Union Budget 2021 had made some amendments in the Finance Act with regards to the ULIP Taxation. It has made the proceeds whether it is maturity, bonus, or surrender, received under any ULIP issued after 1st February 2021, taxable if the premium payable in any policy year exceeds Rs. 2.50 Lakhs.

Prior to this, under section 10(10D) if the sum assured of the policy being ten times the annual premium, the redemption proceeds along with bonus received under any ULIP remained tax-exempt. (Also Read: TDS on Life Insurance Policies)

But now, some new provisions are added in the above section to take care of the amendments in the Finance Act 2021. This exemption would not be applicable on the high-value ULIPs issued after 1st Feb 2021.

However, there were various ambiguities with respect to the above amendment that required clarification. For instance, what if multiple policies are there? How are the proceeds going to be taxed? Under which head? etc.

The Central Board of Direct Taxes (CBDT) recently (in January 2022) released two circulars clarifying all these issues related to ULIP taxation in India.

In this article, let’s try to understand these new rules and provisions in detail with the help of various examples.

ULIP Taxation: Single Policy

Any sum received as surrender/maturity/regular payment under a ULIP would be taxable if-

- The annual premium in any policy year exceeds Rs.2.50 Lakhs,and

- The plan is purchased after 1st February 2021.

In other words, if both the above conditions are satisfied, you are not entitled to claim the tax exemption under section 10(10D).

Any sum received under the ULIP issued prior to 1st Feb 2021 and the ULIP whose annual premium does not exceed Rs. 2.50 lakhs, despite the issue date continue to remain tax-free.

The consideration received on the death of the policyholder under any ULIP would remain tax-free. (Also Read: ULIP vs Mutual Funds)

ULIP Taxation: Multiple Policies

In the case of multiple policies, you can claim the tax exemption only on the consideration received from those policies whose aggregate premium does not exceed Rs.2.50 lakhs in any of the policy years. All other policies would be taxable.

Let us take an example, to have a clear understanding of this provision of ULIP taxation.

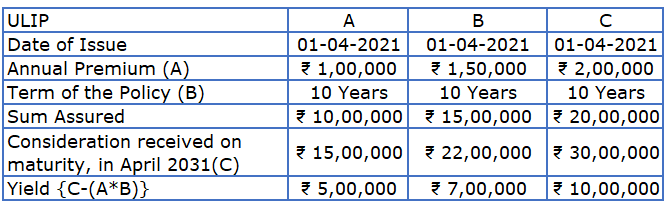

Example 1: Mr. Rahul has purchased the following three ULIPs. All these policies satisfy the conditions of Section 10(10D), except the new provisions.

Since Rahul has purchased all the ULIPs after 1st Feb 2021, he can claim tax exemption only on the maturity proceeds on any of the ULIPs whose annual premium does not exceed Rs. 2.50 lakhs as per the new ULIP taxation rules.

So, there are two options for Rahul to claim the exemption under section 10(10D)- either he can claim it for ULIP A and ULIP B combined or for ULIP C only.

Since the combined yield of ULIP A and B is more than the yield of ULIP C, it would be beneficial for Rahul to claim exemption on the maturity proceeds of ULIP A and B rather than ULIP C alone.

Also Check- Tax Implications when you discontinue a Life Insurance Policy

What happens if exemption under any ULIP is claimed in Previous Year?

If in any of the previous years, you have received any sum under any one or more ULIPs issued after 1st Feb 2021, and have claimed the exemption for the same under section 10(10D). In such a case, the exemption under section 10(10D) for any sum received in the current year is determined as under:

Under one ULIP:

If you have claimed the tax exemption under one ULIP in any previous years, you can claim the same for another ULIP only if the premium of both these ULIPs does not exceed Rs. 2.50 Lakhs in any of the policy years. Else, the proceeds received under the second ULIP are not eligible for the exemption under section 10(10D) as per new ULIP taxation rules.

Let us take an example to have the clarity of the above provision.

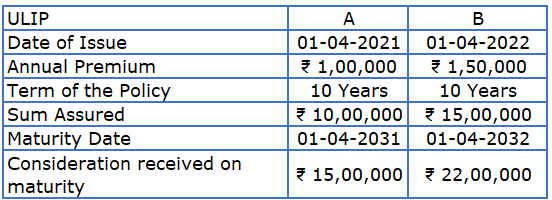

Example 2: Mr. Rahul has purchased the following two ULIPs. All these policies satisfy the conditions of Section 10(10D), except the new provisions.

Since the aggregate annual premium of both these ULIPs does not exceed Rs. 2.50 Lakhs, the maturity proceeds of both these ULIPs are eligible for the exemption under section 10(10D).

In the above example, had the annual premium of ULIP B been Rs. 2 Lakhs then only the maturity proceeds of ULIP A were eligible for the tax exemption as per the new rules of ULIP taxation.

Under multiple ULIPs:

If you have claimed exemption under multiple ULIPs in previous years, you can claim the exemption for new ULIP if the aggregate premium of the new ULIP and the old ULIPs (for which the exemption is already claimed) does not exceed Rs. 2.50 Lakhs in any policy year.

If the individual or aggregate premium of any ULIP(s) exceeds Rs. 2.50 Lakhs in any policy year, the sum received under such ULIP(s) is/are not eligible for tax exemption as per the new ULIP taxation rules.

Let us take an example to have the clarity of the above provision.

