive of investment. But a long way to go and more features need to be added to make this scheme a real success for the betterment of women-hood in our country.

Thanks Santanu.

There are bound to be some initial hiccups in implementation. Let’s hope they get sorted out real fast!

can any body say when a people open ssa account after some days that person death or permanent disability who operated this account if that person not done any lic or insurance investment very low amount .

Nice write up Kiran,

Though wanted to clarify if the scheme is for total 21years or till the child is 21years of age?? Many web sites claim its 21years of age.

Hi Akshay, The maturity of SSA account is 21 years from the date of opening. Now if kid’s age is 10 year old then maturity period will be 31 years, but if she got married before that but after 18 years of age, account will be matured automatically.

Thanks Akshay.

The maturity is 21 years from date of account opening.

Thanks for such a detailed article. I have one question.

Now we have 2 safe and tax free investment options which are for long term savings- One is PPF and Other is this sukanaya a/c. Do you advise if someone has 2-3 lakh of saving window available every year, then one should do in these 2 accounts only. I am a conservative investor and have horizon of 15-20 years. Goal would be my retirement and my daughter’s education .

I think you got the point. Yes, if you have enough money then both these small deposit schemes would be best to create a corpus. Max you can deposit 3 lakh in both the account.

Thanks Supriya.

PPF and Sukanya Samriddhi are excellent options for conservative investors. But while investing you need to understand that there are several other factors that come into play when you talk about goals like retirement. As mentioned in the article you might need to supplement it with other investments over the long term to meet your goals, these products by themselves might not able to give you the entire corpus that you need.

Thank you Manikaran ji for sharing such a superb post. I would like to know more about the details of banks, where I can open Sukanya Samriddhi Account.

Great work sir. I have one question for you. How many deposits I can made in one year ???

Nisha, you can make any number of deposits in a single year upto maximum deposit limit of Rs 1.50 lakh in a year.

It is not clear as and where government is helping or contributing for the beti’s bachao. the scheme seems to be normal saving or RD type account on the name of the child which normally the parents opt for. Other than Tax benefit, no other benefit is desernible.

can huf fund sukanya smridhy yojna and claim tax benefit in 80 cc

I don’t think so. This scheme is for parents and legal guardians.

Great initiative by Govt however their should be an online mechanism to opt for the same. It is difficult to deal with bank especially when they are clueless and least interested.

Online facility has been started for them who has opened Sukanya Account via bank only. Its like transferring money for PPF account. But for post office It will take time as they don’t have any online mechanism for any product so far. I think one can easily transfer the account from post office to bank and then send money online.

Thanks for the info Santanu. Btw is there any way one can transfer post office account to bank? I mean do you know the process?

Amazing post Thank you ! Manikaran 🙂 for sharing such a superb post. I would like to know more about it.

Thanks Vivek for liking the article. You may ask anything specific you are looking for.

Though wanted to clarify if the scheme is for total 21years or till the child is 21years of age?? Many web sites claim its 21years of age. What documents is required.

The sukanya samriddhi yojana account will mature after 21 years from the date of opening of the account.So if the account is opened for a girl 9-10 years of age today, the maturity will be at her age of 30-31 years.You may get this cross confirmed at the time of account opening

Hi Kiran

I want to know that do we have facility of online transfer in SSA scheme.

Kindly assist

Sukanya Samriddhi scheme is available with the post office, you may check it with them. we are expecting post office to go digital very soon. So, if it is not available today, it may be available in future.

nice i like this

My daughter is 10 years 2 months old. Can I start Sukanya account on her name

I guess NO. Still you may confirm from the nearest post office.

My plan is sukanya samriddhi

My baby age is 1year I want invest

Hi,

Can we change the amount deposited for various months in a year or should it be a fixed amount for the whole year ? For e.g., can I deposit Rs.5000 /- in Feb 2020, Rs. 3000 /- in March 2020, Rs. 6000 /- in April 2020 etc. or should it be only Rs. 5000 /- (example) for the whole year (2020).

Yes the amount can be changed, but the maximum amount to be deposited is capped at Rs. 1.5 lakhs per annum.

Where can i open Sukanya sumriddhi account

How to open sukanya samriddi account

The account can be opened at any post office in India and all public sector banks.

Please visit nearest post office branch or branch of any public sector banks, they may guide you on the account opening process. following documents are required:

-Birth certificate of the girl

-Address proof

-Photo identity proof of the girl

-Photo identity proof of the parent/legal guardian

My daughter is 5yrs old how much you can save monthly

You can save any amount monthly, there is no limit. But the total contribution should not exceed Rs. 1.5 lakh per annum.

I would like to invest 2000 per month for next 6 years. Already in this account around 20k is there after 6 year what will be the benefit I will eatn

Not sure, what do you mean by benefits, I guess you are asking the corpus you would accumulate in 6 years, considering the current interest rate of 8.5% continues for the next 6 years, the estimated corpus could be around Rs.2.25 lakhs, as per my calculations.

However, please note that It is not a full proof statement, the actual corpus may vary.

HI,

from last 1 year I already invested 10k per month, but from this 2nd year i want to increase from 10k to 12.5k per month. i believe it is very much possible. can any one suggest.

Yes, you may increase the same, but the total investment per annum cannot exceed 1.5 lakhs per annum

any good scheme for boy child