What is equity? It may sound like a very basic question but it actually is not. I have always found investors looking for or making equity investments, just with a view that stock markets are rising, which is a wrong way to make investments.

Though stock markets help in making out the valuation of a stock but seeing equity investments from the stock market point of view restricts the understanding of the potential the equity investments have.

In the rising market, everyone wants to have exposure on equity investments, in the falling market every second investor shy away from equity, by calling it risky. But I have never seen this happening in Gold and Real Estate. I don’t find people calling them risky. WHY?

Yes, I agree there is no single investment asset that keeps performing all the time, and that is why there is a concept called asset allocation which is important to follow especially in goal-based investments.

But if you look at the average investments in equity over a longer period of time it has beaten all other investments with a Big Margin (Even Real estate, most of the time).there is a concept called asset allocation which is important to follow especially in goal based investments.

The only issue in equity is that its losses even for short-term are visible to the investors, which bothers all Humans. Yes, the issue is the transparency. In Gold, Real estate and even in LIC policies, even if you know that you are not in profits you find solace in tangibility of the assets or finds confidence in the name only.

Recently I had a detailed discussion on this subject with one of my new and young client. He told me that he is new to this investments, so wanted me to answer few of his questions before we start the process. His first question was “what is equity?” I like his openness and confidence while asking this as he is accepting the fact that he doesn’t know anything on this subject.

It made me think that how many of investors actually know the answer to this, leave aside investor very few professionals understand this and invest in equity by believing on what is equity all about.

Through this article on what is equity, I want to share the basic essence of equity investments which every investor should understand and invest with that in mind.

What is equity?

The word equity comes from Equality. In investment terms we call it Equity share. “A share means a Portion of something, so equity share is a portion of ownership in a company.” An equity share investor has equal rights in the company’s profits and losses, based on the proportion of his ownership.

No one likes to invest in a business which is new, so the promoter himself have to invest his own money while starting the venture, that is the first equity investment in that company. He has to bear all profits and losses. He/she may ask for some contribution from family members or friends, in the form of equity /or partnership or in the form of soft loan, which further divides the ownership.

Equity share Investors participate in the growth and also bears the losses of the company. Debt (Loan) investors will get a pre-decided interest, but no portion of the profit.

In a business you do not start earning profits from day 1, sometimes it takes years to reach breakeven and come into profits. Unlike employees, who start earning their salary from the first month, a businessman bets on the future potential of the business. To invest and gain from equity you have to have an attitude of Employer/Entrepreneur.

At the initial stages, banks also are generally reluctant to provide loans, it is only at the later stage when there is some visible cash flow stream starts and some asset base is there, the bank agrees to lend to business, by again asking for some personal guarantee or mortgage of personal assets.

Businessman starts taking the risk from day one with the expectation of earning profits at a later stage and building a business for generations. Yes, business never gets started with Income in mind.

Good profits are bound to come in good business structures. It’s just it needs time to set up. And that time is known as “Long-term”. And this is the long term that you need to have for your investments, not sure if this should be 1 year, 3 years, 5 years or 10 years…or 3-6 months(For traders)

(Did you know? : The average holding period of Equity Mutual fund is 2 years)

When a business reaches a profitable stage and has regular multi-year profits and good numbers to show to the investors, they try to go public by listing their shares on the stock market. It is at this stage when retail and other corporate investors are asked to participate in the growth journey.

This is the time when either the promoter, or the private investors offload their shares at a premium, which becomes the cost price to the stock market Investors, and profit to the old investors. They deserve a higher but reasonable valuation, as they have risked their money at the very initial stages of a business when the sustenance was not sure.

From here the story starts when retail investors, unaware investors, those investors who want to make quick money, fearful investors who are not regular but invest only by looking at market performance and all other categories of investors get these shares.

