Samar, a 45-year-old professional, has finally decided to move back to India to care for his aging parents after working for 15 long years in the United States. A few financial concerns are bothering him, and the major one is about his 401k savings, where he’s accumulated a decent amount as his retirement savings.

This is only part of it, adding to the complexity, he wanted his two children to study and build their careers in the US only, and for this, he wants to provide financial security to his kids for further education and other future needs. This leads to another question – can the 401kl be left behind in the US to take care of kids’ education in the future?

With all these questions, he reached out to us. He also wanted to check if he should roll it over to an IRA or if there are other options.

Samar’s concerns are not uncommon. According to a recent survey conducted by SBNRI, a fintech platform, more than 60% of NRIs living in countries like the US, UK, Canada, Australia, and Singapore consider returning to India post-retirement. While the idea of moving back home is exciting, it brings significant financial complexities, particularly around retirement planning and tax management.

After assessing his situation, we presented him with options that align with his children’s future goals in the U.S. There are a few considerations, assumptions, calculations, and recalculations. So there is no sure-shot solution, but a decision with a reasonable understanding and acceptance.

This made me read about how 401(k) plans work on IRS website. So, before moving forward and for the benefit of readers, let me share my understanding of this product.

In this article, we will understand the details of how a 401(k) works, its features, and tax implications. Also, we will check the options available along with their advantages and shortcomings for Returning NRIs and 401(k) Planning

What is a 401(k)? And exploring available options for Returning NRIs and 401(k) Planning

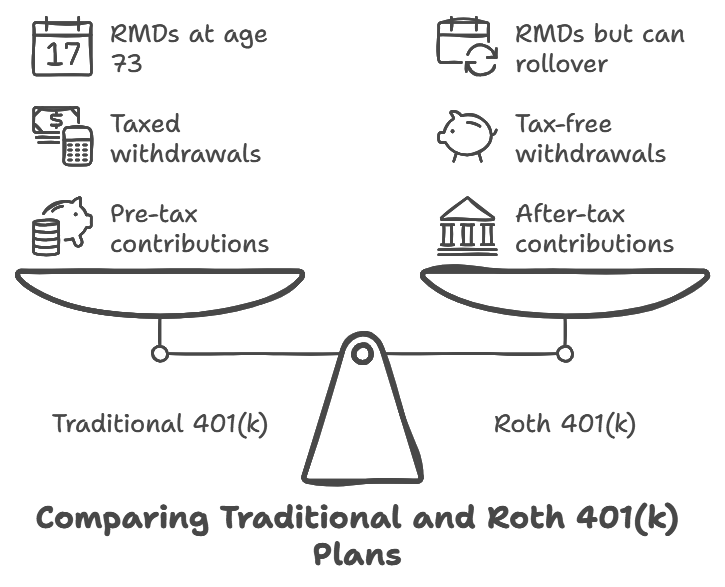

A 401(k) is a retirement savings plan sponsored by an employer, where employees can contribute a portion of their salary on a tax-deferred basis (Traditional 401(k)) or after-tax basis (Roth 401(k)). Tax-deferred means, you will get tax exemption on the amount you save in 401k, and in the case of after-tax you invest your post-tax money.

There are multiple options to choose your investment structure which leads your contributions to grow over time, with the potential to accumulate significant wealth for retirement. The plan often includes employer matching, which means the employer adds to the employee’s contributions based on a certain formula.

Key Features of a 401(k) Plan

- Employee Contributions: Employees contribute a portion of their salary to the 401(k) account. The annual contribution limit in 2024 is $23,000, with an additional $7,500 allowed for people above the age of 50, as a “catch-up” contribution.

- Employer Matching: This is a major incentive to participate in this product. Employers often match (though not mandatory) some percentage of the employee’s contributions. For example, an employer might match 50% of the first 6% of the employee’s salary that is contributed. This means if the employee contributes 6%, the employer adds another 3%.

- Tax Benefits:

- Traditional 401(k): Contributions are made pre-tax, which reduces taxable income in the year of contribution. However, withdrawals in retirement are taxed as ordinary income.

- Roth 401(k): Contributions are made with after-tax dollars, meaning no immediate tax benefit, but withdrawals in retirement (both contributions and earnings) are tax-free, provided certain conditions are met (e.g., the account must be held for at least 5 years, and withdrawals can only begin after age 59½).

- Investment Choices: There are multiple investment options in 401(k) plans, typically including mutual funds, stocks, bonds etc. There is some automatic asset allocation adjustment feature too, just like Auto Choice in NPS in India. The employee is responsible for choosing the investment mix. (Check out NRI Financial Planning Services)

- Tax-Deferred Growth: Investments in a Traditional 401(k) grow tax-deferred, meaning no taxes are paid on the earnings until they are withdrawn in retirement. In a Roth 401(k), growth is tax-free since contributions are made with after-tax dollars.