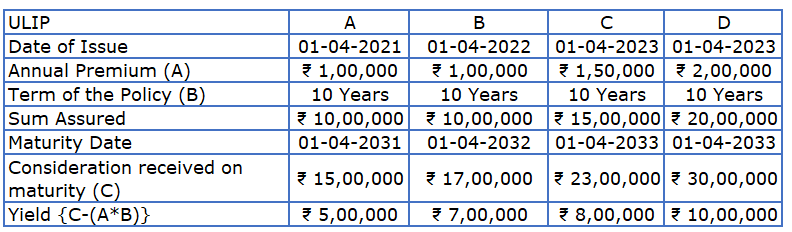

Example 3: Mr. Rahul has purchased the following four ULIPs. All these policies satisfy the conditions of Section 10(10D), except the new provisions.

Case 1: In FY 2031-32, Rahul had claimed the tax exemption for the maturity proceeds of ULIP A.

– Rahul can claim the exemption on only those ULIPs whose aggregate annual premium does not exceed Rs. 2.50 Lakhs. In this case, since he had already claimed the exemption for the maturity proceeds of ULIP A, the annual premium is Rs. 1 Lakh, he is eligible to claim further deduction on the ULIP(s) whose annual premium does not exceed Rs. 1.50 Lakhs.

So, in addition to ULIP A, he can either claim the tax exemption on the maturity proceeds of ULIP B or ULIP C. Maturity Proceeds received under ULIP D would not be tax-exempt,

Since the yield of ULIP C is more than ULIP B, it would be beneficial for Rahul to claim the exemption for ULIP C in FY 2032-33 along with ULIP A (already claimed in FY 2031-32).

Case 2: In FY 2031-32, Rahul had not claimed the tax exemption for the maturity proceeds of ULIP A.

– If Rahul had not claimed the tax exemption under ULIP A, then all the remaining ULIPs- B, C & D are eligible for the tax exemption individually. Since the annual premium of none of these ULIPs exceeds Rs. 2.50 Lakhs.

Now, he has two options to claim the exemption- either he may choose to claim for both ULIP B and ULIP C (since the aggregate premium of both these ULIPs is within the threshold of Rs. 2.50 Lakhs) or for ULIP D alone.

From the tax planning angle, he should claim the exemption under both ULIP B and C as this option would provide him the maximum benefit.

So, rather than claiming tax exemption for ULIP A in FY 2031-32, Rahul should claim the same for ULIP B in FY 2032-33 and ULIP C in FY 2033-34.

ULIP Taxation: Computation of taxable amount

The proceeds of ULIPs not eligible for tax exemption under section 10(10D) would be chargeable to tax as Capital Gains and the taxable gain amount would be calculated as under:

First time receipt:

Any sum received by way of bonus, maturity, or surrender under any ULIP which is not eligible for the exemption, for the first time, the taxable gain would be the difference between the amount received and the total premiums paid until the date of receipt.

Subsequent receipts:

For the calculation of taxable gains for any other subsequent receipts, other than the first receipt, the amount of the first receipt and the premiums paid after the first receipt would be deducted from the amount received.

Let us understand the taxability with the help of an example.

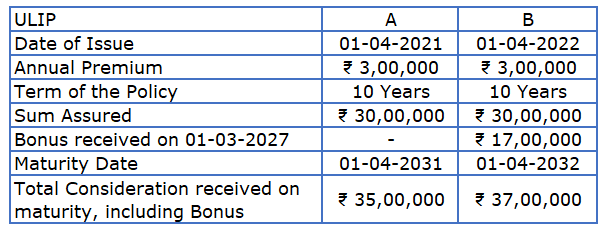

Example 4: Mr. Rahul has purchased the following two ULIPs. None of these policies are eligible to claim the tax exemption Under Section 10(10D).

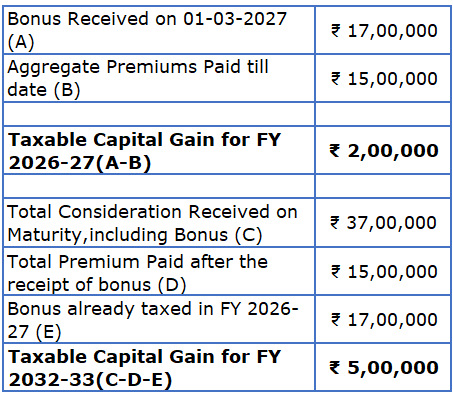

There is no bonus received under ULIP A so, the maturity benefit would be the one and only consideration to be received. But under ULIP B a bonus of Rs.17 lakhs is also received during the policy term. The capital gains tax under both these policies would be calculated as under:

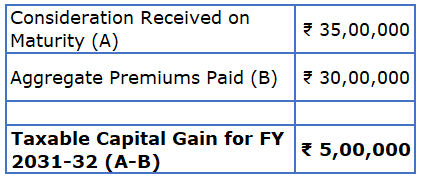

Computation of Capital Gains under ULIP A:

Computation of Capital Gains under ULIP B:

ULIP Taxation: Tax Rates

The tax rates applicable on the gains arising out of ULIPs are similar to mutual funds. ULIPs that invest at least 65% of their assets into equity or related instruments would be taxed similarly to equity mutual funds.

All other ULIPs in which the equity exposure is below 65% would be taxed similarly to non-equity mutual funds.

So, the long-term capital gains, i.e., gains arising out of an equity-oriented ULIP after a holding period of 1 year would be taxed at 10%, and gains arising before 1 year would be taxed at 15%.

However, gains up to Rs. 1 Lakhs per financial year would remain tax-free. (Also Read: Taxation of Mutual Funds In India)

And, the long-term capital gains, i.e., gains arising out of a non-equity-oriented ULIP after a holding period of 3 years would be taxed at 20%, with indexation and gains arising before 3 years would be taxed as per the income tax slab rate applicable.

Sources:

- CBDT Circular 2 of 2022, Dated: 19th January, 2022

- CBDT Notification 8 of 2022, Dated: 18th January, 2022

This Article is written by Mr. Varun Baid, CFP Professional