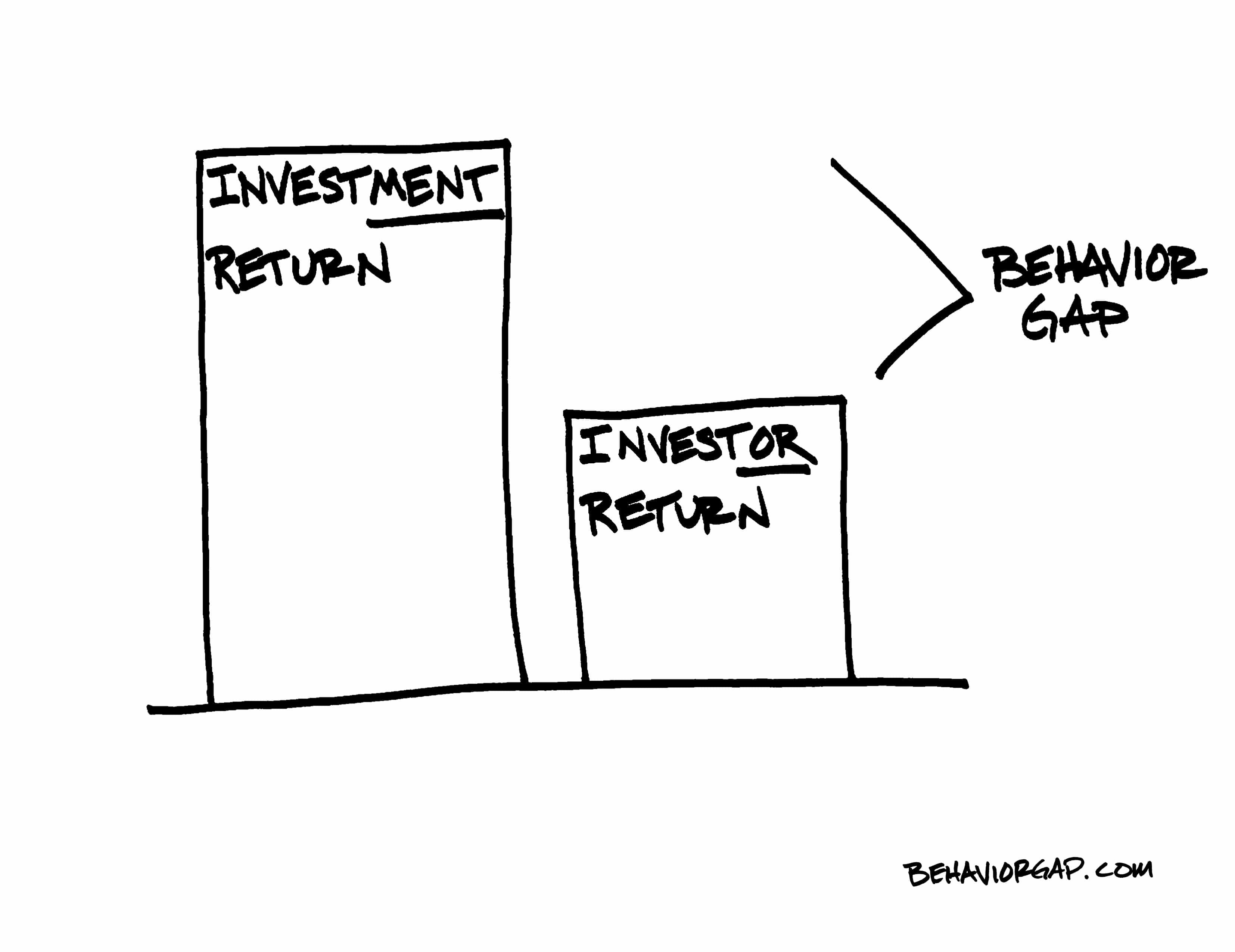

Without valuing the long-term potential of the business, without knowing what actually the business is, they keep reacting to different market movements, and this is the reason that Investments had given returns in the past, but Investors were not able to make money.

This phenomenon is coined as Behavior gap by carl Richards, a blogger and financial planner. It is true that we are the victim of our own behaviour and does not act rationally while making investment decisions.

It is understandable that it’s not possible for everyone to get into every equity shares detail, not everyone can read balance sheets, talk to management people and make investments, which is why the financial markets has other instruments like Mutual funds where you can buy the professional help.

It’s clear that buying even an average mutual fund and holding on to it for long time has been a pretty decent strategy. But the real people don’t invest this way. We Trade. We watch CNBC, read Business papers and invest in top performing funds which keep changing every week/month or year.

We react to all the news without understanding its impact on your portfolio. We buy what’s up and sell what’s down. We do exactly what we all know we should not. It’s not only this, these days people make their investment decision based on information shared on WhatsApp and facebook groups.

Every business faces some problems. When operating on a large scale, every news impacts it, be it political or economic, small currency movements, International issues, but still good management will sail through the troubled waters, it’s just you have to have confidence in them. The role of sensitive markets is to evaluate the impact which gets reflected in the price. If a company is fundamentally strong then short-term impacts don’t bother the long-term evaluation.

Moreover, in markets you will find many kinds of investors some may be greedy, some may be fearful, so how the overall markets will do depend on the type of investors trading there. In 2007-08 it was a greedy market, in 2008-09 it was fearful.

But all this can be said from hindsight, and no one can predict the market movements, no one can time the market, which is why it is advised to invest “Time in the market”. Over a longer period of time equity valuations come back to their fundamental values.

Indian economy got the required push only after 1991 when it was opened for the world. After all Hiccups of 2000, 2008, since inception Sensex has delivered 17%+ kind of CAGR returns.

You will find many stocks that had delivered exponentially higher than Sensex, read WIPRO, Infosys, SBI, HDFC bank etc. , If not sure on stocks then check out the since inception performances of some of the oldest Equity Mutual funds – HDFC Equity (20.45%) , Reliance Growth (23.64%) , Franklin India Prima fund (19.78%). These funds may not be in the recommended funds of many advisors and also many not be coming in the top performers’ list, but my point is just to show you the long-term potential of equity

What is equity – A Financial Planners’ Perspective:

When we know that we do not know what is equity, then we should not own those equity shares directly just because someone who claims to know what he also does not know, has advised you to buy that. Ask professionals, and take equity as investments made into a business and own the profits and losses of the company.

Do not look at equity investments as something to make quick money and that can be traded in the stock market. The stock market is just a platform to provide liquidity to the investors, where someone who believes in the long-term potential of the company, buy shares from the one who feels that it’s over.

Yes, volatility will be there, and to earn from equity you have to bear the volatility, its a part of the business. If it’s not in your risk tolerance then follow an asset allocation and goal-based investment approach, so you should plan your buy and sell in a structured fashion rather than looking at market movements.

Why in Equity is also an important question to answer along with what is equity? You should not look at equity as an investment if your investment horizon is very short term. Unless you are not clear on the WHY aspect, you should never invest.You may also use debt as a good investment tool

Nice post!I am new to stock market and your blog very helpful for us.its very knowledgeable post for me keep sharing more post like this it really helps me.

Thank you.