Types of 401(k) Plans

Traditional 401(k):

- The contribution made to the account lowers the income tax for the current year.

- The earnings are tax-deferred which means The tax will be applicable at the point of retirement as a result of making withdrawals.

- The minimum amount of distribution i.e. Required Minimum Distributions (RMDs) that one can withdraw must start at the age of 73 (SECURE Act 2.0 raises it from the previous 72 years).

Roth 401(k):

- The contributions made are from the earnings after tax is deducted. This makes all of the withdrawals to be taken by the contributor as tax-free so long as the conditions are satisfied.

- One of the conditions is, if the account is held for at least 5 years earnings are not taxable.

- RMDs are required, though funds can be rolled over into a Roth IRA to avoid this.

Solo 401(k):

- It is designed for self-employed individuals or small business owners with no employees and the plan offers the same tax benefits as a Traditional 401(k).

- Here Individuals can contribute both as an employee and employers, allowing for higher contribution limits.

Safe Harbor 401(k):

- A plan where employers must contribute either a matching or non-elective contribution (where all employees get a contribution, whether or not they contribute).

- Provides employers with fewer administrative burdens and is used to avoid certain IRS tests that limit contributions for high earners.

Withdrawals from a 401(k) Plan

- Age-Based Withdrawals:

Here we have two considerations – penalty and taxation

- Withdrawals are allowed without penalty after age 59½.

- In the case of Traditional 401 (k), withdrawals are taxed at an individual’s income tax rate

- In the case of a Roth 401(k), withdrawals are always tax-free, if the account has been held for at least 5 years.

- Besides federal taxes, some states may also apply taxes on 401k withdrawals

- Required Minimum Distributions (RMDs):

Starting at age 73, the terms and conditions of the Traditional 401(k) accounts dictate that clients have to make RMDs and these distributions have tax obligations. However, as said, rolling assets to Roth IRAs/401Ks will help avoid the mandatory RMDs.

- Early Withdrawals (Before Age 59½): If one makes an early withdrawal then there is normally a penalty of 10% plus any income tax that applies to people who take out funds from a Traditional 401K.

Exceptions are – disability, medical bills greater than 7.5% of adjusted gross income, or using account money for first home purchases of no more than 10,000$, among others

Coming back to the query – What to do with 401k after leaving job?

For NRIs with 401(k) plans like Samar, and are planning to return to India, here are the key considerations to answer:

- What are their plans? – Are they going to permanently settle in India? If yes, do they intend to buy their own home? And when?

- Where do they want their children to study in the future? In India or back in the US. As in some cases kids were born in the US and thus were considered to be US Citizens and may get concessions in education costs over there.

- What is their Income status In India going to be?

- What are the other assets and liabilities available to them?

- What is their Retirement Plan?

There may be some other specific concerns too. In one case, an investor has their own house in the US, with a mortgage running over it.

Generally, Investors’ concerns revolve around only one aspect, i.e. Taxation, and like to make arrangements to pay the least possible taxes. But in my understanding, there is no way you can avoid the taxes.

You either have to pay the taxes in the country of residency or the country of Income generation. Yes, you can avoid Double taxation, by proper filing and claiming through proper tax filing..

But you cannot skip the taxes. Still, it will be wise to consult the tax experts in both countries or if you can find a good professional or agency knowing both sides…then nothing like it.

Anyhow, coming back to the Financial Planning Concerns

If they intend to permanently settle in India and need to buy a home here. They have to get their Retirement plan done, based on the probable income and spending structure and other near and long-term requirements.

Kids’ educational requirements can also be part of that retirement plan, considering the assets and liabilities structure in both countries. All this to see how much would an Indian goal require, and how much (if at all) can be left in the other country, and which form (401k, Mutual funds, property etc.)

In my view, never continue with the mortgages in the US, as that will result in earning INR (depreciating Currency) and paying in USD. Yes, you may put the house on Rent and manage your EMIs, that can be one of the possibilities, but you need to be sure of the taxation on rental income, as this may require you to pay taxes in the US, and also need to report in India being the country of tax residency.

So it may be wise to prepay the mortgage completely with the assets in the US.

Whether to retain the house or not again depends on plans.

Don’t just focus on taxation or investment returns, think from the usage side, i.e. where the money is going to be used and how much is required, and when.

I could not find any information on the Partial withdrawal rules (if any) on 401K, but I guess if rolled over to an IRA within 60 days of discontinuance, then one can make use of partial withdrawal by paying penalties. If available this could be one of the considerations while preparing kids’ education plans.

Here you have to be mindful of the estate taxes in the US, which your heirs will have to pay in case of your demise, to claim the money.

