Gold and Silver need no introduction. While new investors might need some guidance with instruments like fixed deposits, almost everyone is familiar with gold and silver.

In households, these metals are primarily used for consumption—jewelry, ornaments, or cultural purposes. However, when it comes to investing, gold and silver are often compared with other financial assets.

The growing interest in these metals can be attributed to their impressive performance. Whether it’s the recent price surge or their solid returns over the last 10 to 20 years—often comparable to broad equity indices—gold and silver have caught the eye of many investors.

But when it comes to choosing between the two, should you invest in gold or silver, and why?

As the old saying goes, “Silver shines in the light, but gold glows in the dark.” This hints at their differing roles, but with a strong correlation between them, it’s important to understand the unique drivers behind their growth.

Let’s explore the key differences and advantages of gold and silver to help you make an informed decision.

Gold vs. Silver: The Basics

Gold: The Safe Haven Investment

Gold is often called a “safe haven” because people turn to it when there is economic uncertainty. It has a long track record of holding its value, even when stocks and bonds are struggling. When inflation rises and the value of money goes down, gold usually stays strong. Though it doesn’t pay dividends or interest, making it less appealing for those seeking regular income, it’s easy to buy and sell worldwide. This makes gold a reliable option for anyone looking to preserve their wealth over the long term. Also read: How good is gold-as-an-investment

Silver: The Versatile Performer

Silver is known for its versatility and affordability, making it a popular choice for many investors. Unlike gold, silver has many industrial uses, from electronics and solar panels to medical devices, which means its price can rise with economic growth and technological advancements. This industrial demand can make silver more volatile, leading to higher potential gains but also bigger risks. Silver is cheaper than gold, so it’s easier for investors to start small and build their portfolios over time. While it requires more storage space due to its bulkier nature, silver’s dual role as both an investment and an industrial metal makes it an exciting option for those looking to diversify their investments.

The Price Difference

One of the most noticeable differences between gold and silver is the price. As of October 2024, the price of gold stands at Rs 7508 per gram (24 carats), while silver is priced at Rs 95 per gram. The lower cost of silver makes it more accessible to new investors or those with smaller amounts of capital. For example, if you’re looking to hold physical bullion, silver can offer an entry point without requiring a significant upfront investment.

However, gold’s higher price can be seen as an advantage when it comes to storing value. A small amount of gold can hold much more value than an equivalent amount of silver, making it easier to store and manage.

What connects the two markets is jewelry. Because gold is 70x as costlier than silver, when prices rise, demand for gold jewelry is expected to fall while silver’s jewelry demand is relatively unresponsive to price because it costs much less. That’s why silver is also called Poor Man’s gold.

Stability: A Sought-after Advantage

If stability is your primary concern, gold is typically the less volatile of the two metals. Its value often rises when the economy faces difficulties, as investors seek safe alternatives to stocks or bonds. This makes gold an excellent hedge against inflation and market uncertainty.

Silver, on the other hand, is known for its volatility. Though it tends to behave similarly in economic crises and provides hedges, its price swings are more extreme because it’s also heavily influenced by industrial demand. During bull markets, silver has the potential to outperform gold, sometimes yielding much higher returns. However, this also means that silver carries greater risk, especially in periods of economic downturns.

Is this the reason why Central banks worldwide have been net buyers of gold after the financial crises?

Long-Term Performance

When comparing the long-term performance of gold versus silver, gold tends to come out ahead. Over the past two decades, gold has shown more consistent growth and stability. The main reason for this is government buying when post the subprime crisis they feel like diversifying from USD. Experiences like European debt crises and Covid, plus the geo-political tensions remaining high in an increasingly multi-polar world have been driving the gold prices.

However, silver’s industrial applications continue to remain volatile. Though it is expanding in today’s world and making it an essential component of modern technology. Given its widespread use, silver could see increased demand in the years to come, especially in industries like renewable energy and electronics.

Gold has hit records in 2024, while silver is still well below its 2011 peaks.

Another reason for the gold and silver prices to rise is the INR depreciation to Dollar. Since these metals are denominated in US Dollars so any movement in the currency or any major change in domestic taxation impacts their performance.

Gold vs. Silver – Last 20 years Return Chart (in USD)

Gold vs. Silver – Last 5 years Return Chart (in USD)

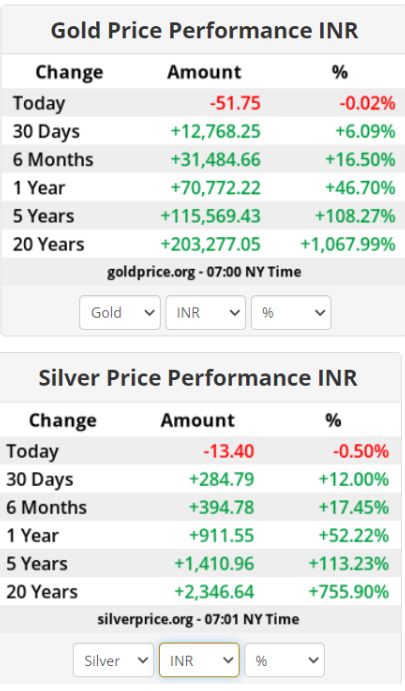

Gold vs Silver – Return Table (in INR)

Trivia - In 1999, photography used 267.7 million troy ounces of silver which accounted for 36.6% of that year’s total silver supply. By 2023 photography used only 23.2 million ounces of silver or about 2.3% of 2023’s total supply due to the rise of digital photography. Meanwhile, silver’s use in electronics and batteries grew from 90 million ounces to 227.4 million ounces or from 12.3% to 22.7% of silver’s total annual supply, partially offsetting the decline in traditional photography, which may partially explain why silver has struggled to hit new highs in recent years even as gold has set records.

Industrial Demand: A Unique Factor for Silver

Silver’s high industrial usage sets it apart from gold. Approximately 56% of the world’s silver supply is used in industries such as electronics, medical applications, and solar panels. In contrast, only about 17% of gold is used for industrial purposes. This heavy reliance on silver in manufacturing means that even during inflationary periods, silver’s value can remain steady due to consistent industrial demand.

Another critical factor is that much of the silver used in manufacturing is unrecoverable, meaning it’s consumed and lost forever. This reduces the amount of silver that can be recycled and reintroduced into the market, creating a unique supply-and-demand dynamic.

How to invest in Gold or silver? – Physical Metals, ETFs, and Mining Stocks

Both gold and silver can be purchased in several forms, including physical bullion, exchange-traded funds (ETFs), or even Funds of funds. Physical assets, such as bars and coins, allow you to hold tangible forms of the metal. However, this comes with added costs like premiums over spot prices, storage, and insurance.

ETFs offer another way to gain exposure to gold and silver without the hassle of storing physical assets. These funds buy and hold the metals for you, while you buy units. Remember, though, that you don’t own the underlying metal when you invest in an ETF, you are just investing in the prices. For further details, you can read: should-you-buy-gold-jewelry-or-gold-etf

Also read – sovereign-gold-bond-scheme

You may also consider mining stocks, where you own shares in companies that extract gold and silver. This option is more speculative, as the value of these stocks can fluctuate based on the companies’ performance and the broader market.

Gold or Silver – Which is a Better Investment?

Concluding with the main question. Given their unique characteristics, the question isn’t necessarily which metal is better for long-term investment, but rather how they can complement each other in a diversified portfolio. Here’s why a balanced approach can be beneficial:

- Risk Management: Diversifying your investments across gold and silver can help manage risk. While gold provides stability during crises, silver can capitalize on industrial growth, balancing out your portfolio’s performance.

- Opportunity for Growth: Silver’s higher volatility can offer higher short-term gains, It may also provide higher returns during periods of economic expansion. While gold’s steady performance ensures long-term wealth preservation.

- Hedging: Both metals provide a hedge against different economic scenarios – gold against inflation and financial crises, and silver against industrial demand surges.

Ultimately, the decision between gold or silver which is a better investment, comes down to your personal financial goals and risk tolerance. If you’re looking for stability and a hedge against inflation, gold might be the better choice. But if you’re willing to take on more risk for potentially greater rewards, silver could be the way to go. Diversifying your portfolio with both metals might offer the best of both worlds.

Also Read:Asset Allocation Strategies: How to Balance Risk and Reward in Your Portfolio

Read More: Financial Freedom: A Journey of Responsibility and Minimalism

What do you say? Which Investment would you prefer to make? Gold or Silver? Do share your views in the comments section.

While the specific gravity of pure gold is 19.32 whereas specific gravity of silver is 10.49 which means that one would require roughly double space for storage for same one kg of silver versus gold. This is the only difficulty otherwise as mentioned in the article, silver, probably holds better future than gold because of its industrial use and non-recyclable characteristic.

both gold vs. silver present compelling arguments for inclusion in any investment portfolio based on individual goals and risk tolerance levels.