If you continue with 401k to withdraw it as per the specified rules and age limits, you have to stay in touch with your employer and be abreast with the changes in the tax rules and implications. You need to ensure that the financial institution holding the IRA accepts international addresses if he plans to permanently settle in India

Samar’s story is a common one for NRIs planning their return to India. Whether it’s a 401(k) in the US or other assets and Investments abroad, early planning is essential. Yes, taxes are an important consideration, not just from the savings perspective, but also to ensure that you will always remain on the right side of the law. And not only Income taxes, you need to be aware of the estate, and inheritance taxes also.

Maintaining assets in 2 different countries requires different professionals’ help unless you have enough time and knowledge to manage the whole thing yourself.

also, read – how to safeguard your child’s future through financial planning?

A detailed financial plan is required to make an informed decision. But as far as 401k is concerned Samar has 3 options

1. To Leave Everything As It Is:

Samar may opt to keep his 401(k) account in its current form until he turns 59½ when he is entitled to make withdrawals. For this option, though, he must continue to communicate with his employer and monitor the taxes that would apply to any early withdrawals he makes.

2. To Rollover His 401k To A Traditional IRA:

Samar would be able to keep the tax advantages by rolling over his 401(k) into a Traditional IRA with a Brokerage account and at the same time be able to access a wider range of investment opportunities. With this option, his money can also be kept growing with tax benefits as it will not be immediately subject to tax.

Note: Samar would have to be mindful that the Bank or Firm where he opens his IRA accepts international addresses if he intends to move to India permanently. And also need to ensure the Reporting of this asset to Indian authorities and be aware of the estate tax laws in US.

3. Rollover to a Roth IRA:

In Roth IRA rollovers, taxes are paid upfront. This allows for tax-free future withdrawals. Roth IRAs also do not have required minimum distributions further increasing flexibility for one’s savings goals

If Samar has no requirement for money in India, for his other goals, and he is comfortable with the US estate tax laws, then he may decide to roll over 401k to an IRA account with some good brokerage house and use the funds towards kids education if required by paying a 10% penalty. This way he may avoid taxes in the US as he may not have any other income there. However, he will have to disclose this transaction in India and pay taxes in the country of residence.

Read further – Financial Planning for NRIs in India

Conclusion:

It’s not an easy decision. Many factors are playing around it. But keeping yourself focused only on the tax aspects may not be wise, which in my view is difficult to avoid. Be in touch with professionals in both countries and have a financial plan in place for better decision-making. Till the financial decision is made, you may think of rolling over 401k to an IRA account.

FAQS – Frequently asked questions on 401k

A 401(k) is an employer-sponsored plan used in the United States and enjoys tax benefits. There is contribution to a Traditional 401(k) or a Roth 401(k), from employees based on their salary prior to or after tax respectively. Employees are able to put in contributions to a plan that is related to the salary while working and would therefore hope for returns based on such investment when the retirement sets in.

Indeed, NRIs can retain their 401(k) even after returning back to India. However, NRIs do need to consider the aspects of taxation in both countries, the DTAA, and estate planning for sure.

For NRIs, tax will be payable on any withdrawal that is made from a Traditional 401K. Earnings also might be taxable in India. DTAA would very well be one of those avenues that can come useful in avoiding dual tax and highly advisable to take professional guidance on taxes from somebody versed with the US India tax issues.

On tax relief, in a Traditional 401(k), contributions are made pre-tax to the employee’s accounts; hence these accounts will pay tax in retirement when the balances are withdrawn. Contributions to a Roth 401(k) are made from income that is already taxed, and the amounts received at withdrawals or retirement along with interest accrued are nontaxable.

You may maintain the 401(k) in the U.S. now, but you’ll be responsible for monitoring tax implications, and , if you’re older than 73 years you’ll have to take care of RMDs. You will also need to update the custodian with an international address if that’s the case.

DTAA between the U.S. and India helps to save tax by avoiding double taxation of income. Thus, the withdrawal of 401(k) taxes will be credited in one country. Although, consulting a tax advisor for proper compliance is very much recommended.

401 k plans offer mutual funds, stocks, bonds, and target-date funds that automatically adjust the asset allocation as you near retirement. Some employers even offer a self-directed option for 401(k) choices with even more choices in investments

Withdrawals are allowed penalty-free after age 59½ though income tax applies if withdrawn from a Traditional 401(k). In contrast, withdrawals before age 59½ are subject to a 10% penalty, with exceptions for disability or medical expense.

RMD stands for the minimum distributions required for a 401(k) account .A new requirement under the SECURE Act 2.0 states that RMDs will begin at age 73 for Traditional 401(k)s. RMDs are also required with Roth 401(k)s, but they can be sidestepped by rolling into a Roth IRA.

This post is written by Ms. Anandy Goel, Associate Financial Planner at Good Moneying